Alameda-led group of GBTC holders sues Grayscale

Alameda Research and a number of funds, as holders of GBTC and ETHE filed a lawsuit against the creator of these trusts—the Grayscale firm.

The activist group intends to compel the asset manager to redeem the shares. It also seeks compensation for an ‘unreasonably high’ management fee, with the rate reduced to ‘competitive levels’ (the current rate is 2% per year).

According to court filings, over the past two years the firm collected more than $1.3 billion in fees.

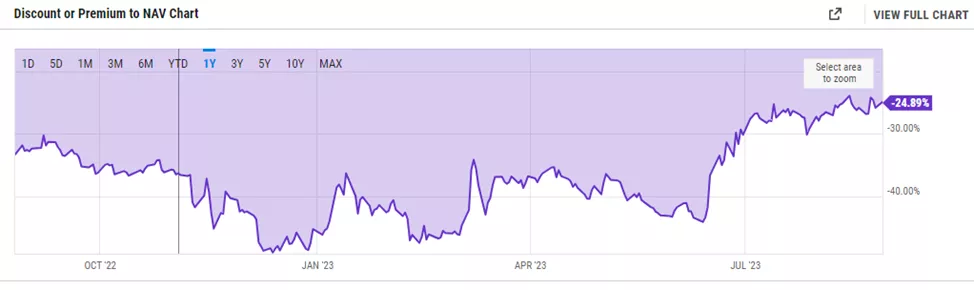

Grayscale has paused GBTC redemptions. Holders can trade the instrument on the market at a discount of 24.9%.

The plaintiffs accused Grayscale of mismanagement of the products and of conflicts of interest in breach of contractual and fiduciary obligations.

Owners of GBTC and ETHE may join the class-action lawsuit.

In June 2023, the asset-management firm Grayscale filed a lawsuit against the regulator for refusing to convert its flagship GBTC trust into a bitcoin ETF. The filing with the SEC to convert the investment product was made by the company filed in October 2021.

On 29 August, the Appeals Court ordered the Commission to reconsider its decision.

The court ruling followed a sequence of appeals to the SEC by major financial institutions such as BlackRock and Fidelity for listing exchange-traded funds based on the spot price of the first cryptocurrency. Bitcoin futures ETFs have been traded in the US since 2021.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!