Mining Difficulty Rebounds by 15% as Hash Price Falls Below $30

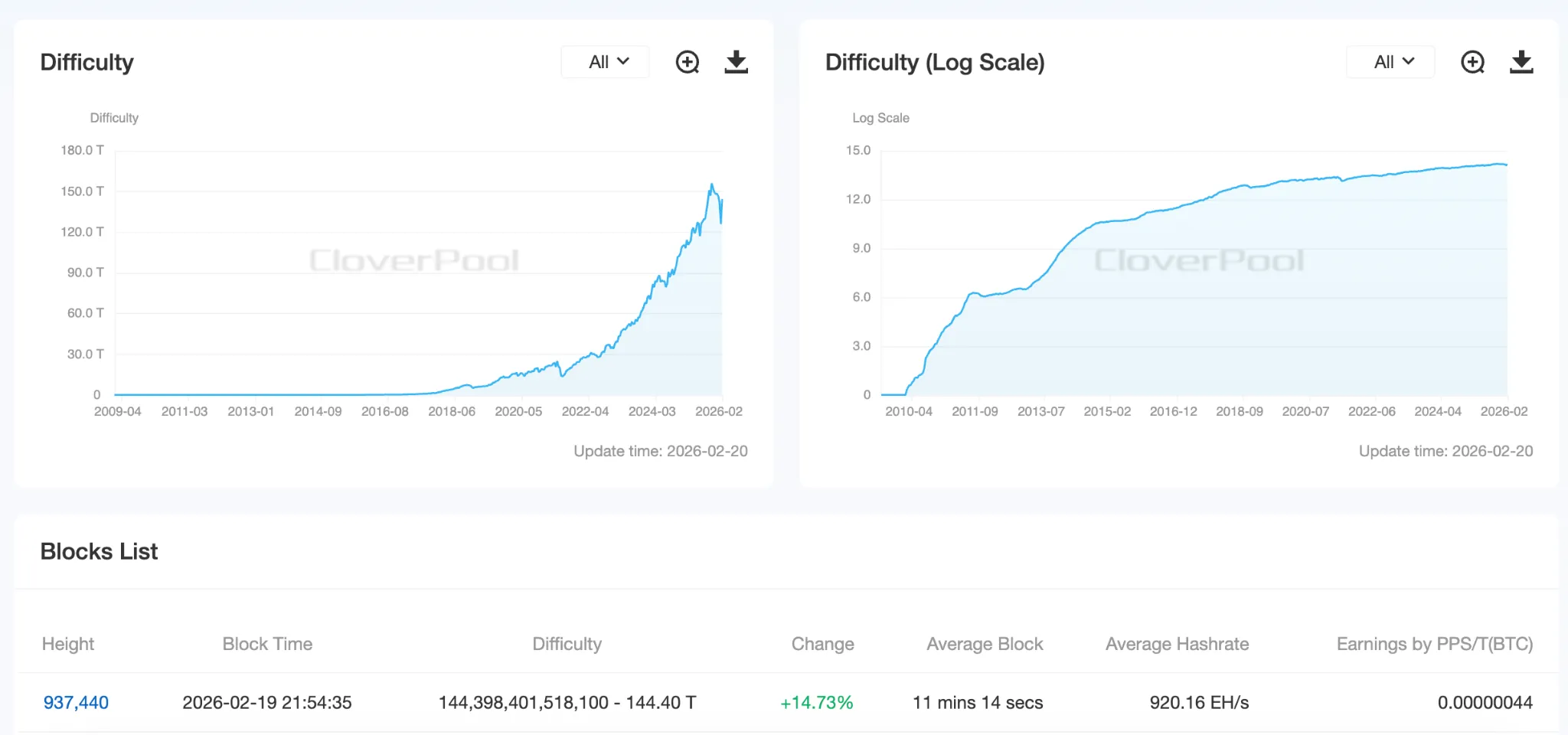

Mining difficulty rose by 14.73% to 144.4 T after the latest adjustment.

Following the latest adjustment, the mining difficulty of the leading cryptocurrency rose by 14.73% to 144.4 T.

This marks one of the most significant changes since 2021, when China’s ban on digital asset mining led to network disruptions, followed by a 22% increase as stability returned.

