Arcane Research: BitMEX share decline will benefit the crypto derivatives market

BitMEX’s share of the Bitcoin futures market by open interest (OI) has fallen by more than half since the start of the year — from 36.9% to 16.8%. With rising competition, the crypto derivatives market has become less vulnerable to sudden problems on platforms, according to Arcane Research analyst Vetle Lunde.

The fact that the OI in the BTC futures market has spread its wings to new exchanges is a healthy sign for BTC going forward, as the BTC derivatives market is less exposed for sudden clampdowns on certain exchanges, such as the very recent BitMEX incident.https://t.co/CUEm0r12T9

— Vetle Lunde (@VetleLunde) October 5, 2020

On October 1, news emerged of a lawsuit filed against BitMEX by the U.S. Commodity Futures Trading Commission (CFTC). The U.S. Department of Justice likewise charged the exchange’s owners with violations of the Bank Secrecy Act.

These events led to Bitcoin’s price dropping to around $10,500 and a substantial outflow of funds from the once-leading crypto derivatives exchange. In just a few hours, the open interest in Bitcoin futures on BitMEX fell to 61,869 BTC, below the year’s low.

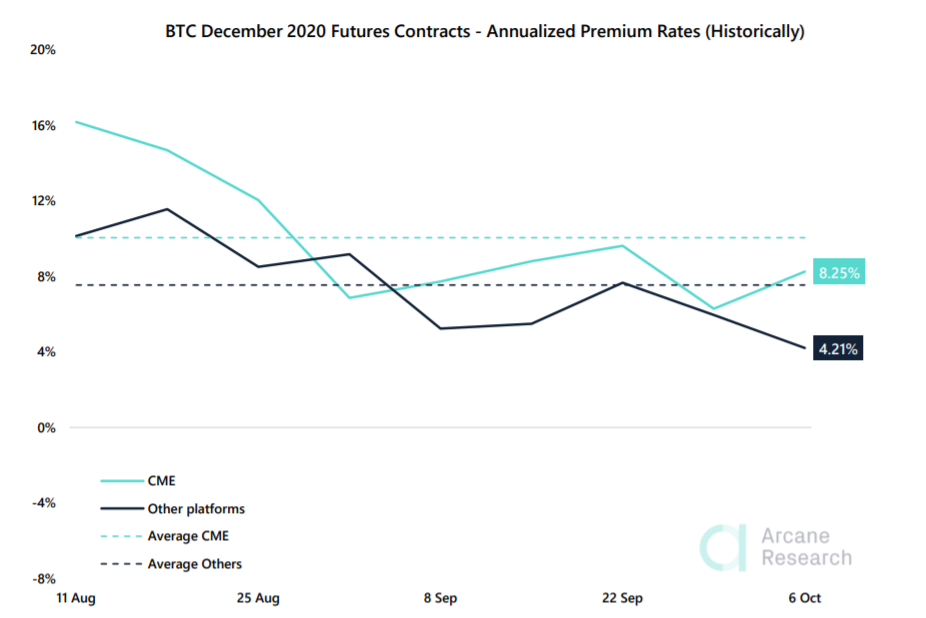

Arcane Research believes that BitMEX’s regulatory troubles have negatively affected user trust in such retail platforms. This hypothesis may be supported by a chart showing rising premium for December Bitcoin futures on the regulated Chicago Mercantile Exchange (CME) in light of the latest events. It also shows that on other platforms this metric has fallen.

Premium dynamics for December Bitcoin futures. Source: Arcane Research.

According to Lunde, BitMEX’s market positions have shifted to other platforms. Growth was observed at CME, Bybit, Binance, FTX and Bitfinex. Second and third places by open interest are held by OKEx and Huobi. Like BitMEX, they failed to hold on to market share.

There has been significant movements in the open interest in the BTC futures market this year.

BitMEX has lost its dominant position while the competition in the derivative markets has been sharpened as more exchanges have gained traction. pic.twitter.com/BVRQTAOSoo

— Vetle Lunde (@VetleLunde) October 5, 2020

CME, Bybit, Binance, FTX and Bitfinex have all seen strong growth in their relative shares of the total open interest in the BTC futures market this year. pic.twitter.com/ANfK7d63Ux

— Vetle Lunde (@VetleLunde) October 5, 2020

As of early October, five platforms held more than 10% of the total open interest in the Bitcoin futures market:

- OKEx: 23.07% (~$830m);

- BitMEX: 17.33% (~$620m);

- Huobi: 14.35% (~$515m);

- Binance: 12.14% (~$440m);

- Bybit: 10.58% (~$381m).

In January, there were three such platforms with OI above 10% — BitMEX, OKEx, Huobi.

There are now 5 exchanges holding more than 10% of the total OI in the BTC futures market (October average).

OKEx: 23.07% (~830m USD)

BitMEX: 17.33% (~620m USD)

Huobi: 14.35% (~515m USD)

Binance: 12.14% (~440m USD)

Bybit: 10.58% (~381m USD) pic.twitter.com/Zm5DijfxB9— Vetle Lunde (@VetleLunde) October 5, 2020

Исследователь отмечает стабилизацию общего ОИ по биткоин-фьючерсам на уровне 350 тысяч BTC после сентябрьской коррекции. Тогда этот показатель приближался к 600 тысячам BTC. В последний раз текущие уровни наблюдались в начале мая.

The OI in the BTC futures market has stabilized at around $4 billion following the BTC correction in the beginning of September.

The total OI in the BTC futures market measured in BTC is currently below 350k BTC. A sustained OI below 350k BTC has not been seen since early May. pic.twitter.com/wAaxqAVPx0

— Vetle Lunde (@VetleLunde) October 5, 2020

ForkLog previously reported that in 2020, due to increased competition and user outflows to DEXs and derivative platforms ceased to exist 75 Bitcoin exchanges.

Follow ForkLog’s news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!