Analysts set out conditions for bitcoin to break above $115,000

Swissblock: bitcoin must hold $114,000 to sustain a push to new highs.

Since the October 11 sell-off, bitcoin’s rebound has stalled below $115,000. According to Swissblock, it must hold support at $114,000 to keep the rally going toward new highs.

Bitcoin, what is the plan?

This week is about confirmation — proving that Bitcoin is forming a bottom and can hold the $114K support.

The key lies in momentum ignition.

So far, momentum has remained negative, with no decisive reversal.

For BTC to sustain upside continuation,… pic.twitter.com/GsceJsau5w

— Swissblock (@swissblock__) October 27, 2025

“This week is about confirmation; it is necessary to prove that bitcoin is forming a bottom and can hold the $114,000 support,” they noted.

To ignite sustainable momentum, the asset “needs to generate new buying pressure and start forming a new bullish structure from this price base,” the analysts added.

The crypto investor known as Rekt Capital stressed that bulls need to turn the weekly close at $114,500 into support via a retest to confirm the breakout.

Bitcoin has successfully Weekly Closed above both the 21-week EMA (green) and $114.5k (black)

Both $114.5k & EMA could get retested to confirm a reclaim to support$BTC could achieve this via a volatile retest of $114.5k, wicking into the EMA below#Crypto #Bitcoin https://t.co/T7WJgk9mIY pic.twitter.com/hw1chWDSdx

— Rekt Capital (@rektcapital) October 27, 2025

The trader going by Daan Crypto Trades pointed to the importance of holding the 200-day moving average at $114,000.

In his view, bitcoin needs to reach $116,000 to exit the corrective zone.

“This threshold is key to breaking the market structure in the current time frames. Price has cleared the moving averages (200MA/EMA) on the 4-hour time frame, which have acted as resistance since the drop. A first win for the bulls, but it is now important to hold above these levels,” he said.

Analysts at QCP expressed a similar view. They added that “with several macroeconomic catalysts, the crypto market will continue to move in a sideways range before determining the next direction”.

At the time of writing, bitcoin is trading around $114,100.

The problem of low activity

Bitcoin’s ability to clear $115,000 is constrained by a lack of buyers and low on-chain activity, according to Glassnode data.

For the first time since the October 10th flush, spot and futures CVD have flattened, indicating that aggressive selling pressure has subsided over the last several days pic.twitter.com/UaNgNfZxTD

— glassnode (@glassnode) October 26, 2025

According to the analysts, over the past two weeks the CVD indicator on spot and futures markets has stabilised but remains negative. This indicates a reduction in selling intensity.

In parallel, spot trading volume has declined by 17.5% to $12.5bn, pointing to a shortage of speculative activity.

As noted in the 27 October report, bitcoin’s recent recovery to $116,000 occurred without significant market participation.

“The pullback indicates a cooling of market activity and a likely shift to a consolidation phase, as the current price rise has not yet been confirmed by a substantial inflow of capital,” they added.

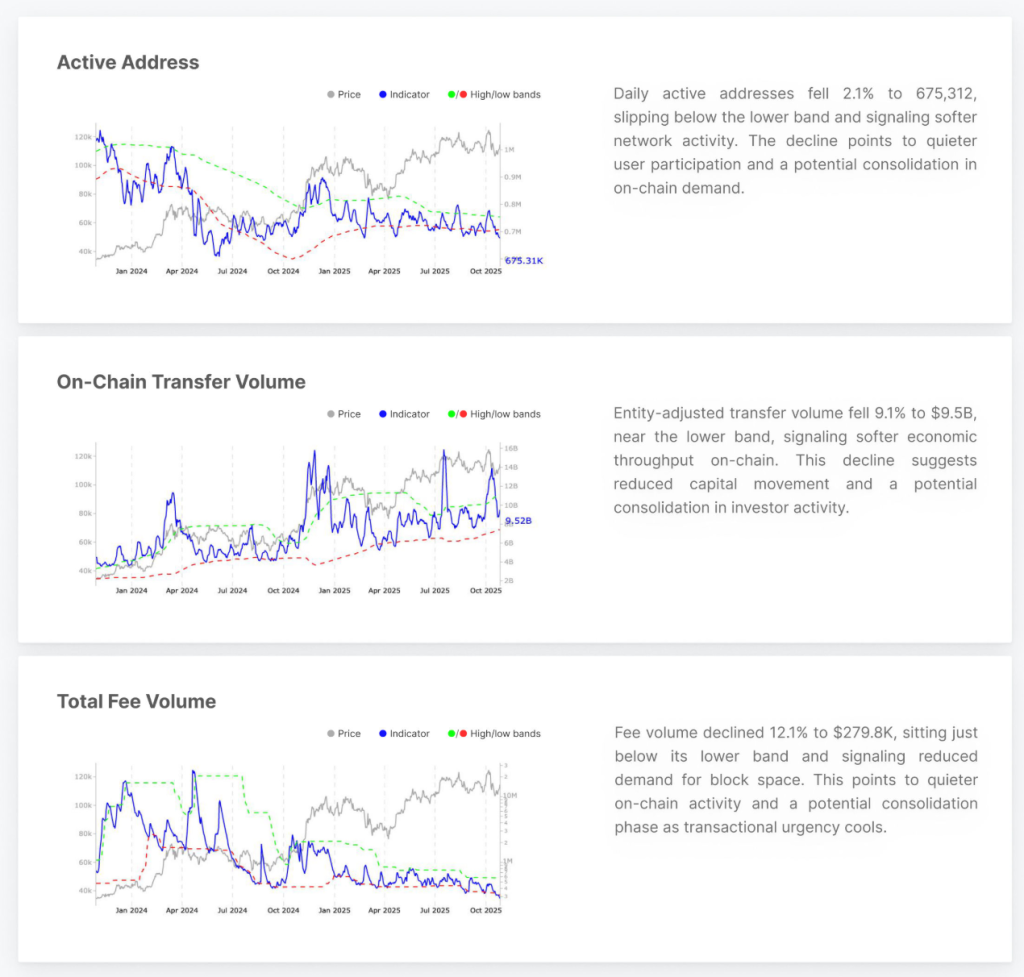

Active addresses, transfer volumes and fees on the bitcoin network continue to decline.

Analysts believe a rise in spot volume and on-chain activity is needed to trigger an accumulation phase and a strong rally.

Earlier, Standard Chartered’s head of digital-asset research Geoffrey Kendrick said that bitcoin’s drops below $100,000 are over.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!