Mine, baby, mine: how miners turned into speculators—and the risks for the market

While investors focus on US exchange-traded funds, bitcoin miners are adapting to the new regime after the April 2024 halving. It cut daily issuance from 900 to 450 BTC. Yet, contrary to common belief, aggregate revenues for the diggers of digital gold have barely changed.

Oleg Cash Coin examines what large miners are doing to preserve cash—and the risks they pose to the market.

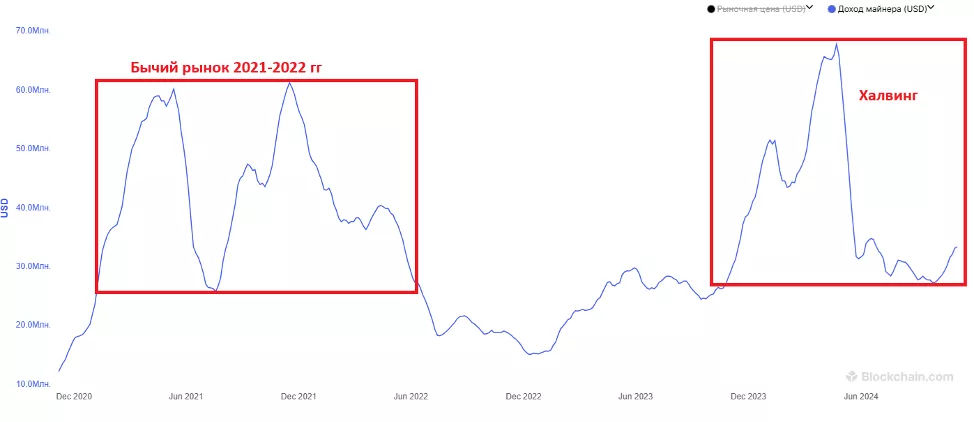

In the month of the halving, the 30-day average of miner revenues fell from roughly $60m to $30m. For comparison, from 2021 to mid-2022 this metric hovered in the same $30–60m range.

To be fair, in 2021–2022 bitcoin traded around $20,000–60,000 and the hashrate was nearly four times lower.

That is, there were far fewer miners, yet selling pressure and average profitability were roughly the same.

This is the key metric to watch, because miners are a class of ‘forced sellers’ of bitcoin. If one assumes their overall selling pressure on price is broadly similar before and after the halving, the event appears to have had little impact on their dollar revenue.

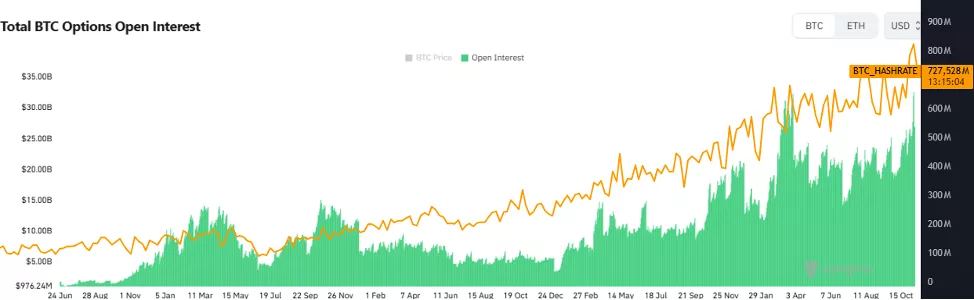

Two metrics truly matter for now: competition and rising hashrate. If an individual miner fails to grow its share at a pace comparable to the network’s capacity, it starts to lose money (or earn less than it could).

Hence miners’ operations can differ markedly from the intuitive “sell as soon as you mine”. Instead, miners may use futures or options to budget, building a steady business strategy over months or years.

Intriguingly, as hashrate has risen, the bitcoin options market has expanded markedly, a trend not seen in other derivatives. Now imagine a large swathe of the market tied to such instruments.

What might this mean for bitcoin’s price? It will raise overall liquidity, but could also import systemic risk via margin that is exposed to volatility.

Company reports do little to dispel this picture: even increases in individual hashrate are leading to losses or strategy shifts.

The US firm MARA (formerly Marathon) reported that despite nearly tripling its own hashrate since 2023, the number of coins mined halved. And even with bitcoin’s price rising, as of the second quarter MARA was still posting multi-million-dollar losses.

On top of that it has over $326m in accumulated debt (as of June 2024, according to documents filed with the SEC)—a strategy akin to MicroStrategy’s (MSTR).

MARA differs from MicroStrategy in that its shares have not rallied. Michael Saylor’s company is up 300%, while the miner is down 16% since the start of the year.

Canadian miner Cathedra has also flagged the problem. In its report it noted that mining has shown poor efficiency in terms of growing “bitcoin per share”. Japan’s Metaplanet confirmed the effectiveness of accumulating digital gold via premiums from selling put options.

These are just some examples of what public miner–speculators like MARA can—and seemingly do—pursue. Holding, say, 1,000 BTC on the balance sheet, they raise debt via share or bond sales and create a delta-neutral position as follows.

An option contract is written to sell bitcoin with a modest premium for the seller. The coin’s price is largely irrelevant—the aim is to maximise the premium. Simultaneously, a hedge is opened in either direction. Metaplanet placed 223 BTC and built a hedge position of $13.826m with borrowed funds. For each bitcoin it received a premium of 0.1075 BTC (10.75%).

These are rough calculations, of course, but the options market is now bloated to around 350,000 BTC in monthly volume, while miners’ aggregate revenues are barely changing. Even with bitcoin topping $80,000, BTC-denominated returns per unit of hashrate are at historic lows.

The most dangerous scenario in such conditions is not a price drop, but a lack of volatility in derivatives and shrinking premiums. That would prompt miners and firms now creating demand for bitcoin by taking on new fiat debts to sell the coin to cover their accumulated liabilities.

This even as market participants are sober about their leverage and cautious in raising debt. A single big misstep could set others off—simply out of fear they, too, might prove insolvent.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!