Analysts spot optimistic on-chain signals amid Bitcoin rally

Bitcoin’s return to May highs is accompanied by positive trends in accumulation, hodler behaviour, and rising on-chain activity. Analysts at Glassnode have concluded as much.

#Bitcoin on-chain fundamentals continue to paint a bullish picture, with Long-Term Holder supply hitting ATH

Leverage has also crept back into derivatives, with futures premiums, open interest and funding rates on the rise

Read more in The Week On-chainhttps://t.co/gHMLh2UUMo

— glassnode (@glassnode) October 11, 2021

The analysis indicated an increased likelihood of additional demand for Bitcoin in the fourth quarter.

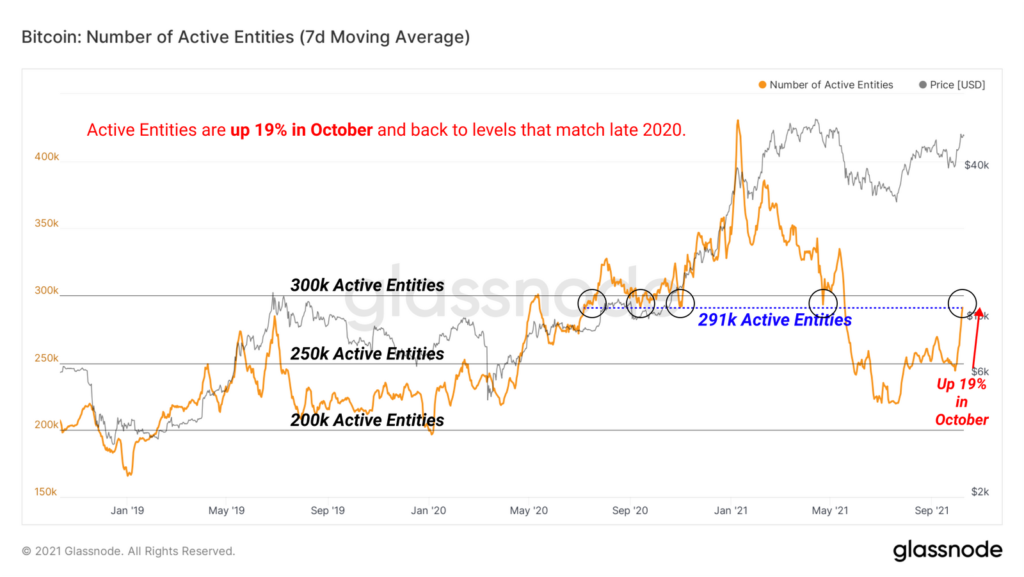

The number of active network participants in October rose 19% to 291,000 (seven-day moving average). The last time such values were observed was in late 2020, just before the rally reaching record April highs.

Historically, the dynamics of this indicator correlated with growing interest in the asset in the early stages of a bull market.

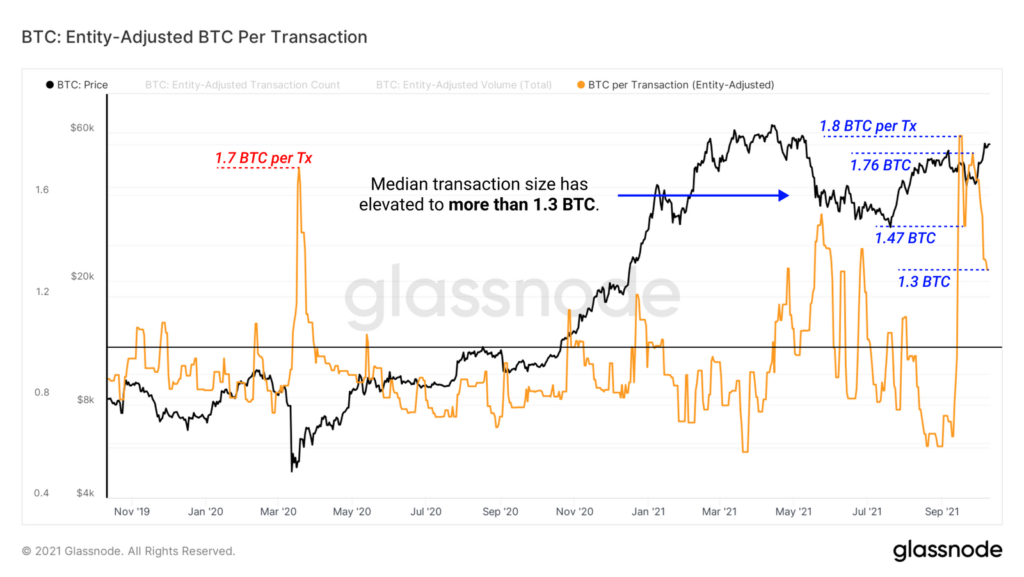

The median transaction size exceeded 1.3 BTC. Shortly before, higher values were recorded, up to 1.8 BTC. The last time the metric reached this level was on the eve of the March 2020 crash.

