Analysts Uncover Reasons Behind Bitcoin’s Drop to $115,500

Concerns over the future policy of the Federal Reserve emerged as the primary factor causing market correction. This was stated by Vincent Liu, Chief Investment Officer at Kronos Research, in a comment to The Block.

Over the past day, the price of the leading cryptocurrency fell by 2.2%, according to CoinGecko. At the time of publication, bitcoin is trading at $115,543.

“The decline in bitcoin’s price reflects cautious investor sentiment amid higher-than-expected inflation data in the US,” the expert noted.

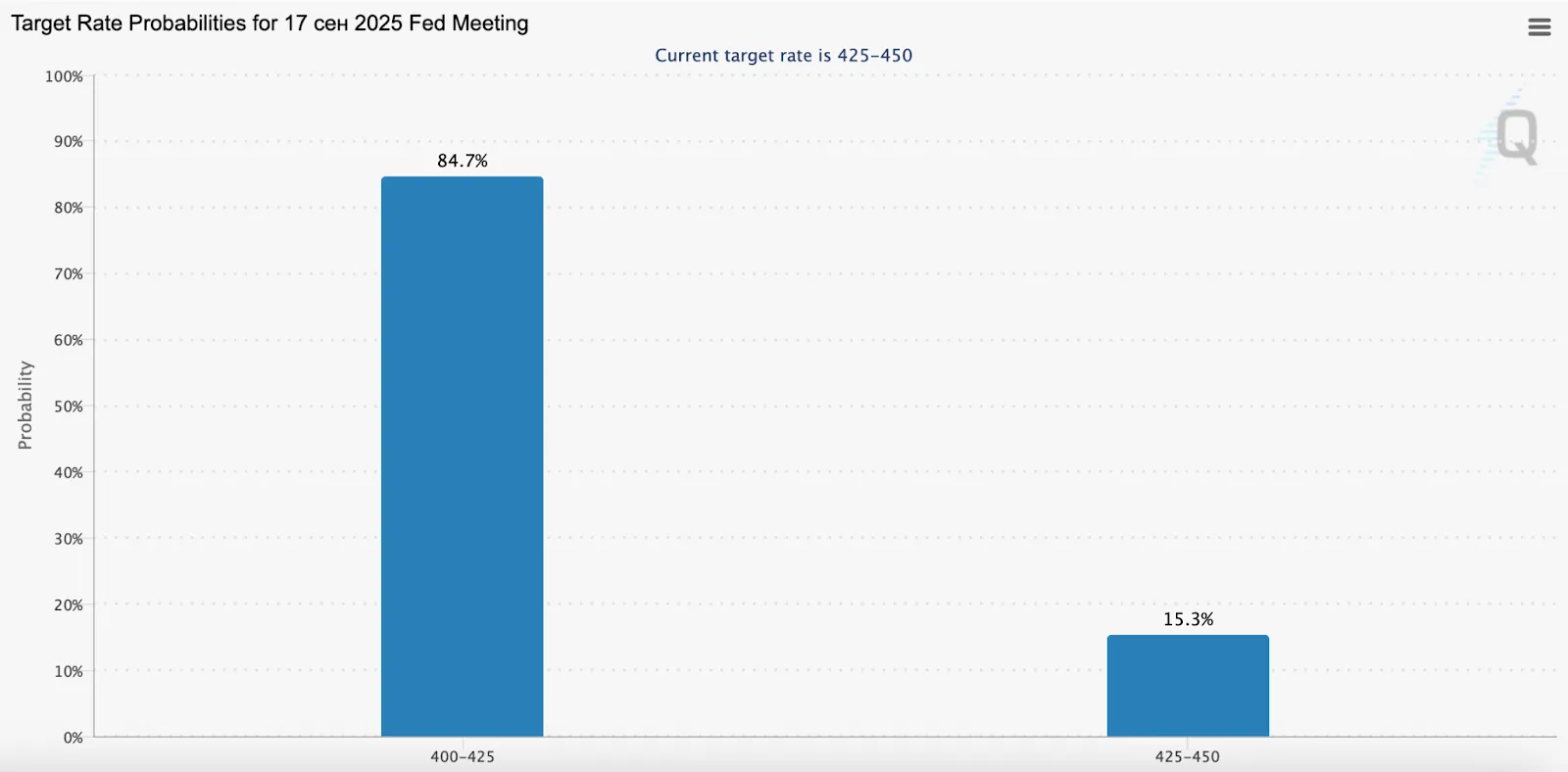

On August 12, the US released data on the Consumer Price Index (CPI). The figure remained at 2.7%, contrary to forecasts of 2.8%. At that time, the probability of a rate cut at the Federal Reserve’s September meeting jumped to 93.9%.

However, investor optimism was dampened by the Producer Price Index (PPI) for July, which rose by 3.3% against the expected 2.5%. According to Liu, this reduced hopes for easing Federal Reserve policy, strengthened the dollar, and prompted market participants to shy away from risks.

Additional negative sentiment came from US Treasury Secretary Scott Bessent, who ruled out augmenting bitcoin reserves through the budget.

