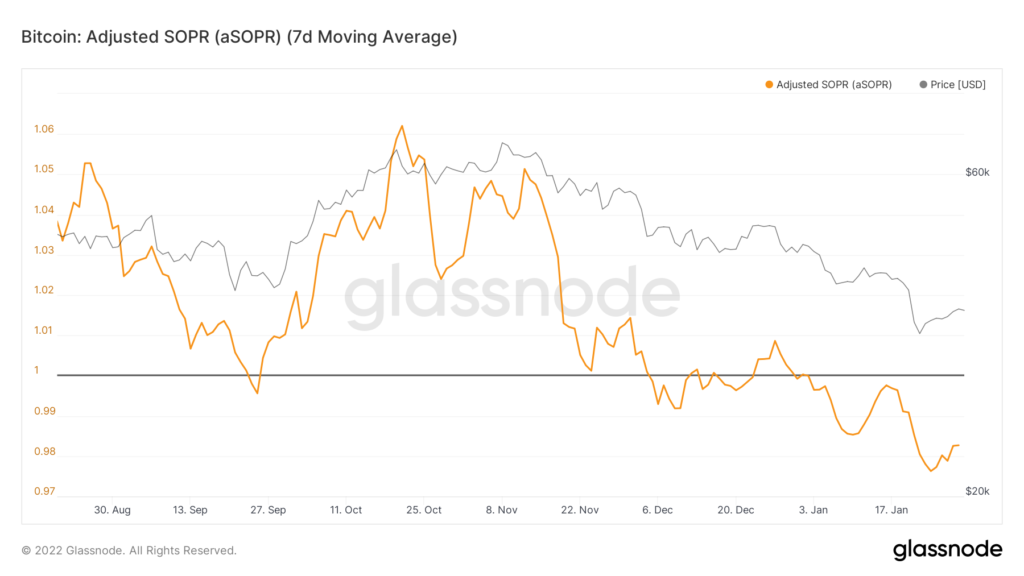

aSOPR Indicator Signals Sharp Deterioration in Market Sentiment in January

Throughout January, amid a falling market, values of the indicator aSOPR (7MA) remained below the 1 level, signaling a significant deterioration in market sentiment and investors recording losses. This is described in ForkLog’s analytical report.

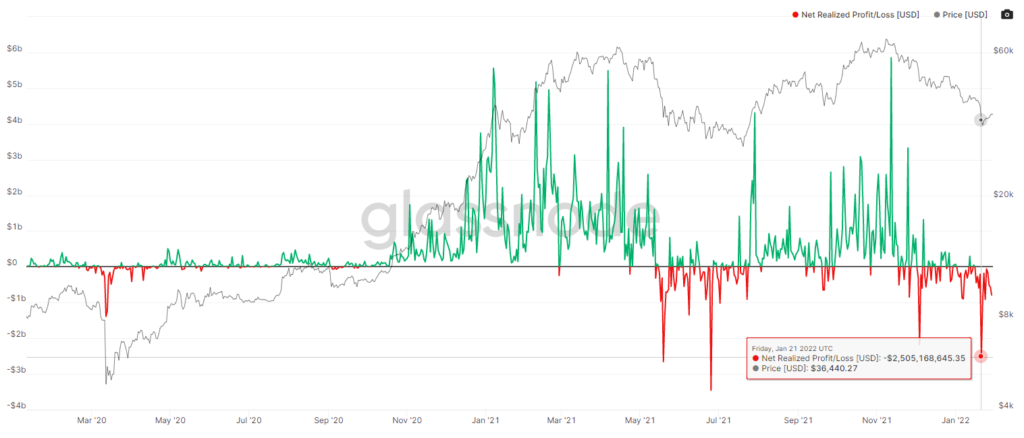

On January 21, net realized losses by investors reached $2.5 billion. The last time comparable values appeared was in May and June 2021.

