Analyst forecasts the collapse of Strategy imitators

The tactic of boosting market capitalisation by building corporate bitcoin treasuries may prove less durable than many expect, according to on-chain analyst James Check.

My instinct is the Bitcoin treasury strategy has a far shorter lifespan than most expect, and for many new entrants, it could already be over.

It’s not about a measuring contest.

It’s about how serious & sustainable your product & Strategy is to sustain the accumulation.

— _Checkmate ??⚡☢️?️ (@_Checkmatey_) July 4, 2025

For most new entrants in this segment, “it could already be over,” he noted.

“It’s not about a measuring contest, but about how serious and sustainable your product and strategy are to sustain the accumulation,” Check wrote.

In his view, firms now copying Strategy’s policy of forming a bitcoin treasury using equity and debt will find it harder to raise capital. Investors will prefer earlier followers.

“No one wants the 50th company with a treasury. I think we are already close to the ‘prove it to me’ phase, when a random firm X will find it increasingly difficult to hold high positions and move forward without a serious niche,” Check said.

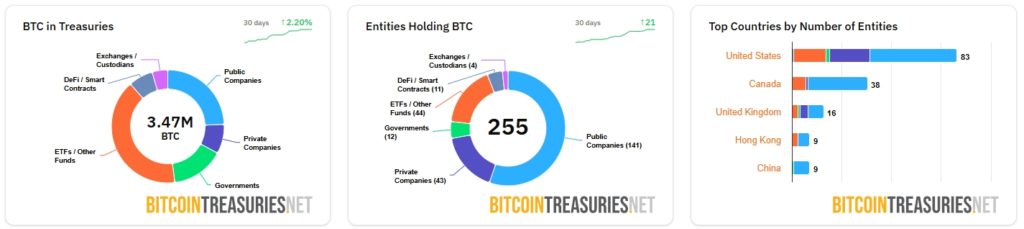

According to BitcoinTreasuries, the number of companies holding the first cryptocurrency on their balance sheets has reached 255, up by 21 in the past 30 days alone.

By the size of corporate bitcoin reserves, Strategy leads outright with 597,325 BTC. In second place, mining company MARA Holdings holds 50,000 BTC.

Check agreed with Taproot Wizards co-founder Udi Wertheimer that many firms use a bitcoin-treasury strategy as a way to make a quick profit without understanding its essence.

Agree.

— _Checkmate ??⚡☢️?️ (@_Checkmatey_) July 4, 2025

“The weak among them may be absorbed by the strong at a discount, and the trend may gain a few additional directions,” the entrepreneur added.

Check noted that flows into the debt or equity of companies with BTC reserves are largely provided by retail investors, whose money is “not infinite”. He added that Strategy has far greater capacity to attract it than a hypothetical “number 300” in the niche.

He declined to specify a timeline for a shake-out in the segment, citing optimistic expectations for the bitcoin price.

Who faces a “death spiral”?

