Analysts record a spike in DeFi token trading

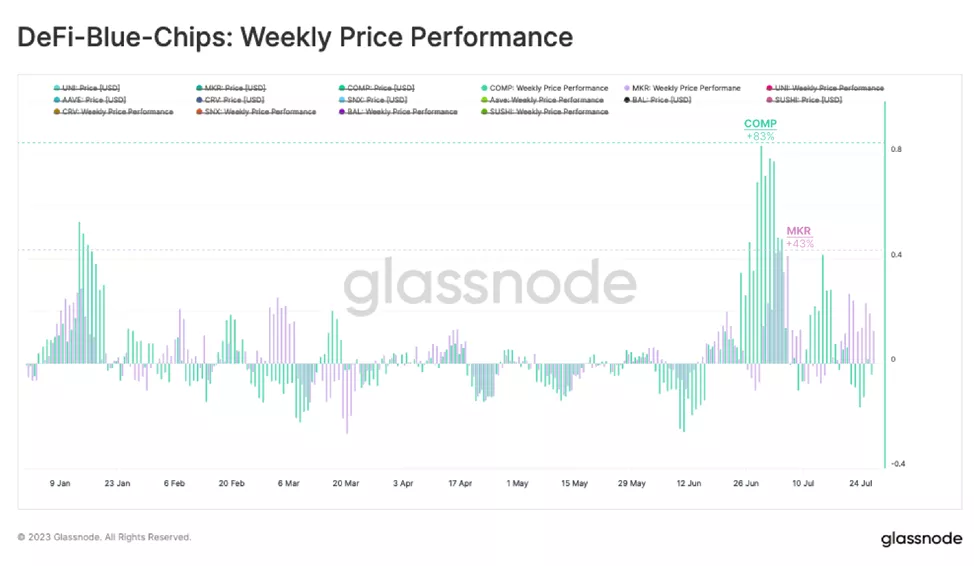

In recent weeks DeFi tokens, led by MKR and COMP, have outpaced the market. Experts at Glassnodelinked this to retail-trader activity.

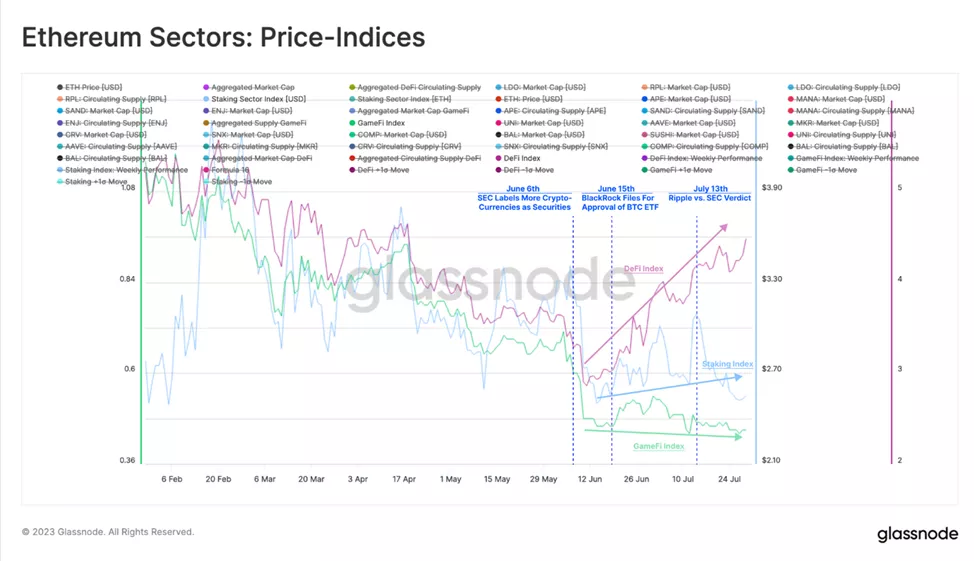

Analysts noted a conflicted news backdrop — from the SEC‘s designation of 68 tokens as securities to the hype around bitcoin-ETFs and Ripple’s partial victory.

During this period, the DeFi-asset index rose 56% from the June 11 low.

The drivers of the move were Maker (MKR) and Compound (COMP). Analysts attributed this to new fundamental principles of the projects.

On 28 June, the CEO of the latter, Robert Leshner, announced his departure and the launch of an Ethereum fund focused on investments in U.S. Treasury securities within the company Superstate.

The structure will also invest in government-agency assets and other state-backed instruments. Against this backdrop, COMP rose by 83%.

Around the same time, MakerDAO activated the Smart Burn Engine — a program to repurchase MKR from the Uniswap pool using excess DAI. As a result, the asset price over the week jumped 43%.

A shift in focus supported trading activity on the DEX — the ratio of trading volume to the equivalent figure on centralized platforms jumped from 3.75% to 29.25%.

