Bit Digital Turns Profitable with Shift to Ethereum Accumulation

Nasdaq-listed company Bit Digital reported a net profit of $14.9 million in the second quarter, compared to a loss of $12 million a year earlier, according to the firm’s press release.

The company’s total revenue fell by 11.7% to $25.7 million, attributed to a 58.8% drop in bitcoin mining revenue, which decreased from $16.1 million to $6.6 million.

“The decline is due to increased network difficulty, the halving in April 2024, and a reduction in active hash rate,” Bit Digital representatives stated.

New business directions offset these losses. In June, the company began winding down its digital gold mining operations and redirected capital into Ethereum.

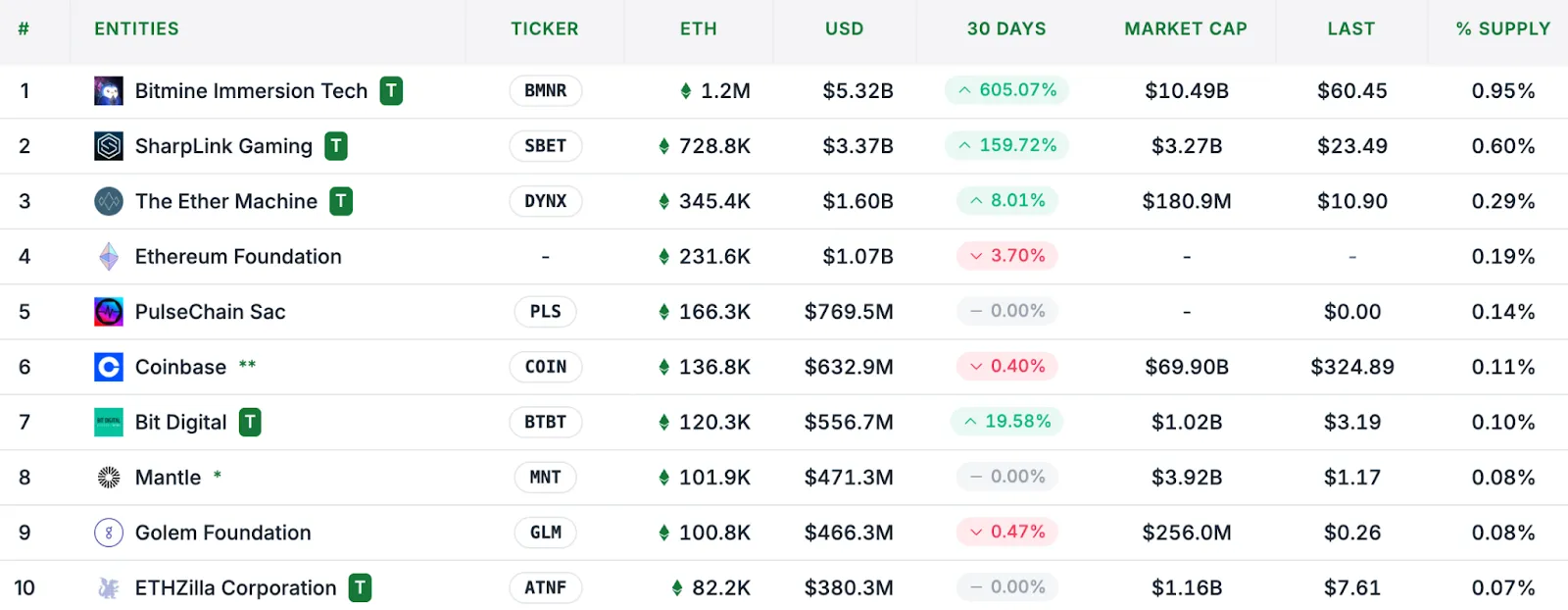

At the time of publication, Bit Digital held over 120,300 ETH valued at $556.7 million. In total, corporate treasuries hold 3.7 million ETH worth $17 billion.

In the last quarter, the company also received approximately 166.8 ETH in staking rewards with an annual yield of 3.1%.

“Our goal is to build one of the largest public ether balances on the blockchain and generate attractive staking yields for shareholders,” said Bit Digital CEO Sam Tabar.

In the latest trading session, the company’s shares fell by 0.63% to $3.19, according to Yahoo Finance. However, over the past five days, their price increased by 8.1%, and since the beginning of the year, by 8.9%.

Corporate crypto treasuries have sparked debate within the community. Proponents argue that such structures enhance ecosystem recognition and create long-term value, while critics warn of potential conflicts of interest.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!