Binance reports $16 billion in Bitcoin reserves

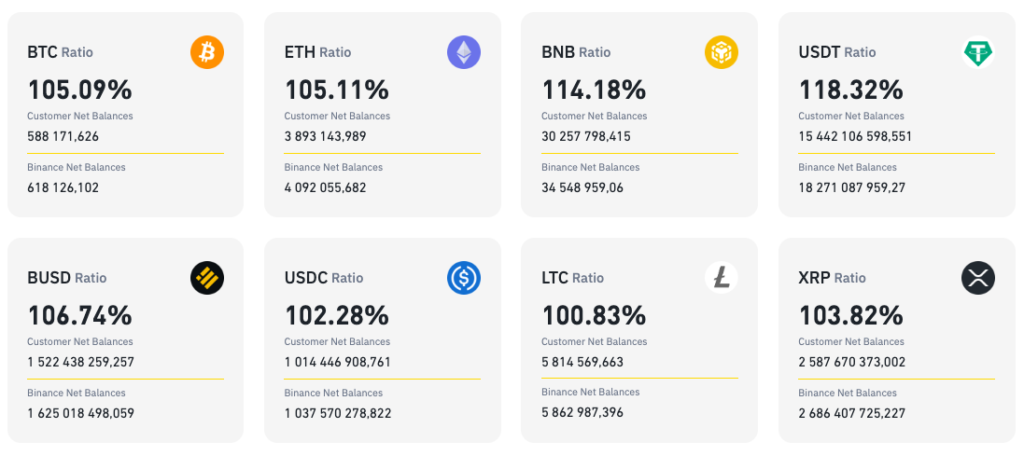

The cryptocurrency exchange Binance has published its monthly proof-of-reserves report (PoR) — it holds 618,126 BTC (about $15.9 billion) on its balance sheet to back client deposits of 588,171 BTC (about $15.1 billion).

Ethereum reserves are also over-collateralized by 5%. The most over-collateralized assets were MATIC (119%), USDT (118%), FDUSD (116%), BNB (114%) and CHZ (108%).

The stablecoin BUSD, whose support will be discontinued by 2024, has an excess of 7%.

Notably, only 31 tokens out of 350 listed on the platform are included in Binance’s PoR.

“When a user deposits one bitcoin, Binance’s reserves increase by at least one bitcoin to guarantee full backing of customer funds. It should be noted that corporate assets stored in a completely separate registry are not included,” the exchange said.

According to the company, the report aggregates all user balances from the Merkle Root hash, which consolidates account data from the Merkle Tree into a single table for auditors.

To conduct PoR, the exchange uses a special type zero-knowledge proof — zk-SNARK. This approach does not permit leakage of customers’ personal data.

In November 2022, Binance was the first among centralized exchanges Proof-of-Reserves. The move followed a loss of trust after the collapse of FTX. Subsequently, similar initiatives were implemented by Bitget, OKX, Gate.io and Huobi.

A number of experts questioned the effectiveness of such checks, noting that the metrics do not indicate the safety of users’ assets.

Earlier in April 2023, the crypto exchange OKX updated the procedure for reserve verification by adding support for zk-STARKs.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!