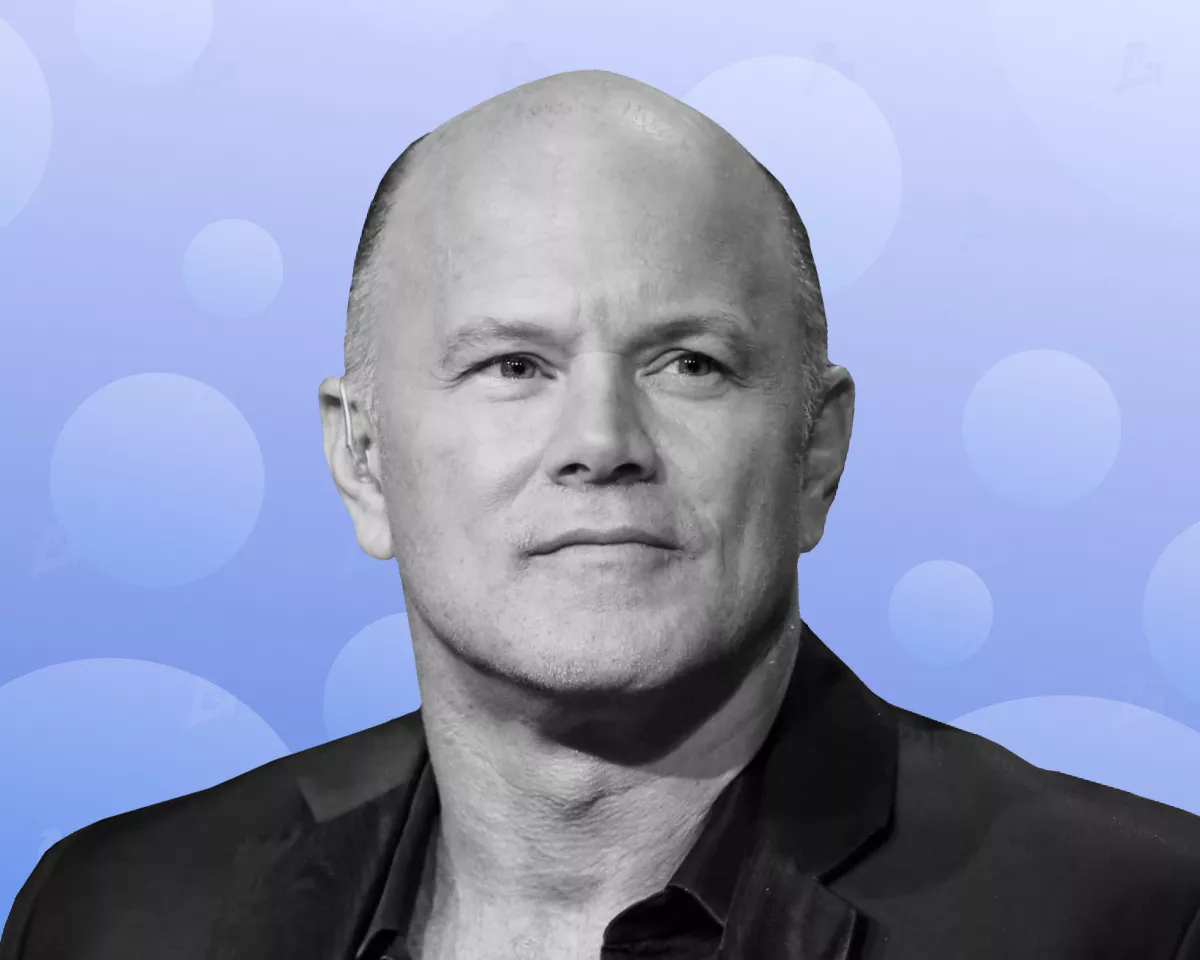

The BlackRock filing on launching Bitcoin-ETF is part of the ‘adoption cycle’ that would allow the price of the leading cryptocurrency to surpass ATH. In an interview with Bloomberg, Galaxy Digital CEO Mike Novogratz said.

He noted an improved perception of digital gold by Larry Fink, the head of the world’s largest asset manager.

“The most important thing that happened this year in the crypto market — Fink. He opened his eyes — he was skeptical, but he believed in Bitcoin. Now he says: ‘Hey, this will be a world currency. People around the world trust it’,” — Novogratz said.

An important component for improving the dynamics of digital gold, he said, is the expected shift by the Fed toward lowering the key rate.

“If you are young and have a high risk tolerance, buy Alibaba stock, silver, gold, Bitcoin and Ethereum. If your risk tolerance is not high, allocate 30% to such a portfolio, and the remaining 70% — to bonds and, perhaps, an index fund,” — he suggested.

During the discussion, Novogratz named the court verdict in the SEC case against Ripple Labs “a huge win” for the crypto industry.

On the prospects for Worldcoin (WLD), Galaxy Digital’s CEO advised not to bet against Sam Altman (the project’s founder and also known as co-founder of OpenAI with the ChatGPT product).

“I think the price [WLD] could potentially be much higher due to the hype around AI. I don’t know whether we will all use this [World ID] as our identity,” he said.

Worldcoin announced an official launch on 24 July. The project’s main product—the World ID protocol—is based on zero-knowledge proofs. It is a mobile tool that allows people to verify their identity by iris scan or phone number.

Earlier, Worldcoin’s activities drew the attention of regulators in the United Kingdom, Germany, France, and Kenya.

Back in June, Novogratz pointed to the crypto market’s apathy due to waning institutional interest. He described the removal of regulatory uncertainty in Hong Kong as one of the drivers of the shift.