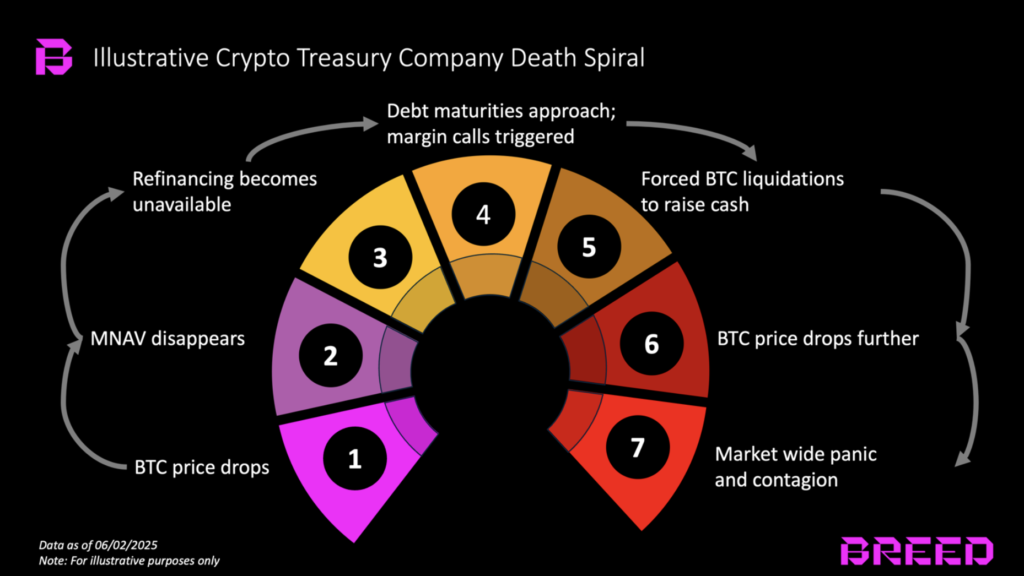

Few companies accumulating digital gold will stand the test of time and avoid a “death spiral”, according to venture firm Breed.

Most at risk are businesses buying cryptocurrency with borrowed capital and focused exclusively on building bitcoin reserves.

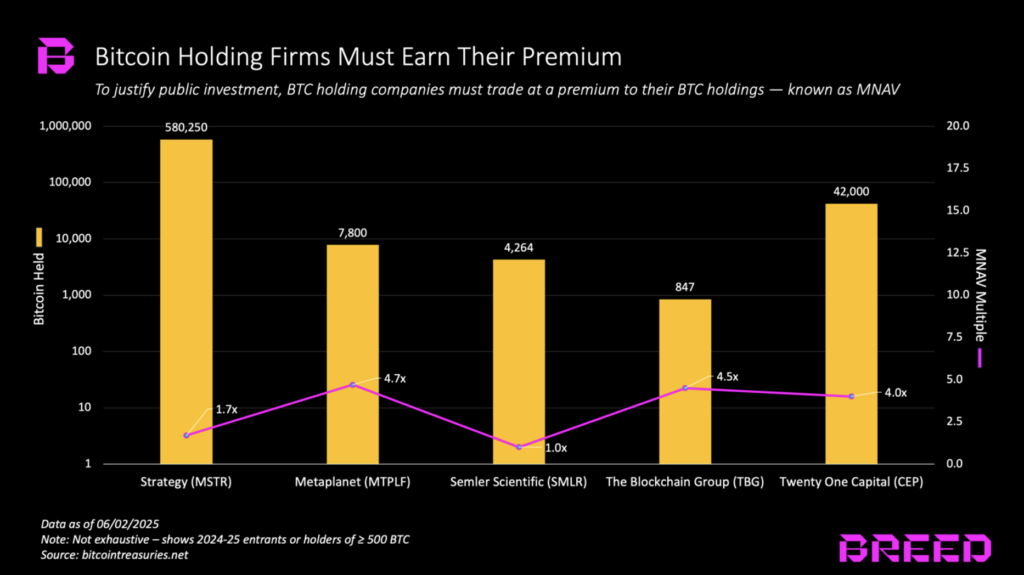

These firms require a constant inflow of financing. The appeal of such investments is supported by a premium to the company’s value, reflected in the Multiple on Net Asset Value (MNAV) metric. The ratio is calculated as the firm’s market capitalisation divided by the dollar value of the cryptocurrency held on the balance sheet.

“The market does not reward a company with an MNAV simply because it owns bitcoins. This happens when investors believe the management can reliably grow ‘BTC per share’ faster than they could do it themselves,” the Breed experts explained.

The main threat is a prolonged bear market, which will “undermine” MNAV and bring companies’ capitalisation closer to their net asset value (NAV). The need to refinance debt amid dwindling capacity to raise capital would force partial liquidation of reserves. Such sales would pressure bitcoin’s price and could trigger a cascading effect, the report’s authors believe.

“New treasury companies face this risk even more acutely. Without Strategy’s scale, reputation and passive index inflows, they are likely to raise capital on tougher terms and with a higher leverage ratio,” the experts noted.

However, in their assessment, the odds of widespread contagion are low, since bitcoin purchases are mostly financed with equity.

Breed’s specialists also backed Wertheimer’s view that strong players in the segment will absorb struggling competitors.

Fakhul Miah, managing director at GoMining Institutional, told Cointelegraph he is concerned about the rapid spread of Strategy imitators.

“There are now other companies trying to build bitcoin banks without proper safeguards or risk management. If these smaller firms fail, we could see a ripple effect that harms the image of cryptocurrency,” he said.

Earlier, analysts at Coinbase Institutional called the growing popularity of corporate bitcoin reserves one of the main systemic risks for the market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!