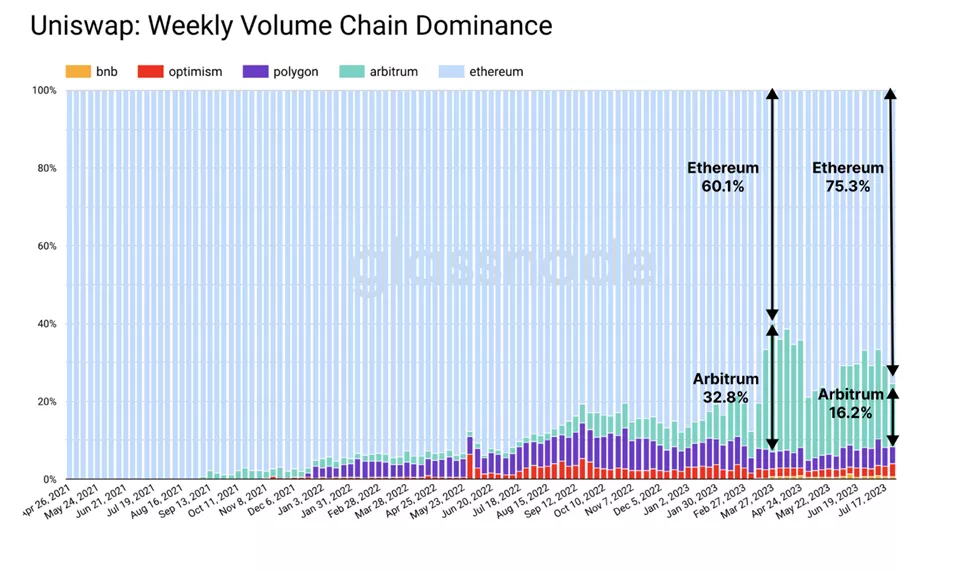

In absolute terms, these changes did not show on the sector’s largest venue, Uniswap on the Ethereum network. The reason — a shift to Arbitrum. A similar platform on the L2 solution captured 16.2% of weekly turnover. In March the figure was twice as high (32.8%).

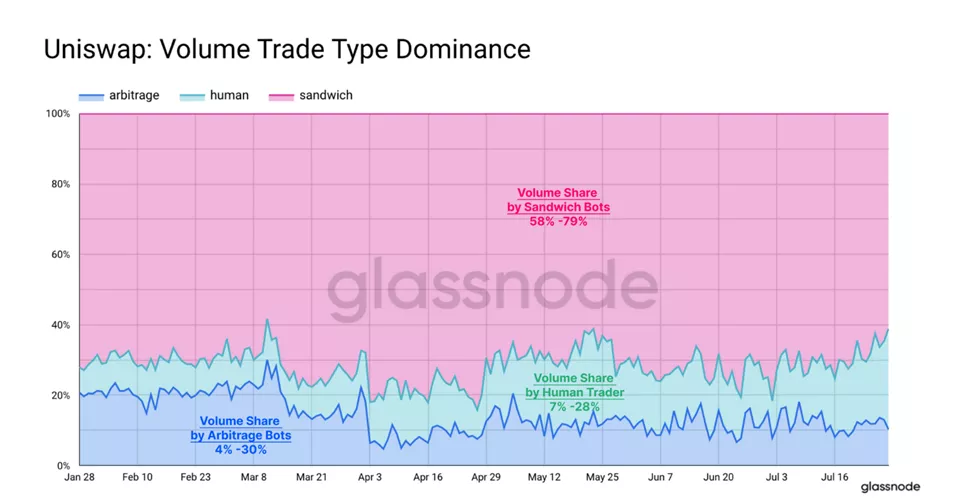

Within Uniswap activity analysts recorded a rise in trading volumes attributable to traders to 28%, reflecting a period of heightened interest in DeFi tokens.

The shares of sandwich bots and arbitrage bots declined to 62% and 10%, respectively. For comparison, at the end of January the latter accounted for up to 79% and 30% of trading activity.