The rise in the metric does not indicate price gains; rather, it signals growing involvement of institutional investors in network activity. This group tends to emerge at the end of bear markets.

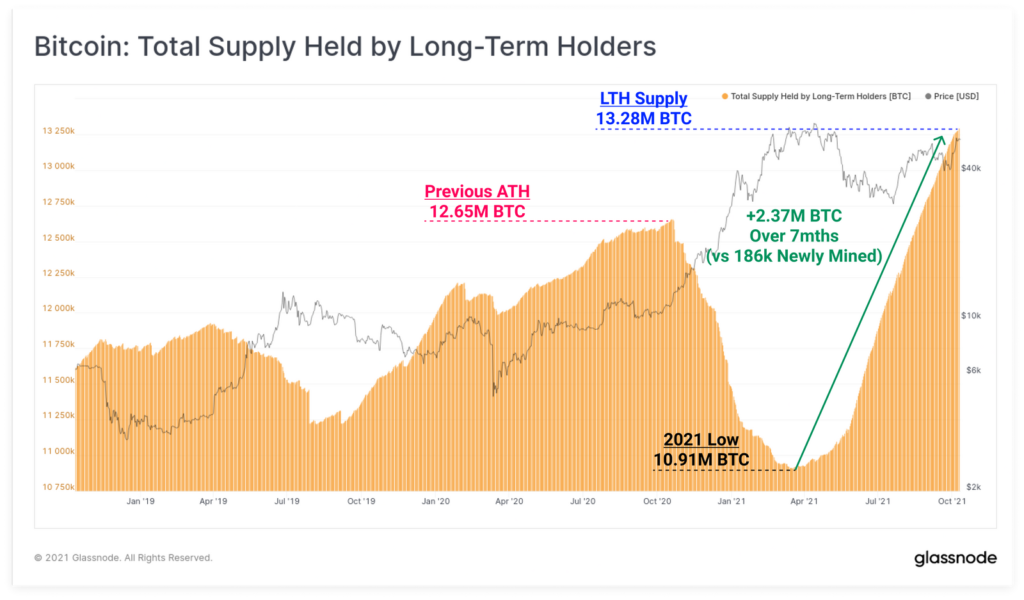

In the last seven months, 2.37 million BTC moved into the long-term holder category (the last activity was more than 155 days ago). In that period, miners mined 186,000 BTC — 12.7 times fewer coins.

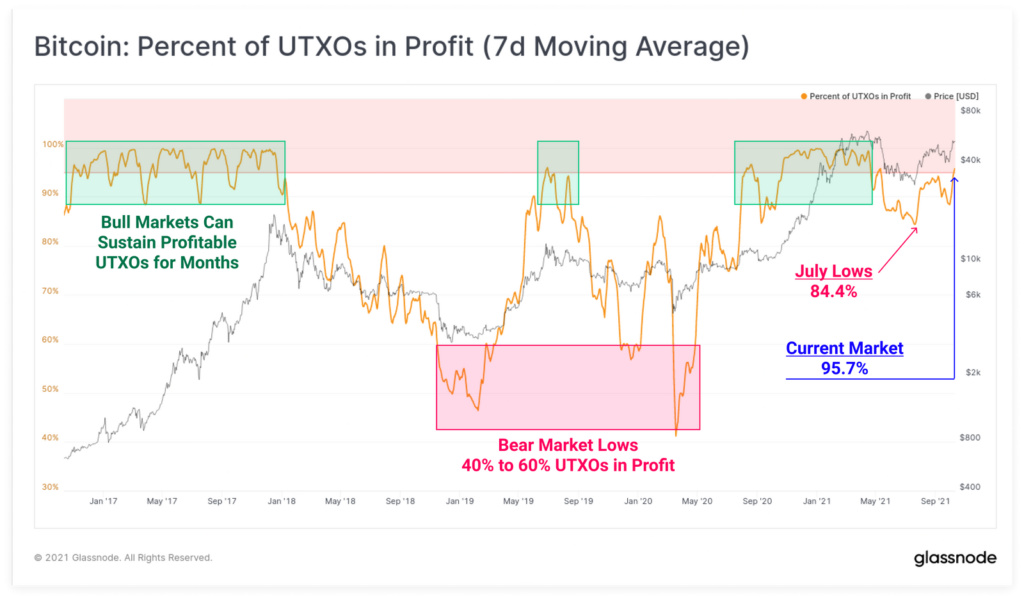

The price rise raised the share of profitable coins to 95.7% of the total supply based on UTXO data. Since the September lows, the indicator has risen by 11.3%. Despite the depth of the May correction (more than 55%), the share of “unprofitable” BTC did not reach 40–60%, typical for 2018–2019 and March 2020. Analysts also noted that values above 90% had previously been sustained for many months in a row.