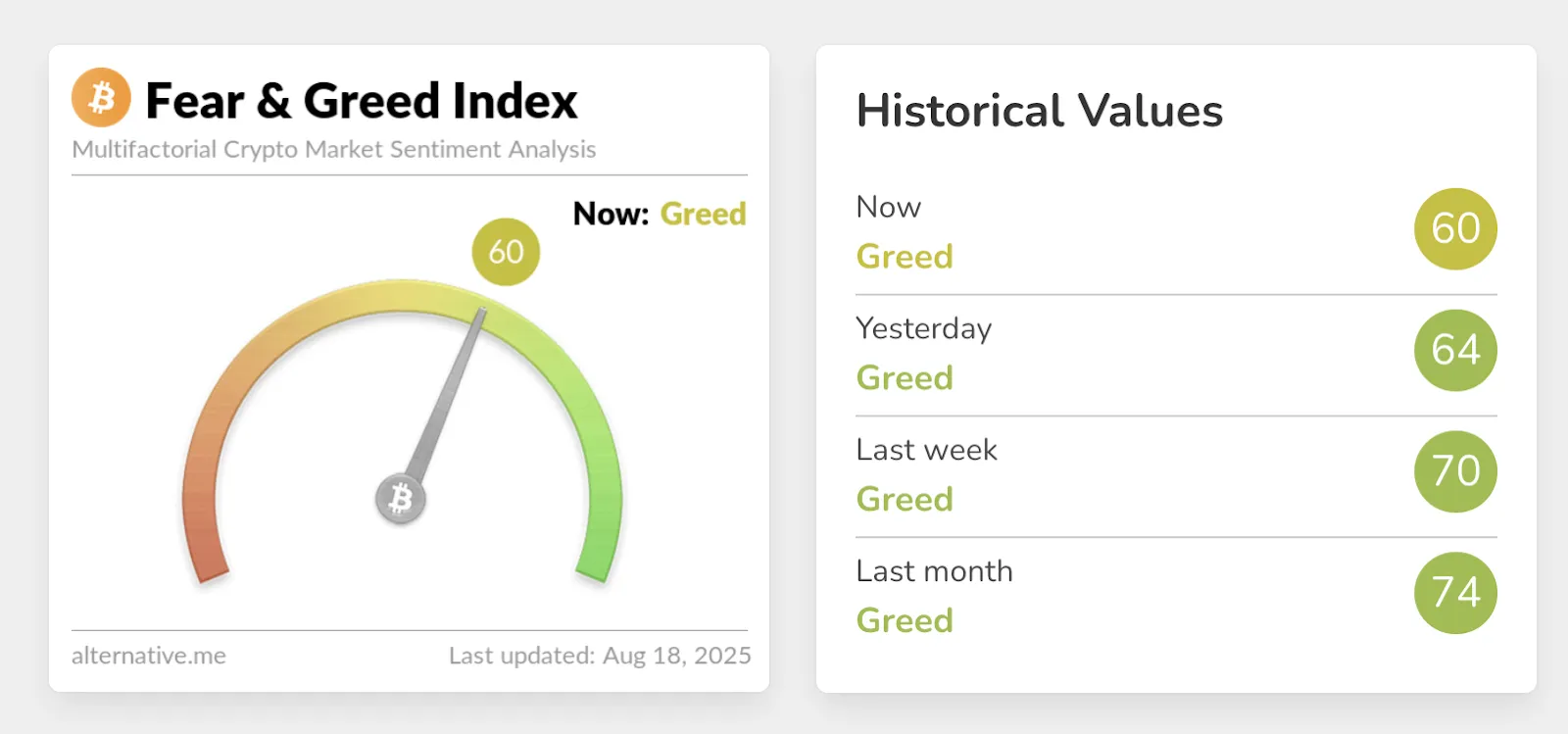

The Fear and Greed Index fell to 60, indicating a decrease in investors’ risk appetite.

BTC Markets analyst Rachel Lucas believes the drop in the price of digital gold reflects a capital rotation rather than a loss of confidence. On August 15, spot bitcoin ETFs from Grayscale and Ark Invest recorded outflows, while BlackRock’s fund attracted $114 million.

“Although daily flows have slightly decreased overall, the scale of institutional investor participation remains significant, indicating that investors are consolidating into cheaper products rather than exiting the market entirely,” the expert noted.

She also pointed to key support levels for the leading cryptocurrency — $115,000 and $112,500. A break below these marks could lead to a drop to $110,000.

The next catalyst could be the Federal Reserve symposium in Jackson Hole from August 21-23. According to Lucas, any hints of monetary policy easing could support cryptocurrencies.

Companies Remain Optimistic

Meanwhile, corporate treasuries continue to accumulate bitcoin. On August 18, Japanese company Metaplanet acquired another 775 BTC for approximately $93 million, announced its president Simon Gerovich.

Metaplanet has acquired 775 BTC for ~$93 million at ~$120,006 per bitcoin and has achieved BTC Yield of 480.2% YTD 2025. As of 8/18/2025, we hold 18,888 $BTC acquired for ~$1.94 billion at ~$102,653 per bitcoin. $MTPLF pic.twitter.com/9r1law8jyH

— Simon Gerovich (@gerovich) August 18, 2025

“I understand the frustration over the recent pullback. Such feelings are natural. But our confidence is bolstered by the foundation we are building together,” he noted.

The total number of coins on the company’s balance sheet reached 18,888 BTC worth $1.94 billion at an average purchase price of $102,653.

Metaplanet has risen to sixth place in the list of the largest holders of digital gold. The leader remains Michael Saylor’s Strategy, managing 628,946 BTC worth $72.5 billion.

Back in the day, the trend of corporate crypto treasuries sparked debates within the community. Proponents argue that such structures enhance the ecosystem’s visibility and create long-term value for the assets companies accumulate. Critics, on the other hand, point to the risk of conflicts of interest.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!