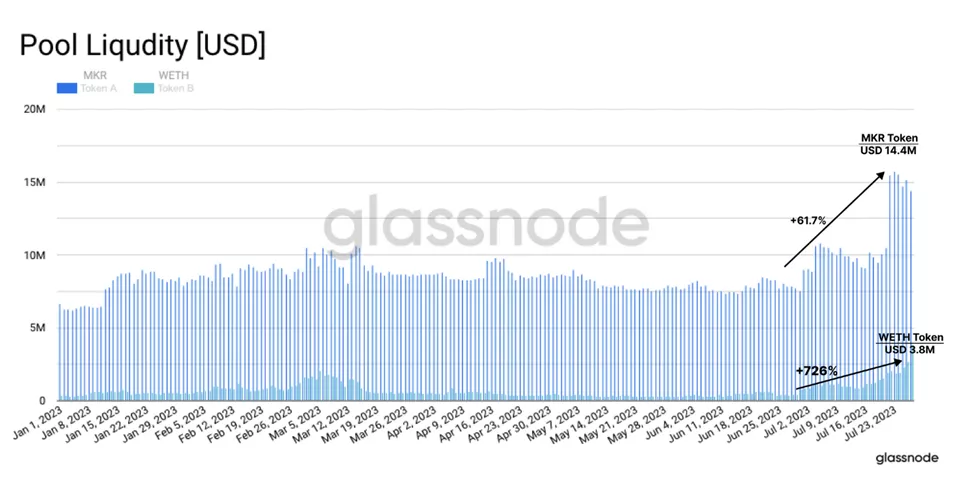

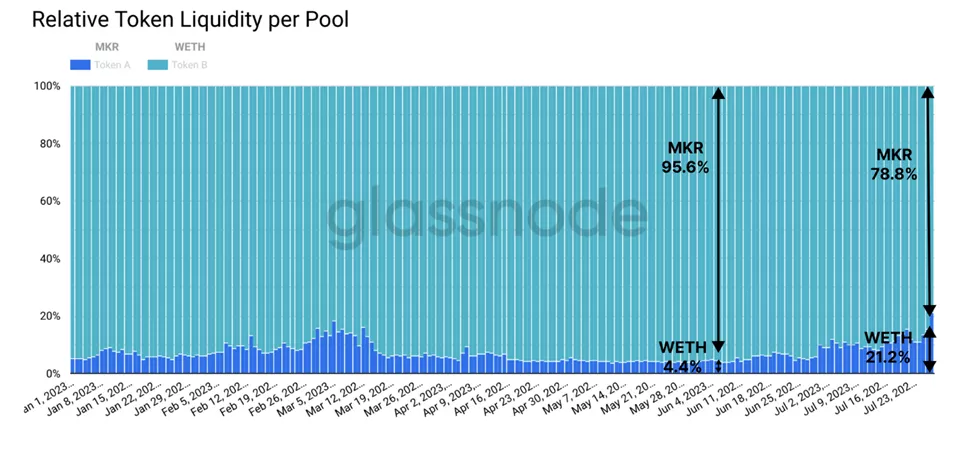

Since the announcement of MakerDAO’s buyback program, the largest concentration of liquidity for MKR on Uniswap v3 has been in the MKR/WETH pool. MKR’s value-denominated volume during the period rose 61.7% to about $14.4 million, WETH by 726% to about $3.8 million.

Analysts emphasised that ‘liquidity providers signal expectations of higher trading volumes for this pair’.

As a result of strong demand for MKR, the share of WETH in the pool by value rose from 4.4% to 21.2%.

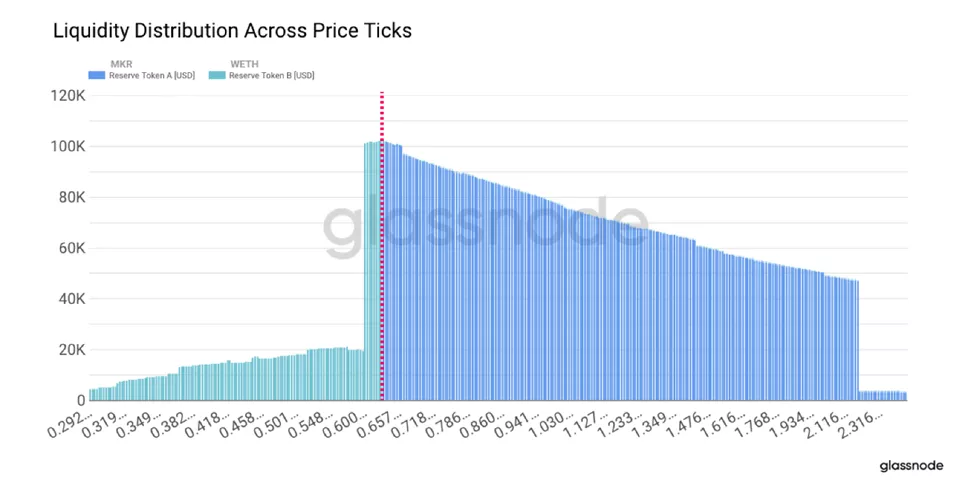

Experts urged attention to MKR–WETH liquidity outside the current range, where it concentrates. They noted that the metric rises with price ticks well above the MKR/ETH rate (the chart below illustrates the situation).

Analysts said that, assuming liquidity providers are rational actors seeking profit, their liquidity movement may provide a market-like view of expected volatility and the token’s implied range.

“Based on the assumption that liquidity providers are rational actors seeking profit, their liquidity movement may provide a market-like view of expected volatility and the token’s implied range”, explained the experts.

In late July, an unknown attacker targeted Curve Finance’s stablecoin pools. The exchange lost digital assets worth about $52 million.

In the first half of 2023, the crypto industry faced 395 hacks, losing about $479.4 million.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!