Ahead of the Federal Reserve meeting, bearish sentiment strengthens in the options market

Options markets point to rising bearish sentiment ahead of the the Fed meeting. This is reported by CoinDesk.

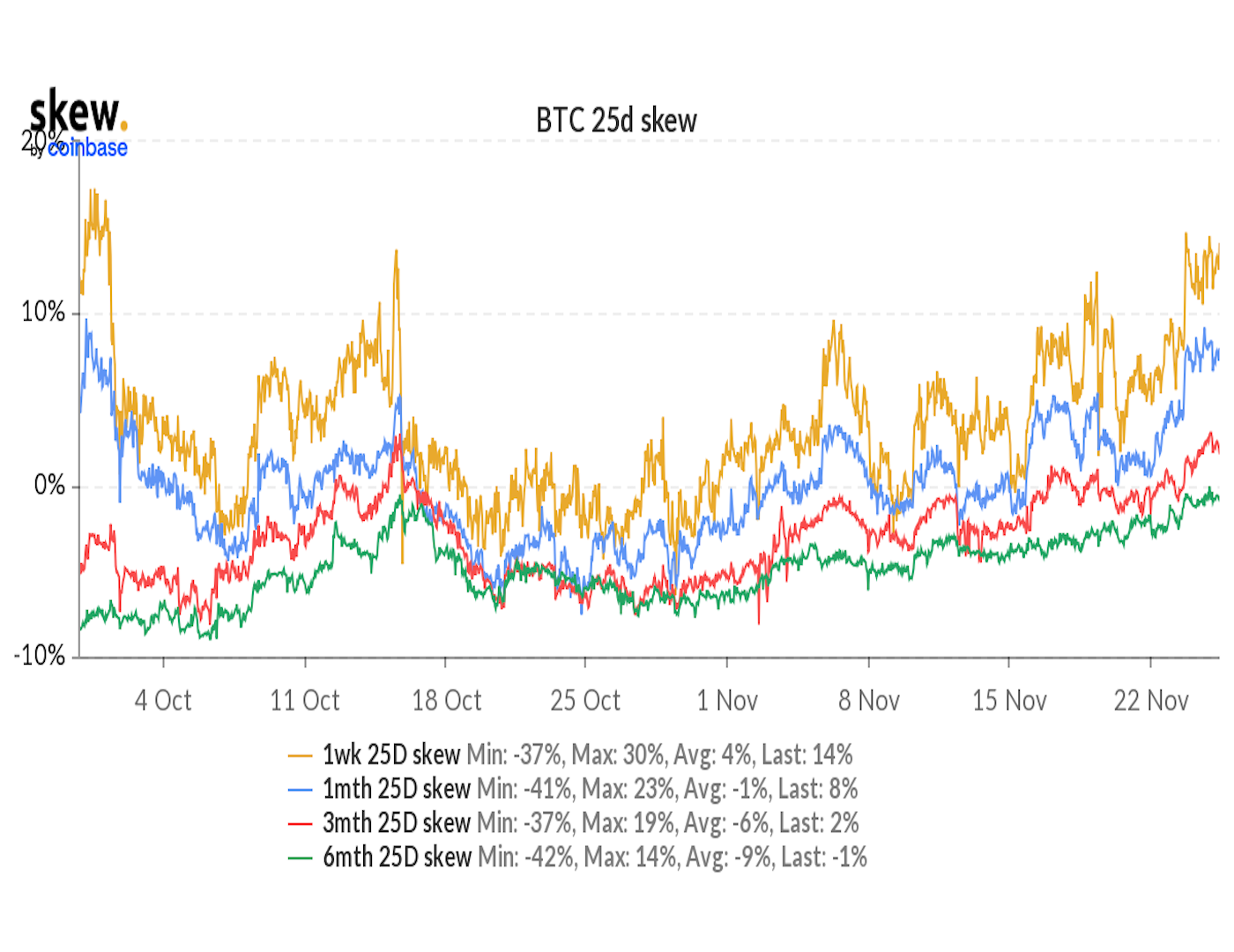

The three-month put-call premium over calls reached a six-week high — at 3%. At the start of the month the metric stood at -5%.

A similar dynamic, with a move into a bearish curve, was also evident in contracts expiring in November and December. For six-month expiry options, the bullish sentiment was effectively neutralised.

The ratios may indicate growing willingness to hedge long positions on spot and futures markets amid a noticeable bitcoin price correction. From a record high, it had fallen by nearly 20%.

The driver of the decline in the leading cryptocurrency recently could be the prospect of faster normalization of monetary policy by the Federal Reserve. The data showed annual inflation rising to a 30-year high of 6.2%.

