Analysts Predict ‘Uptober’ Despite Market Fear Signals

The Fear and Greed Index fell to 28 points, its lowest since March 2025.

The Fear and Greed Index fell to 28 points, marking its lowest level since March 2025. This decline coincided with a brief dip in Bitcoin below $110,000.

Fear returns to the market 😨

The Crypto Fear & Greed Index just dropped to 28—its lowest level in 6 months. pic.twitter.com/J4tcC3DvP5

— Maartunn (@JA_Maartun) September 29, 2025

Despite this, analysts see signs of a market bottom forming and anticipate growth in October.

According to CryptoQuant analyst JA Maarturn, investor sentiment has worsened from a neutral 40 points in August to “extreme fear.”

Against this backdrop, Bitcoin and Ethereum fell below the psychological thresholds of $110,000 and $4,000 respectively last week. However, the decline was short-lived—at the time of writing, Bitcoin’s price had recovered to $113,311, and Ether was trading above $4,100, according to CoinGecko.

Signs of a Bottom?

Asset management firm Bitwise believes the current situation may indicate the end of the downturn phase. Analysts noted that sellers appear “increasingly exhausted.”

“Last week, sentiment twice reached the ‘extreme fear’ level, yet Bitcoin showed relative resilience, holding around $108,000. This level serves as strong support,” Bitwise stated.

Data from Glassnode supports this thesis. According to the service, short-term holders are currently realizing net losses. Historically, such capitulation periods have often laid the foundation for long-term rallies.

#Bitcoin short-term holder NUPL has rolled into loss territory, signaling stress among recent buyers.

STH capitulation events have historically marked periods of market reset, often laying groundwork for renewed accumulation.

🔗https://t.co/Jz7M1I1b7e pic.twitter.com/PKBlULo8hM— glassnode (@glassnode) September 29, 2025

ETFs as the Main Catalyst

Ryan Lee, chief analyst at crypto exchange Bitget, described October as a “turning point” for the market in comments to ForkLog. He believes that decisions by the SEC on spot ETFs will play a key role.

“We view October as a turning point due to the Commission’s move towards unified listing standards for spot exchange-traded funds. This could shorten approval timelines and open a new stream of institutional capital,” Lee stated.

The expert predicted that digital gold could rise to between $100,000 and $130,000, and Ethereum to $3,600–$5,500, should there be positive ETF news.

Traders Shift Focus to Altcoins

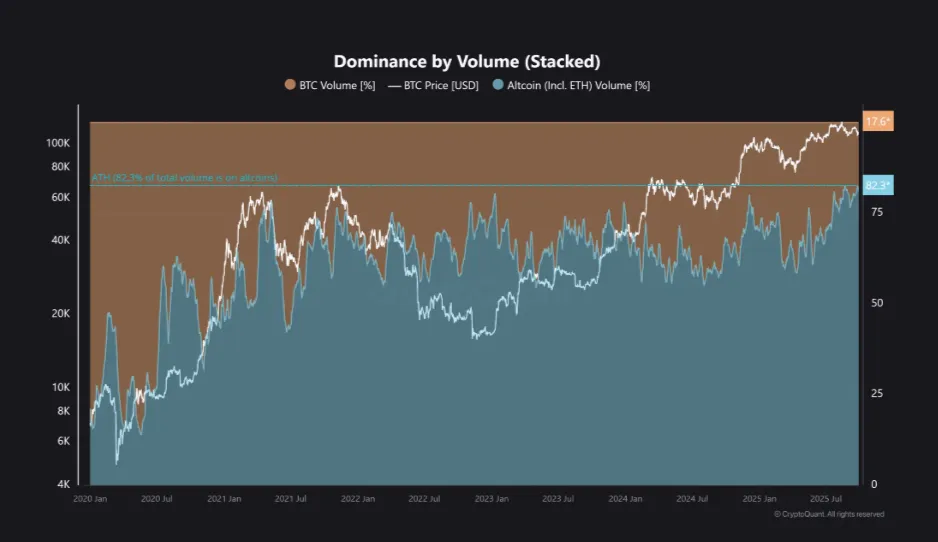

Meanwhile, another trend is emerging in the market. JA Maarturn noted that the share of altcoins in Binance’s futures trading volume reached a record high of 82.3%.

This figure even surpassed the peak levels of the 2021 altseason.

This indicates a shift in traders’ focus from the leading cryptocurrency to more volatile assets in anticipation of higher returns.

QCP also confirmed the return of optimism to the perpetual futures market. Open interest in Bitcoin rose from $42.8 billion to $43.6 billion.

However, QCP warned that for a sustainable upward trend to be confirmed, Bitcoin’s price must hold above the $115,000 level.

Back in September, analysts at XWIN Research reported that the implied volatility of the leading cryptocurrency had fallen to its lowest level since 2023.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!