New Investors Pose Risk to Bitcoin, Says Glassnode

The average new market participant is experiencing unrealized losses, which could increase selling pressure if the price of digital gold continues to correct, according to a report by Glassnode.

The #Bitcoin market continues to experience downwards pressure over recent months, despite the average Bitcoin investor remaining profitable overall.

However, the Short-Term Holder cohort remains heavily underwater on their holdings, making them a source of risk for the… pic.twitter.com/nlE0K2WgPk

— glassnode (@glassnode) September 4, 2024

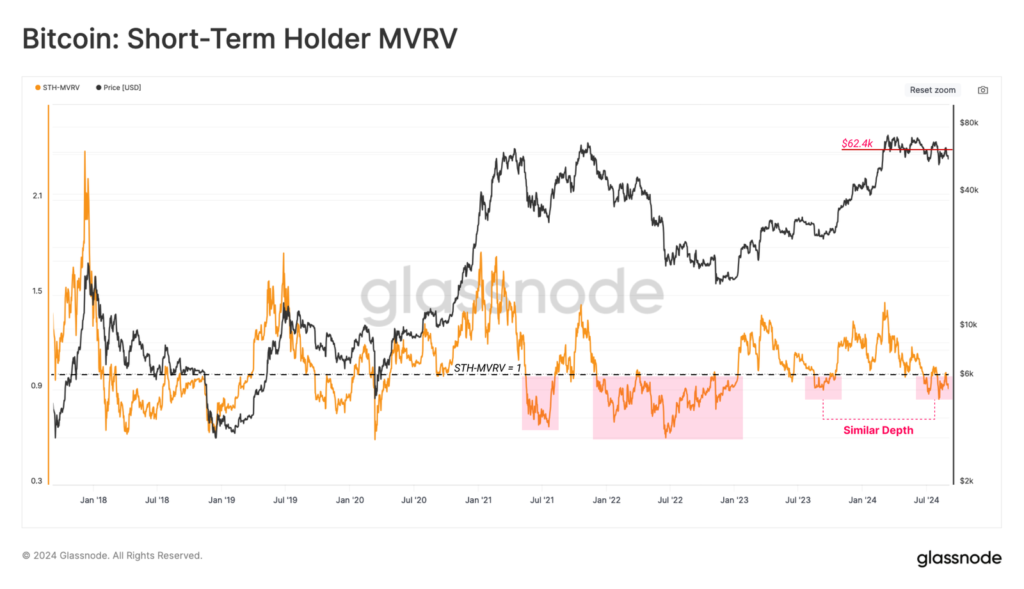

“Until the spot price returns to the short-term holder basis at $62,400, further market weakness is expected,” noted the experts.

Considering all market participants, the total amount of “paper” losses is not as significant compared to previous cycles. However, the unrealized losses of short-term investors are relatively large, making them the main risk factor in the current market conditions.

“The short-term holder group, representing new demand in the market, appears to bear most of the market pressure. Their unrealized losses are predominant overall. Their magnitude has been steadily increasing over the past few months,” explained the specialists.

They added that the current level of “paper” losses is reminiscent of the volatile year 2019. At that time, the price of Bitcoin started its movement from $4,000, peaked above $12,000 in the summer, and subsequently found equilibrium near the $7,000 level.

MVRV

The MVRV ratio for short-term investors has fallen below the breakeven level (1.0).

Currently, the metric is at levels comparable to those of August 2023. This was a period of prolonged Bitcoin recovery following the FTX collapse and a drop to around $16,000.

At the time of writing, the leading cryptocurrency is trading around $56,000. Over the past 24 hours, the asset has decreased by 3.2%, and over seven days, by 8.2%, according to CoinGecko.

Earlier, Glassnode experts warned of the market entering a phase of increased volatility.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!