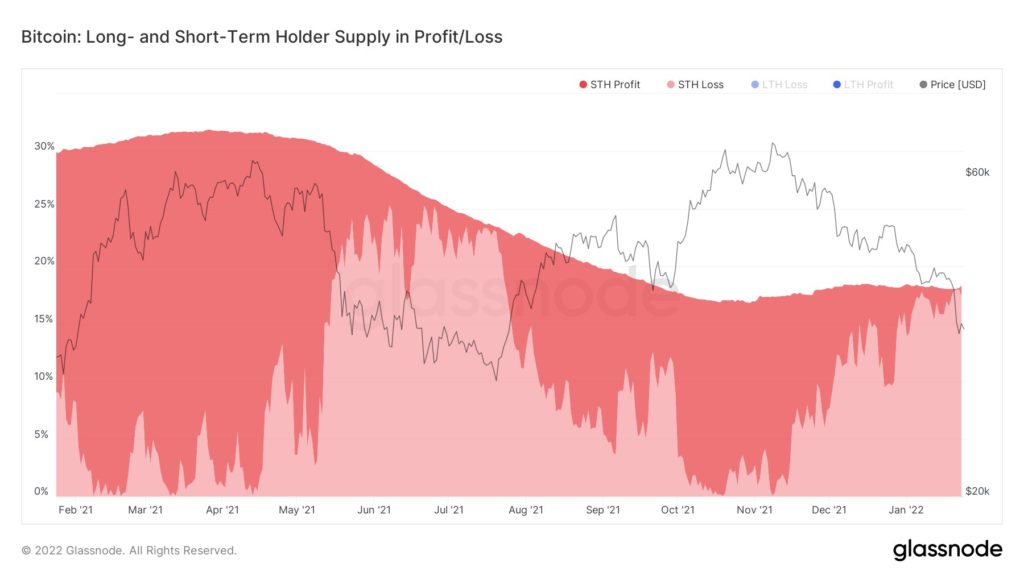

The share of short-term investors’ assets in the total Bitcoin supply at the end of January stood at more than 18%. Over 90% of coins are “in the red” for holders — bought at higher prices.

The share of long-term investors’ assets in the total Bitcoin supply surpassed 80% — a level near multi-year highs. At the same time, only 6% of coins are “in the red” for their owners.

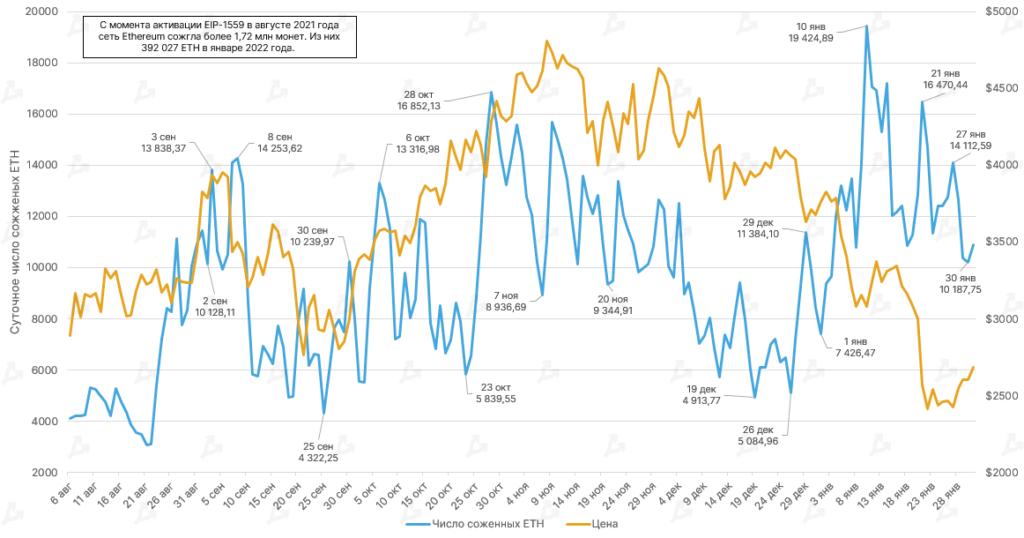

Since the activation of EIP-1559 in August 2021, the Ethereum blockchain has burned more than 1.72 million ETH. In January, the protocol burned more than 392 000 ETH. On the 10th, the network set a new historical maximum for this metric (19 424.89 ETH). The burn rate correlates with the asset’s price.

In January, the largest number of “burned” ETH (65,697 ETH) was tied to operations related to the NFT marketplace OpenSea. The reason — increased trading volume on the platform.

In February, Fundstrat managing director Mark Newton forecast a “good probability” of Bitcoin reaching a local bottom.

Earlier in January, JPMorgan analysts cut the fair value estimate for Bitcoin from $150,000 to $38,000.

Follow ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!