ARK Invest adds Coinbase shares worth $8.6 million

ARK Invest-managed funds increased their holdings in Coinbase shares by about $8.6 million.

The investment company also purchased additional securities on the same day that the crypto exchange filed a lawsuit against the U.S. Securities and Exchange Commission.

Cathie Wood’s firm’s portfolios allocated the purchases as follows:

- flagship ARK Innovation ETF — 122,083 shares;

- ARK Next Generation ETF — 20,327 shares;

- ARK Fintech Innovation ETF — 14,633 shares.

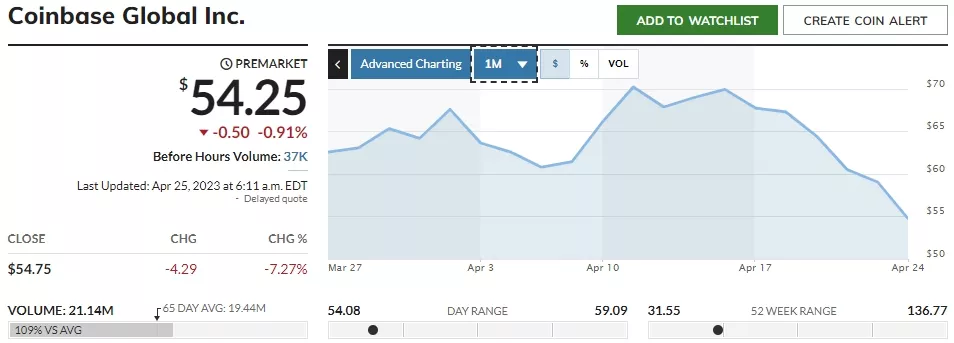

Based on the close price of $54.75, the total amounted to nearly $8.6 million.

In late March, ARK Invest, in two sessions (the 24th and 27th), bought blocks of Coinbase shares. The firm took advantage of the price pullback from near $84 to around $66.

In the last 30 days, the crypto exchange’s shares have fallen about 15%. At the time of writing, the premarket price was $54.25.

ARK Invest resumed purchasing Coinbase shares in October 2022 for the first time since June. The firm steadily increased its positions in the stock and only in March disposed of a stake worth $13.5 million.

Stocks of cryptocurrency-related companies typically correlate with Bitcoin’s price. Since the start of the year, Bitcoin has risen about 65.5%, Coinbase’s shares have gained 50%. Digital gold is trading around $27,400 (CoinGecko).

In January, Ark Invest experts projected that Bitcoin could rise to $1.36 million by 2030.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!