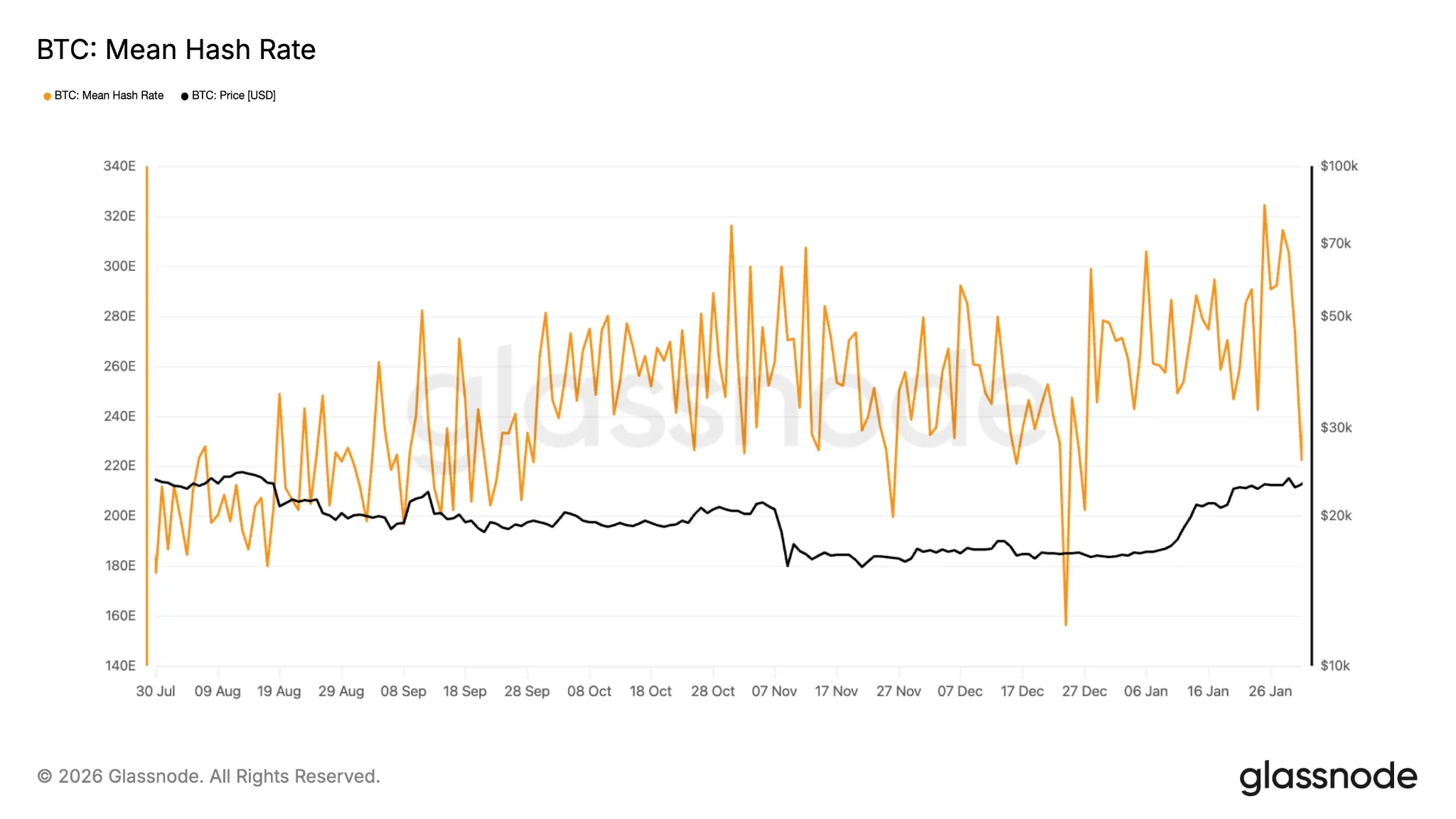

The current rise was preceded by an 11% drop, triggered by a decline in hash rate amid a winter storm in the United States. Due to adverse weather conditions, many large miners temporarily halted operations.

As of February 19, Bitcoin’s hash rate remains above 1 ZH/s, with the seven-day moving average at 1.01 ZH/s.

Foundry USA holds the largest share of the global hash rate at 33.62%, with AntPool at 14.35% and ViaBTC at 12.42%.

The hash price has decreased over the past day from $33.5 to $29.7 per PH/s.

Despite the decline in profitability, players with access to cheap energy continue to expand their capacities. For instance, the unrealized profit from Bitcoin mining in the UAE has reached $350 million.

Such well-capitalized and efficient companies maintain a high hash rate even amid the low price of the leading cryptocurrency, which at the time of writing is approximately $67,900 (CoinGecko).