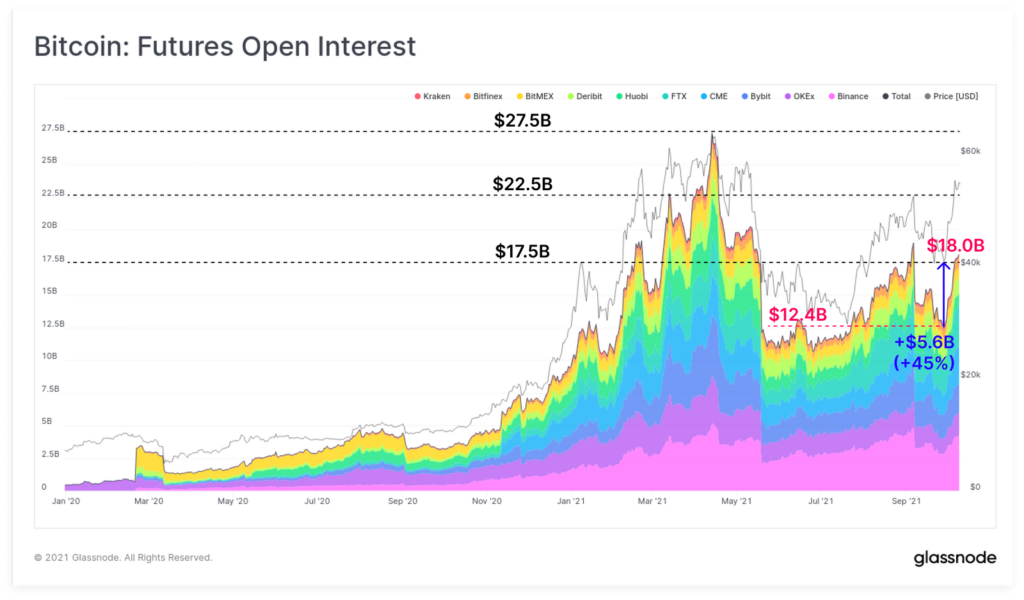

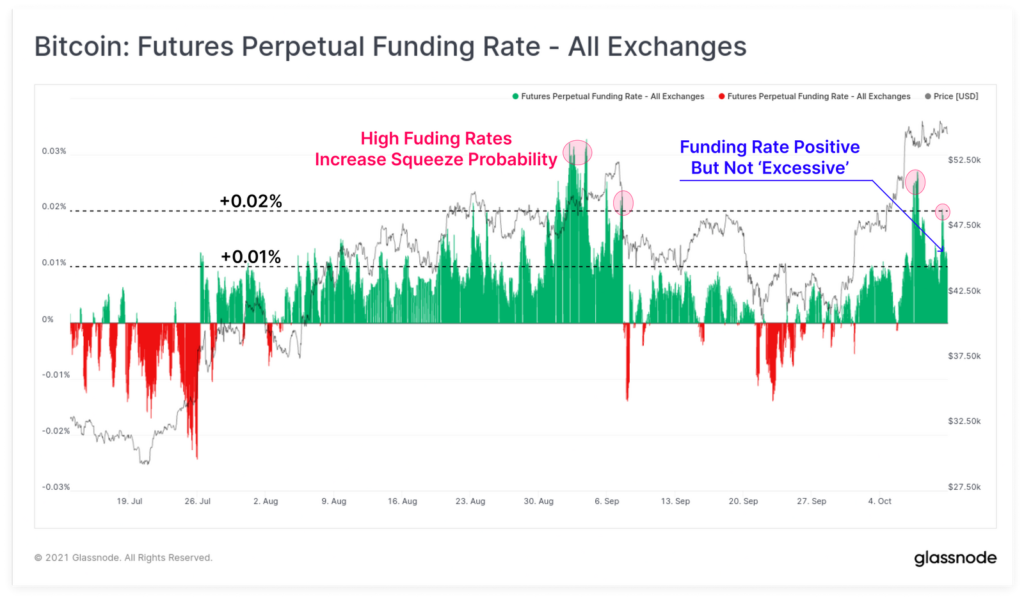

The optimism also showed up in the derivatives market with higher open interest, contango in futures, and higher funding costs for perpetual swaps.

Open interest in futures rose 45% from September lows to $5.6 billion, and in options by 64% to $3.6 billion. In the first case, the market returned to levels seen at the start of September and mid-May, preceding the contraction of the metric.

On perpetual swaps, funding costs remain in the range of 0.01% to 0.02%. Analysts noted that compared with previous periods, traders use leverage more cautiously to boost returns on long positions.

Experts advised monitoring the metric for signs of entering an extreme-value zone, as happened in September shortly before the cascade of long liquidations.

The driver of Bitcoin’s ascent to new highs since May has been expectations of a positive Bitcoin-ETF decision — in August Bloomberg predicted approval of the instrument by the end of October.

Pantera Capital CEO Dan Morehead did not rule out that the launch of the instrument could end the bull market.

Subscribe to ForkLog news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!