A volatile Friday: how crypto reacted to tariffs and the Fed chair’s remarks

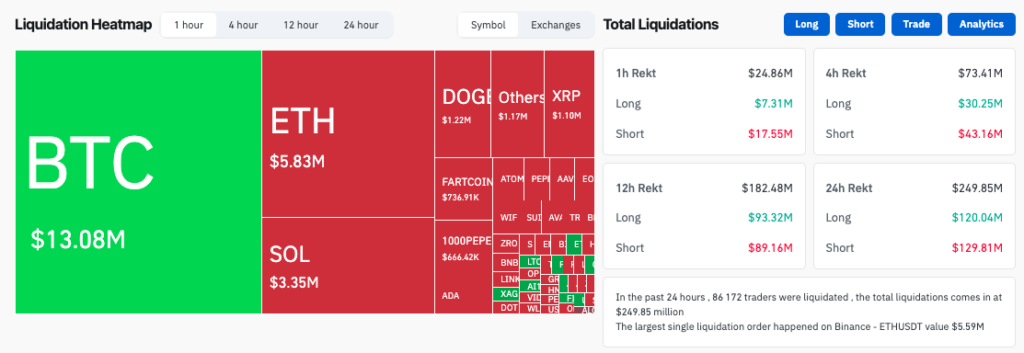

On April 4, daily liquidations across the crypto market reached $250m amid uncertainty around the Fed and jitters over U.S. trade tariffs.

Long and short liquidations were roughly balanced — $120m and $130m, respectively. This reflects elevated volatility in bitcoin and the broader market.

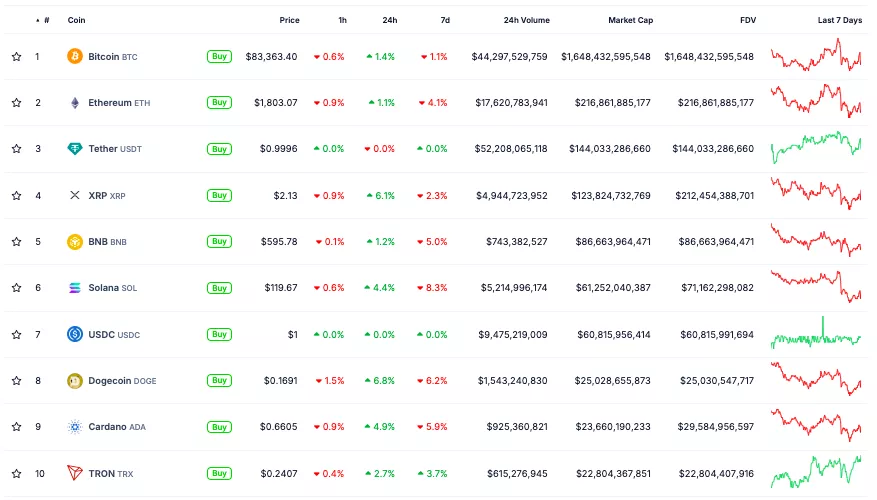

On Friday, bitcoin climbed from $81,800 to $84,700, only to fall back to initial levels after China announced retaliatory tariffs against the U.S. Since the advent of the ‘day of liberation’, bitcoin has repeatedly and unsuccessfully tried to reclaim the lost $85,000 level.

Over the day, digital gold gradually recovered, but then slipped again after the release of labour-market data in the United States. Sentiment worsened after a subsequent speech by Fed chair Jerome Powell.

Despite a call by U.S. president Donald Trump to cut the policy rate, Powell stuck to a cautious line. He noted that trade tariffs are highly likely to have a negative impact on inflation.

“Our duty is to keep long-term inflation expectations at the proper level and to make sure that a one-time increase in the price level does not become a permanent inflation problem,” the Fed chief stressed.

At the time of writing, bitcoin is trading around $83,000. Other top-cap cryptocurrencies show a high correlation with the leading asset.

In parallel, bitcoin’s dominance index approached 63%. The gauge has been rising since January 2023.

Expert views

Analyst and MN Trading founder Michaël van de Poppe noted that bitcoin “continues to hold up.” However, he did not rule out a dip below $80,000.

#Bitcoin continues to hold up.

I still think that it’s very likely that we’re going to be seeing a retest sub $80K.

Ultimately, buying the dip isn’t that bad.

Better times are upon us. pic.twitter.com/H3XN99neB1

— Michaël van de Poppe (@CryptoMichNL) April 4, 2025

Technical analyst Ali Martinez also pointed to the risk of further correction amid slowing on-chain activity.

#Bitcoin $BTC is seeing a slowdown in exchange-related activity, which often signals reduced investor interest and declining network utilization. Watching closely for a shift in trend! pic.twitter.com/nICCgHFm11

— Ali (@ali_charts) April 4, 2025

Trader Cas Abbé took the opposite view. He identified a “falling wedge” pattern pointing to a possible bitcoin rebound. To validate an upward scenario, the asset should clear $86,500.

$BTC falling wedge pattern ?

It didn’t hit a new low yesterday despite stock market having their worst day in 5 years.

Historically, BTC always bottoms first before the stock market so expecting $76.5K was the bottom.

Now, I’m waiting for a reclaim above $86.5K level for… pic.twitter.com/fK7DYMrgPP

— Cas Abbé (@cas_abbe) April 4, 2025

“Bitcoin did not hit a new low yesterday despite the stock market having its worst day in five years. Historically, the first cryptocurrency always bottoms first, before the stock market,” the expert added.

Earlier, JPMorgan specialists noted that high volatility and outflows from BTC ETFs undermine the perception of the first cryptocurrency as digital gold.

CryptoQuant founder and CEO Ki Young Ju said the bull run had ended for bitcoin. In his forecast, over the next six to twelve months prices will continue to decline or remain range-bound.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!