Aave Community Backs Integration of PayPal’s PYUSD Stablecoin

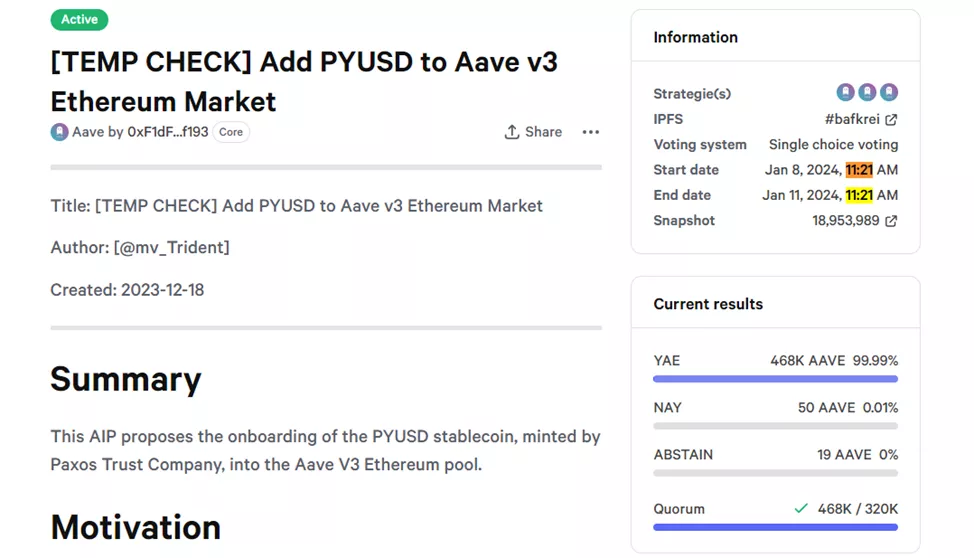

99.99% of voters supported the integration of PayPal’s PYUSD into the DeFi platform Aave’s pools, achieving the necessary quorum. The initiative was overwhelmingly backed.

The vote commenced on December 18 and will conclude on January 11 at 8:21 UTC.

The initiative followed a December decision by the decentralized exchange Curve to list PYUSD.

The proposal’s author, Trident 15, explained that the integration would foster synergy with PayPal’s asset and strengthen the connection between PYUSD and Aave’s multi-collateral decentralized stablecoin, GHO.

“The idea is to maintain yield at a sufficiently high level. This will create organic demand for PYUSD loans on AAVE,” the statement reads.

If approved, Trident 15 will contribute between $5 million and $10 million in liquidity to the pool.

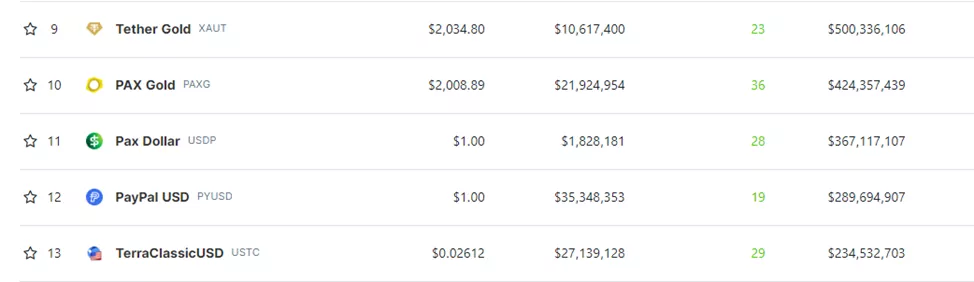

According to CoinGecko, the stablecoin’s market capitalization stands at $289.7 million, having increased by 71.9% over the past month. The asset ranks 12th among stablecoins, nearing USDP by Paxos ($367.1 million).

According to DeFi Llama, Aave ranks as the third-largest DeFi project by TVL ($6.26 billion).

Back in November, the team behind the DeFi platform Aave, known as Aave Companies, rebranded to Avara.

Earlier, Aave suspended some operations after a vulnerability was discovered. The project assured that user funds were safe.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!