On November 3, the U.S. central bank announced the start of tapering of monthly government bond purchases by $10 billion, and of mortgage-backed securities by $5 billion. If kept at these paces, the process would be fully completed in eight months — by June 2022. The next Federal Reserve meeting, at which these paces may be revised, will take place on December 15.

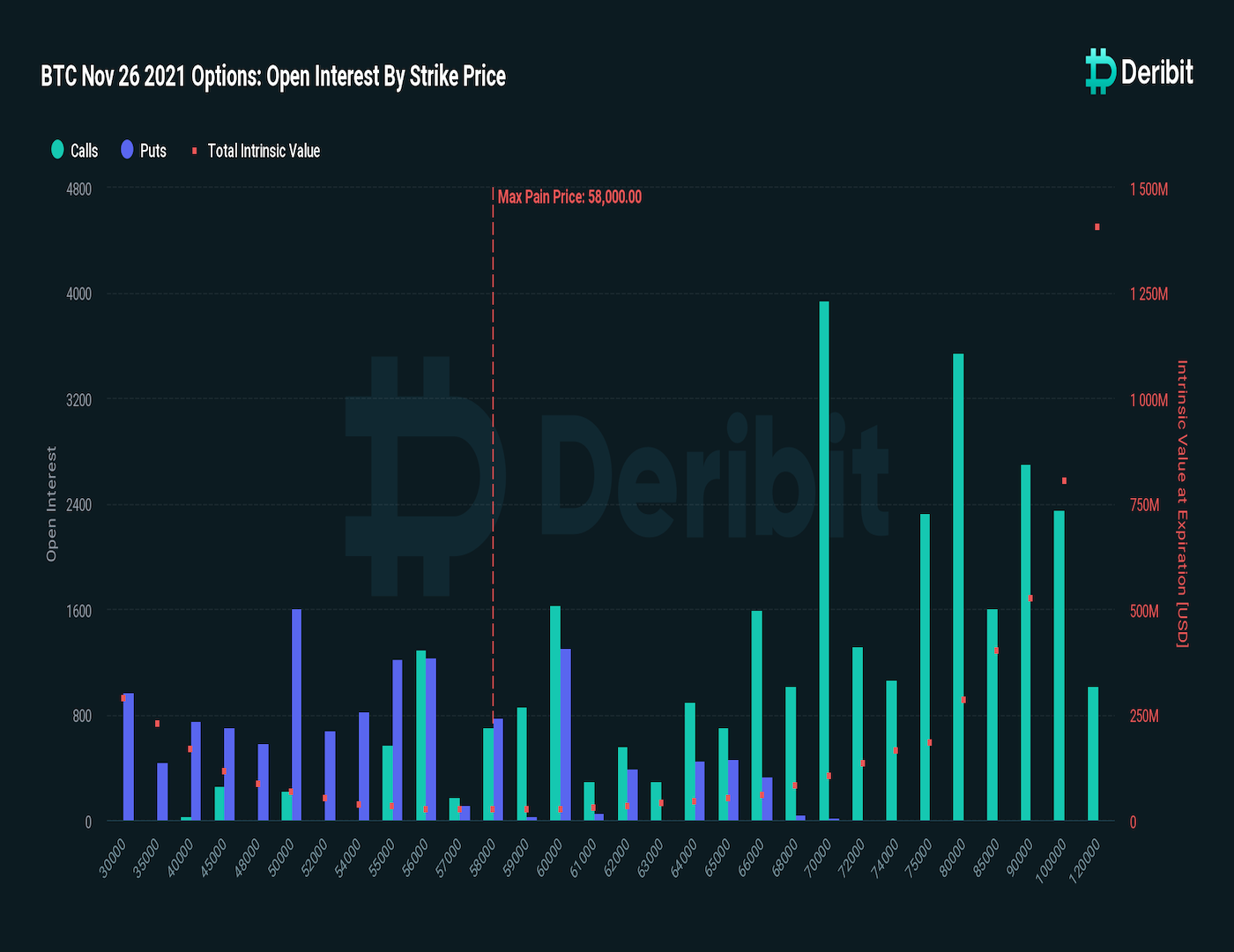

On November 26, expiry will occur for 51,900 options worth nearly $3 billion. The majority of them have strike prices above the historical maximum. On Deribit, where the lion’s share of contracts will expire, option buyers will incur the largest losses with the spot price near $58,000. Bitcoin is trading at $58,800 as of writing, according to CoinGecko.

Earlier, analysts at Huobi named the Stock-to-Flow model by PlanB as flawed.

Earlier, SkyBridge Capital founder Anthony Scaramucci forecasted that the price of the leading cryptocurrency would reach the $500,000 mark.

Subscribe to ForkLog’s news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!