Beat the house? Hyperliquid whale ‘left’ with a $25m profit—then returned

James Wynn, a trader famed for aggressive bets, said he was leaving the “Hyperliquid casino” with $25m in profits. At its peak, the tally reached $87m from initial stakes of roughly $3–4m.

To all the fans and haters:

We had a good run gambling on perps

At peak the account was up $87,000,000 profits from like $3-$4m.

Now decided to leave the casino with my $25,000,000 profit

It’s been fun, but now it’s time for me to walk away a wynner

Wynn 1-0 Haters… pic.twitter.com/vuUiET2CQZ

— James Wynn ? (@JamesWynnReal) May 26, 2025

“We had a good time gambling on perps. […] It was fun, but now it’s time for me to walk away a winner,” — Wynn said.

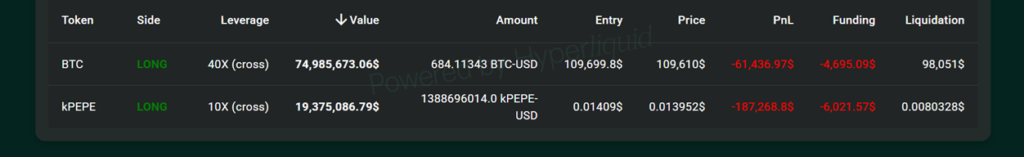

The trader drew attention after opening a long position of 10,200 BTC ($1.14bn) with 40x leverage on Hyperliquid.

Despite partially locking in $11.23m in profit, which peaked at $40m, Wynn ultimately closed the long with a $13.4m loss.

Before going “all in” on bitcoin, the user booked $25.19m in profit on a long position in PEPE.

New opportunities—or addiction?

The trader’s “break” proved short-lived. A few hours later, Wynn opened another long with 40x leverage for 684 BTC ($75.34m).

Just a few hours later, top trader @JamesWynnReal was back in the casino and continued to long $BTC with 40x leverage.

The position size reaches 684 $BTC($75.34M) and the liquidation price is $103,120.https://t.co/FX6sISVWOhhttps://t.co/xW7TdghTLp pic.twitter.com/i0YKEnMroR

— Lookonchain (@lookonchain) May 26, 2025

The whale also went long PEPE with 10x leverage.

The top trader @JamesWynnReal went long on $PEPE with 10x leverage again, with an unrealized profit of $130K.https://t.co/FX6sISVWOhhttps://t.co/YLO2XD1MIq pic.twitter.com/q8khoLvA3v

— Lookonchain (@lookonchain) May 26, 2025

At press time, the combined unrealized loss reached $248.8k.

Outside view

In a conversation with ForkLog, trader Artem Zvezdin supported Wynn’s decision to leave the market.

“The logic is simple — bitcoin is at a peak, how much more can it grow? Well, to $120,000–150,000. Is it worth risking the money earned? I personally am not sure, and no one is sure of this. On the other hand, buying alts and trying to guess which of them will grow, and whether they will grow at all, is not much fun,” Zvezdin explained.

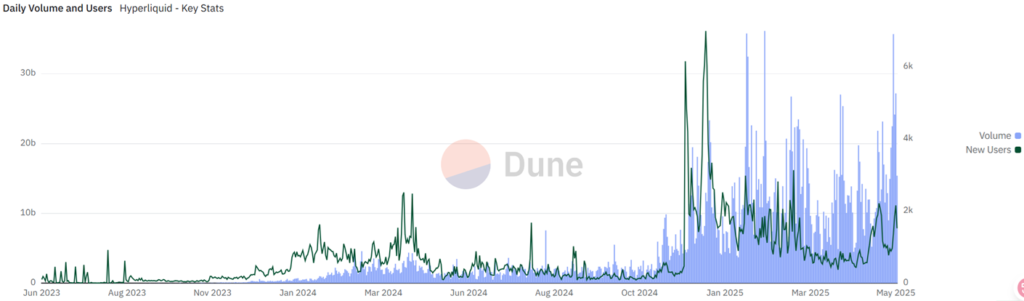

Crypto trader and Coen+ Telegram channel author Vladimir Coen called Hyperliquid the main beneficiary of Wynn’s trading, which recorded growth in volumes and capitalisation.

At the same time, behind the image of a “legendary trader” lie accusations of fraud and the systematic use of pump-and-dump schemes in memecoins, Coen said.

The expert found that Wynn had previously urged buying ELON, attracting a large number of retail investors, but then closed his position through a secondary account. This led to a 70% drop in the token and losses for those who followed his recommendations.

The latest hype around Wynn increased the number of followers of his X account. Around the same time, the trader began actively “pushing” Moon Pig. The token’s chart clearly shows a pump-and-dump scheme over the past five days, Coen noted.

New HYPE records

On May 26, the price of the platform’s native token HYPE continued to set records. A new all-time high was set at $39.68. Over the past week, the asset rose 48.6%.

The project’s market capitalisation now stands at $12.74bn, moving it to 13th place in the rankings.

A catalyst was comments to CFTC on the potential approval of perpetual contracts and 24/7 crypto trading. Hyperliquid Labs, the team behind the DEX, backed the regulator’s proactive stance and advocated integrating DeFi.

Wynn’s activity pushed daily trading volume to $35.7bn, close to February’s record levels ($36.2bn).

The Hyperliquid platform is built on its own high-performance L1 HyperEVM and offers CEX-like functionality: a real-time order book, high liquidity and competitive fees. Hyperliquid does not require KYC procedures.

The network uses a modified version of the Proof-of-Stake consensus algorithm called HyperBFT, with throughput of 200,000 TPS.

In March, ForkLog examined a chain of events in which high-risk positions threatened not only the platform’s stability but also the safety of client funds in the Hyperliquidity Provider Vault.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!