Bernstein Highlights Institutional Interest in Bitcoin Miners

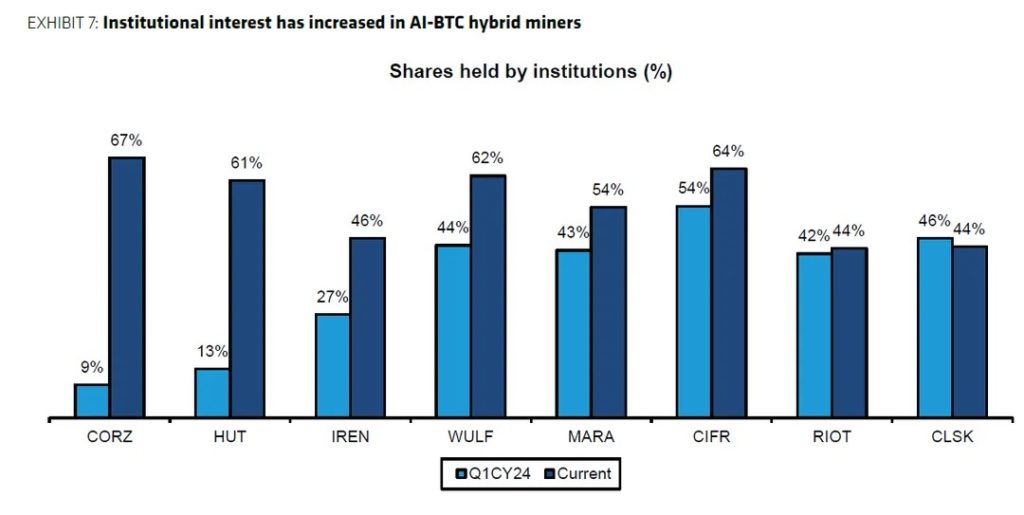

Institutional investors are drawn to mining companies for their potential in the AI sector, yet they may ultimately benefit unexpectedly from a cryptocurrency bull run. This is reported by Decrypt, citing a Bernstein report.

“If our forecast of a $200,000 Bitcoin price proves accurate, investors will come for AI but may end up enjoying the bull market, though they did not expect it,” experts noted.

In their view, miners hold a “unique position” in high-performance computing (HPC) due to significant energy resources and strategic locations.

Bernstein specialists believe that cryptocurrency miners have a substantial advantage over traditional data centers in terms of infrastructure.

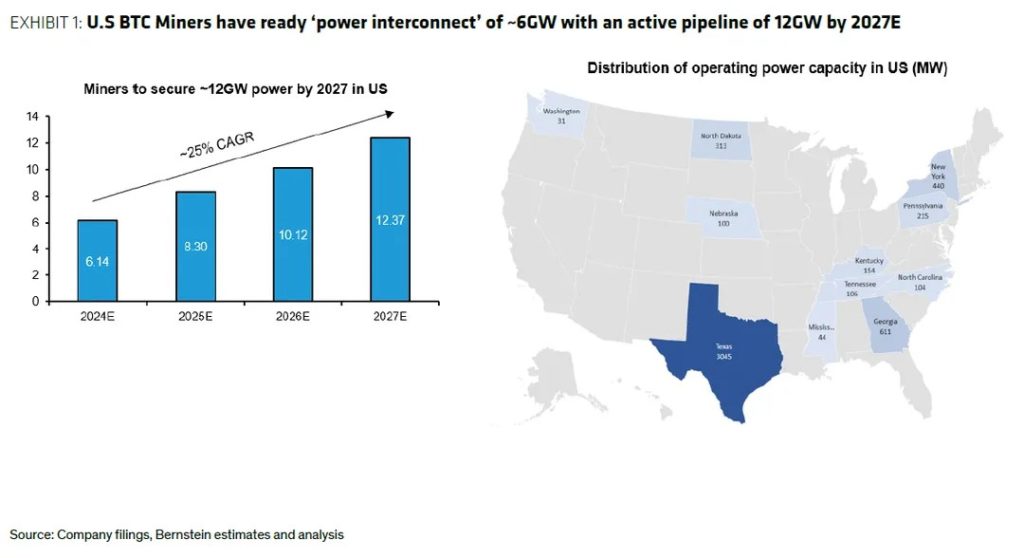

It is expected that miners in the US will have an operational capacity of 6 GW by the end of the year, reaching 12 GW by 2027. The industry also has experience in organizing high-density operations (70-80 kW per rack), meeting the power requirements for AI computations.

Many miners have established their operations in unconventional locations with abundant electricity and available land. This approach has led to the creation of extensive facilities covering hundreds of hectares and capacities ranging from 100 MW to 1 GW, experts emphasized.

Additionally, miners employ sophisticated methods to reduce electricity costs to achieve profitability, including hedging strategies on wholesale markets and various forms of collaboration with utilities and network operators.

Back in a report by VanEck, Bitcoin miners could gain approximately $13.9 billion in additional annual revenue if they shift 20% of their energy capacity to the AI and HPC sector by 2027.

According to JPMorgan, Bitcoin miners’ revenue from block production is estimated to be ~$37 billion over the next four years.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!