Analysts Warn Bitcoin Could Fall to $67,000

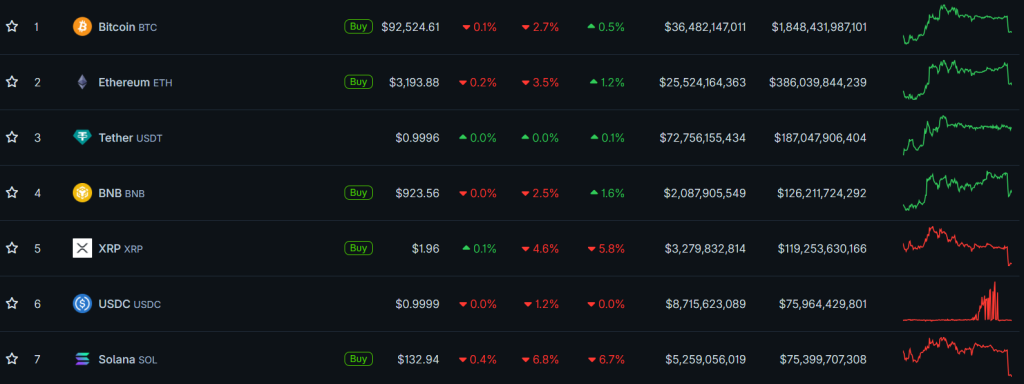

Bitcoin drops 3.3% to ~$92.3k; analysts see risk of a slide toward $67k.

On January 19, the price of the leading cryptocurrency fell from $95,467 to $92,263, down 3.3%. Leading altcoins followed bitcoin into the red.

Heightened volatility triggered mass liquidations in the futures market. In just four hours, traders lost more than $870m, with the brunt borne by long positions.

At the time of writing, digital gold trades around $92,500, down 2.8% over the past 24 hours.

Analysts linked the drop to fears of a potential US–EU trade war. Rising political tensions weighed on investors.

Presto Research analyst Min Jung noted the weakness of cryptocurrencies compared with traditional instruments: while equity indices are holding steady, digital assets are losing ground.

BTC Markets analyst Rachel Lucas sees geopolitics as only part of the problem. She cited regulatory uncertainty in the US as the fundamental cause after consideration of the Clarity Act to structure the crypto market stalled.

According to Lucas, bitcoin is in a consolidation phase after reaching an all-time high at $126,000 in October 2025. A breach of the 50-week moving average triggered automated selling by algorithmic bots.

Outflows from spot bitcoin ETFs worsened matters: funds shed $4.4bn in November and December.

If macroeconomic pressure persists, the price could fall into the $67,000–74,000 range. Even so, she stressed, the current pullback does not resemble the protracted “crypto winters” of past years, as the industry has become more mature.

Open interest

Since the start of the year, open interest (OI) in bitcoin futures has risen by almost 13%. Analysts link this to a gradual return of risk appetite.

According to CoinGlass, the metric increased from an eight-month low of $54bn (January 1) to $61bn (January 19). A local peak was recorded on January 15 at $66bn.

A CryptoQuant analyst known as Darkfost noted that the market is moving into recovery. The current trend contrasts with the autumn correction, when, against the backdrop of falling prices, OI shrank by 17.5% (from 381,000 BTC to 314,000 BTC).

🗞️ Bitcoin Open Interest falls from 381K to 314K BTC while Binance holds 36% of total OI.

Futures markets continue to account for the vast majority of Bitcoin trading volumes, far ahead of spot and ETFs. In this context, Open Interest is a key indicator to assess investor… pic.twitter.com/uzWba0fAvM

— Darkfost (@Darkfost_Coc) January 18, 2026

Darkfost described the market as a “slow return of risk appetite”. A strengthening of this trend could support bullish sentiment.

Even so, the market is still in a “deleveraging” phase: in dollar terms OI remains 33% below the October all-time high of $92bn. The analyst considers such deleveraging healthy — it helps form a bottom and builds a base for future growth.

Options edge out futures

Coin Bureau CEO Nic Pakrin noted an important structural shift. Last week, open interest in bitcoin options exceeded that of futures.

Something quiet but important just happened to Bitcoin.

For the first time, options OI is bigger than futures.

This means big money’s building positions that shape price itself through hedging and expiry mechanics.

It isn’t just betting up or down anymore.

There’ll be fewer…

— Nic (@nicrypto) January 18, 2026

According to Checkonchain, aggregate options OI reached $75bn, compared with $61bn for futures.

Pakrin believes the bitcoin market is becoming more mature:

- big money is using sophisticated strategies rather than simple up-or-down bets;

- cascade liquidations are becoming rarer;

- the market is shedding its “casino” reputation and evolving into a structured financial system.

As reported by CryptoQuant contributor IT Tech, short-term holders of the leading cryptocurrency have moved to take profits, the analyst reported.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!