0xngmi pegs Solana meme‑coin haul at $3.6bn–$6.6bn

- The meme-coin hype has netted insiders and infrastructure players more than $3.6bn.

- Adverse fallout in the segment could undermine the crypto industry’s development.

- Solana’s price may have formed a top two weeks ago amid the meme-coin frenzy.

TRUMP insiders, MEV participants, Pump.fun and various DEXs collectively made between $3.6bn and $6.6bn from the meme-coin frenzy on Solana, according to DeFi Llama cofounder 0xngmi.

calculated the total extracted from memes on solana:

— trading bots & apps: 1.09bn

— pumpfun: 492m

— MEV: 1.5-2bn

— Trump insiders: 0.5-1bn

— Other insiders: unknown

— AMMs: 0-2bnTotal: 3.6-6.6+ bn

Sources in the next tweet

— 0xngmi (@0xngmi) February 15, 2025

He stressed the figures are conservative because meme-coin volumes across AMMs are hard to track and insider launches entail losses.

The breakdown is as follows:

- trading bots and dapps — $1.09bn;

- Pump.fun — $492m;

- MEV — $1.5bn–$2bn;

- TRUMP insiders — $0.5bn–$1bn;

- AMMs (Raydium, Meteora, Orca) — up to $2bn.

One of the main MEV bots for sandwich attacks (front-running) on Solana made roughly $500m.

Trading-bot profit split:

- Phantom — $120m;

- Photon — $357m;

- BullX — $153m;

- Maestro — $27m ($102m across all networks);

- Moonshot — $27m;

- Mevx — $30m;

- Bonkbot — $168m;

- gmgn — $38m;

- Trojan — $166m.

Underlying causes

According to 0xngmi, in previous cycles traders went to CEX such as Binance and paid 0.1% per trade in fees. Those targeting TRUMP now use MoonShot, where the fee is 2.5%.

In the DeFi Llama cofounder’s view, market participants see meme coins as an “unstable casino” and want to “make a quick buck” before “the music stops”.

Whereas Binance is keen to retain users because it focuses on crypto’s long-term development, Moonshot has no such goal. Its aim is to earn as much as possible before customers leave, 0xngmi added.

“It seems that the ‘this is the last cycle’ narrative makes everyone focus on the short term,” the specialist stressed.

He noted that during the previous bull run OpenSea and NFT royalty recipients made about $3bn.

Later the focus shifted to the BYAC ecosystem with a peak capitalisation of $10bn and to DeFi tokens such as AAVE.

“If coin trading is a zero-sum game, you need a huge inflow to keep it [afloat],” — 0xngmi stressed.

Risks for the industry

The DeFi Llama founder set out his reasoning amid intense discussion of the LIBRA token.

On February 14, after a mention on social network X by Argentina’s president Javier Milei, the asset reached a $4.56bn market capitalisation, but within the next few hours its price plunged 94%.

After the crash, Milei deleted the promo post and clarified that he had merely “supported a private initiative”, blaming political opponents for using the incident to cause harm.

According to Lookonchain, eight project-linked wallets withdrew more than $107m in liquidity (57.6m USDC and 249,671 SOL). Bubblemaps data show 82% of the project’s supply was unlocked and available for sale from the outset.

Some Argentine politicians are threatening the president with impeachment over his association with the failed token.

0xngmi voiced concern about the current frenzy:

“If the majority of society starts to perceive cryptocurrency as pure evil or if the result is tighter regulation, we will be in a situation where the negative effects of meme coins spread and hinder the prosperity of other ideas such as sovereign money or trust minimization.”

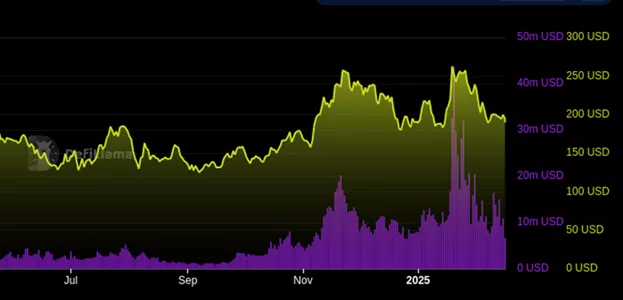

In closing, 0xngmi cited the view of DeFi enthusiast Patrick Scott (Dynamo DeFi) that Solana may have topped two weeks ago.

He found that each time revenues from dapps (highlighted in purple) spiked, SOL approached a local top (in yellow). The same pattern appeared two weeks ago.

Earlier, Binance founder and former chief Changpeng Zhao sparked a wave of meme coins dedicated to his Belgian Malinois named Broccoli.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!