Bernstein Analysts Raise Bitcoin Price Forecast to $90,000

Amid improving market dynamics, Bernstein analysts have revised their Bitcoin forecast from $80,000 to $90,000 by the end of the year, reports The Block.

Experts also anticipate the leading cryptocurrency reaching $150,000 at the peak of the 2024-2025 bull rally.

They believe the upcoming halving will not impact miners as significantly as in previous years.

“Considering the overall bull market conditions with strong ETF inflows, low leverage among miners, and healthy on-chain fees, the impact of the reward halving appears relatively mild,” noted Bernstein researchers Gautam Chhugani and Mahika Sapra.

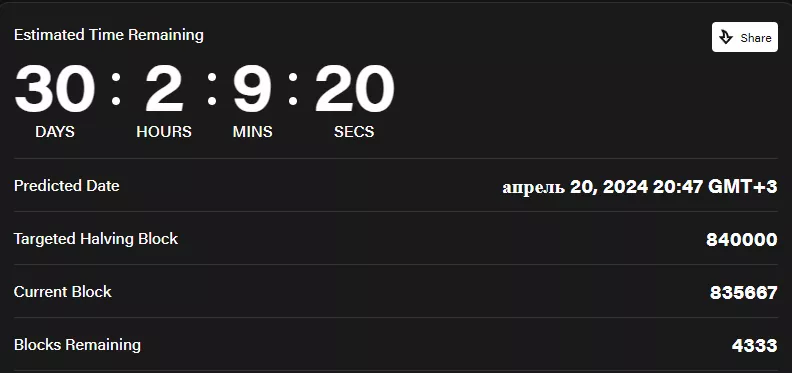

The upcoming halving is expected at block #840,000, around April 20.

This will result in the miner reward being halved from 6.25 BTC to 3.125 BTC, effectively pushing out relatively inefficient players.

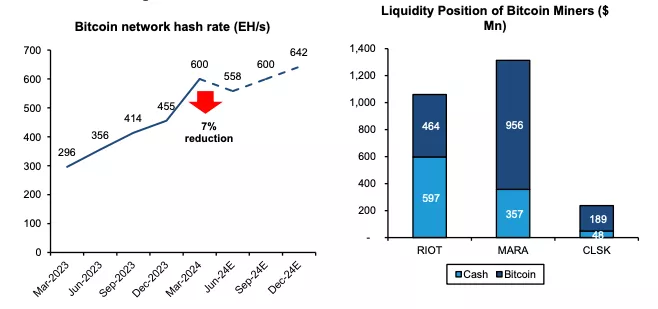

The overall hash rate decline after the previous halving was 15-20%. However, Bernstein analysts estimate this time it will decrease by about 7% (previously, the company predicted a 15% drop).

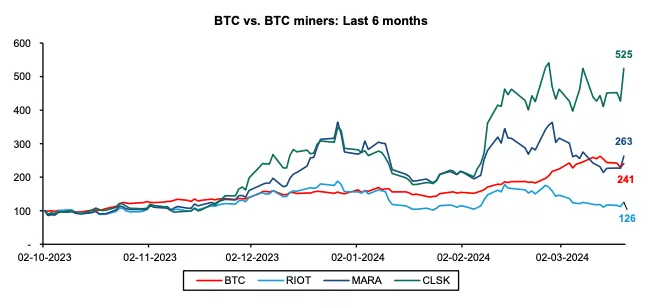

Chhugani and Sapra are confident that only the most efficient miners, capable of mining cryptocurrency at relatively low costs, will remain in the market. They believe CleanSpark and Riot Platforms will manage to increase their market share. The report also highlights significant potential for Marathon Digital.

According to analysts, investing in Bitcoin mining is the best alternative to direct cryptocurrency investments. They observe that three companies listed on American stock exchanges control about 10% of the digital gold network’s hash rate. The combined capitalization of these firms is approximately $13 billion.

Targets for CleanSpark and Riot shares are $30 (+48%) and $22 (+77%) respectively. Marathon’s forecasted figure is $23 (+3%).

At the time of writing, Bitcoin is trading around $66,370. According to CoinGecko, the cryptocurrency has risen by 4.3% over the past day. However, the asset has decreased by 6.5% over the last seven days.

Earlier, Bernstein analysts considered the correction to around $63,000 a good buying opportunity “at the lows” before the halving.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!