The Race for Megawatts

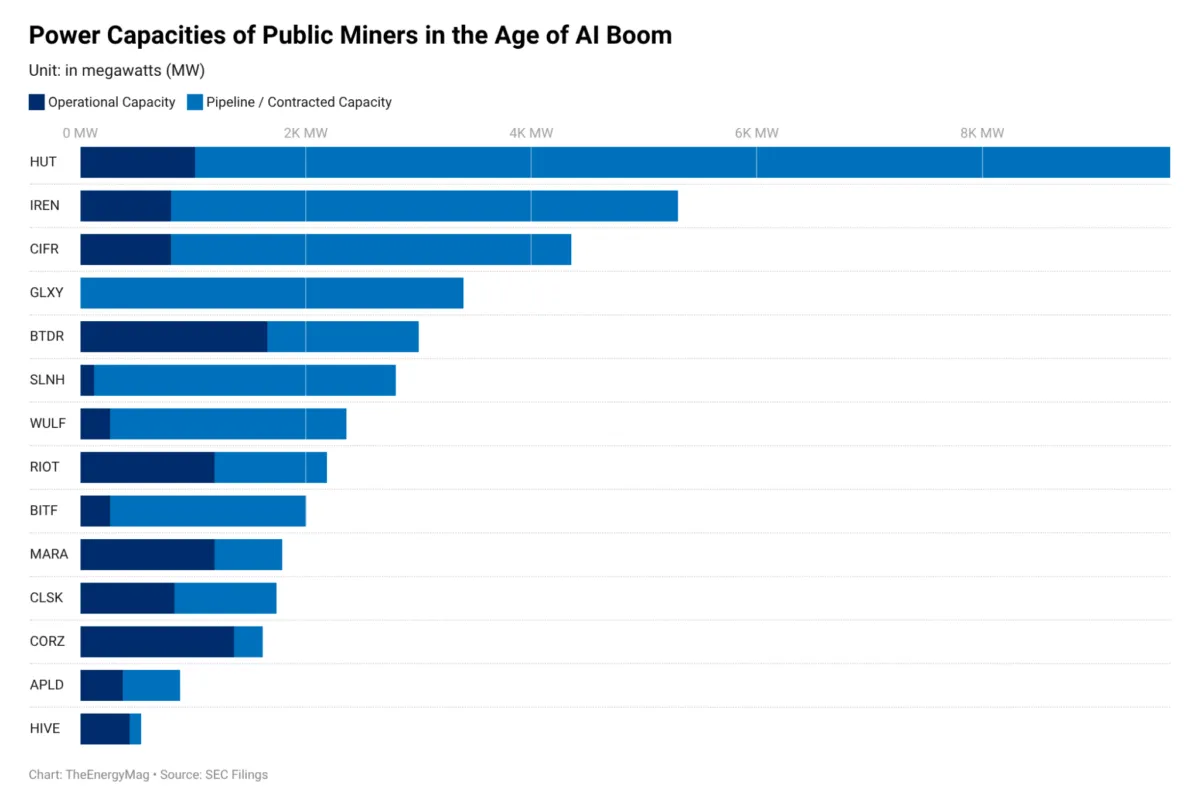

The 14 largest mining companies plan to introduce around 30 GW of new capacities aimed at AI workloads, reports TheEnergyMag. This is nearly three times their current capacity of 11 GW.

The reason is the declining profitability of cryptocurrency mining amid a persistently low hash price. Companies are eager to redirect their main asset—access to energy—towards the more lucrative AI infrastructure market.

However, most of these megawatts currently exist only as plans, connection applications, or early-stage projects. Analysts estimate that on paper, this infrastructure is comparable to the energy supply of a small country, but actual deployment may be significantly lower.

“Declared megawatts are not a guarantee of success, but merely a formal figure,” noted TheEnergyMag.

According to analysts, the industry is undergoing a structural transformation. Previously, competition was about the efficiency of ASIC miners and electricity costs, but now the key factors are:

- access to capital;

- ability to connect to power grids;

- capacity to deliver data centers on time.

Meanwhile, transitioning to the artificial intelligence segment brings new risks. In mining, monetization occurred automatically—equipment began mining Bitcoin immediately after connection.

With AI infrastructure, it is more complex. Computing power must be rented to clients, and its utilization depends on demand, service quality, and competitive offerings.

In effect, miners are becoming infrastructure providers. In this business model, access to energy is merely a basic requirement that does not guarantee stable revenue.

“This is a race for megawatts in the era of the AI boom. But its outcome depends on the sustainability of demand and the ability of companies to monetize the infrastructure they are now planning to build,” concluded the experts.

Earlier in February, Bitcoin miner Cipher Mining announced raising $2 billion to expand AI computing.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!