America’s first Ethereum ETF with staking launches

Meanwhile, BlackRock targets an income-generating bitcoin ETF

On September 25, REX Shares and Osprey Funds announced the launch in the US of an Ethereum-ETF with staking. Filings from BlackRock and Fidelity remain under review by the SEC.

As noted in the announcement, the new product with the ticker ESK “became the first fund in the States to offer access to the spot price of the second-largest cryptocurrency and to include staking.” Investors will receive monthly distributions for participating in supporting the Ethereum network.

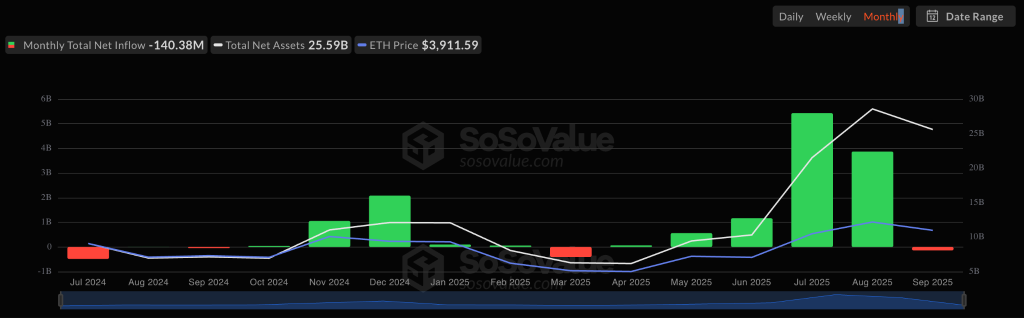

The Commission earlier requested additional time to evaluate applications from BlackRock, Fidelity and Franklin Templeton to add this feature to their ether-based ETFs. Exchange-traded funds based on the asset already trading have attracted about $25.5 billion in total.

In July, REX-Osprey launched the first U.S. Solana ETF. In September, trading in exchange-traded funds based on Dogecoin and XRP started with the companies’ backing.

In August, the firms also filed with the SEC to register a BNB-based product with staking.

Instruments from REX Shares and Osprey Funds are structured under the Investment Company Act of 1940. It provides a shorter review period—75 days versus 240 days under the Securities Act of 1933, under which bitcoin and Ethereum ETFs were launched.

BlackRock targets an income-generating bitcoin ETF

On September 25, BlackRock registered in Delaware a trust for a new Bitcoin Premium Income ETF. Bloomberg ETF analyst Eric Balchunas noted the move, stressing that such a step often precedes an official filing with the SEC.

BlackRock registered the name iShares Bitcoin Premium ETF, filing coming soon. This is a covered call bitcoin strategy in order to give btc some yield. This will be a '33 Act spot product, sequel to the $87b $IBIT. pic.twitter.com/IR7hJ59m6q

— Eric Balchunas (@EricBalchunas) September 25, 2025

According to him, the product involves a covered-call strategy on bitcoin futures. The goal is to generate regular income for investors by collecting premiums.

However, this would potentially limit participation in the upside of the first cryptocurrency’s price compared with direct investment via spot ETFs that follow the market, Balchunas noted.

“The fact that BlackRock is developing a new bitcoin product while other coins are waiting for their funds to be approved is quite telling. It seems the company has decided to focus on building an ecosystem around the largest cryptocurrencies by market capitalisation, leaving altcoins aside, at least at this stage. This opens broad opportunities for other market participants, who will now not have to face giants like BlackRock,” — added the expert.

Earlier, macro analyst Luke Gromen said that the absence of built-in yield in digital gold is an advantage that makes it a safer store of value.

Bitwise bets on Hyperliquid

In parallel, Bitwise filed an S-1 with the SEC to launch a Hyperliquid ETF. According to the document, the fund will hold HYPE tokens directly, which provide discounts on the decentralised exchange and are used to pay fees on the HyperEVM blockchain.

NEW: @BitwiseInvest files for Hyperliquid ETF. HYPE pic.twitter.com/l3WaXRmo8Z

— James Seyffart (@JSeyff) September 25, 2025

To begin the review process, the company must also file Form 19b-4.

In mid-September, the SEC simplified the listing procedure for crypto ETFs. To shorten timelines, a product must be tied to an asset that trades on venues within the ISG, or serve as the basis for a futures contract registered on an approved market for at least six months.

However, Bitwise representatives noted that “at present, futures contracts on Hyperliquid are not registered with the CFTC.” Therefore, approval may take up to 240 days.

Amid the adoption of unified rules for exchange-traded funds based on cryptocurrencies, Hashdex together with Nasdaq Global Indexes announced an expansion of its ETP to include Stellar, XRP and Solana. Previously, it included only bitcoin and Ethereum.

As reported, assets under management in digital-asset investment products reached $40.4 billion since the start of the year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!