Bitcoin and Ethereum ETFs Experience Continued Outflows

Net capital outflows from spot exchange-traded funds based on the two largest cryptocurrencies by market capitalization have persisted for the fourth consecutive day.

Net capital outflows from spot exchange-traded funds based on the two largest cryptocurrencies by market capitalization have persisted for the fourth consecutive day.

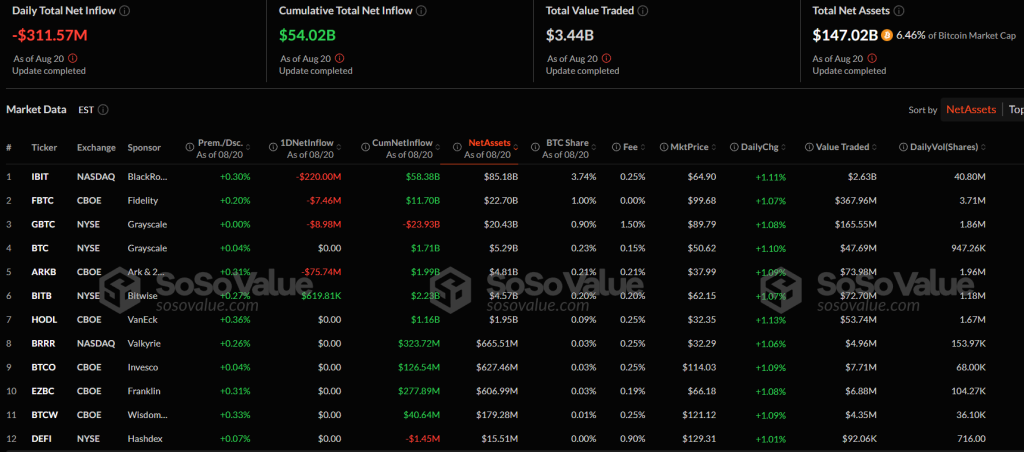

In the past 24 hours, $311 million has been withdrawn from Bitcoin ETFs. The largest loss was recorded by IBIT from financial giant BlackRock, with an outflow of $220 million. The ARK 21Shares Bitcoin ETF (ARKB) saw a reduction of $75.74 million.

The cumulative net inflow since the launch of these instruments in January 2024 has reached $54 billion. The total AUM stands at $147 billion.

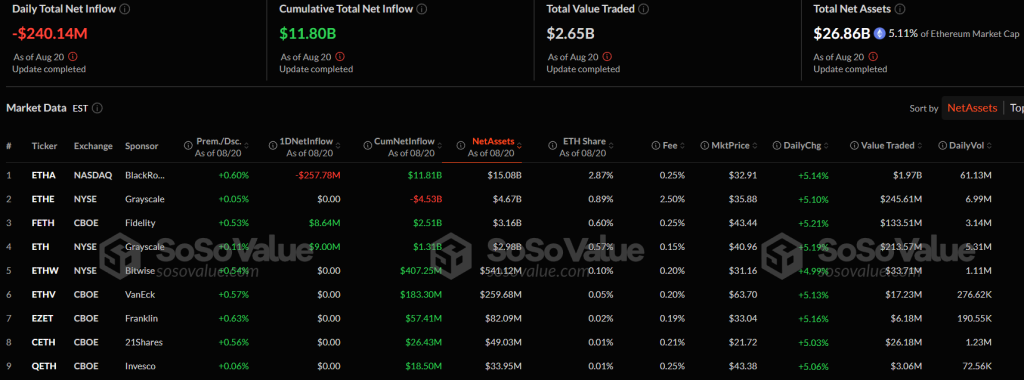

Ethereum ETFs saw a total outflow of $240.14 million over the past day. The largest fund in the segment, ETHA from BlackRock, recorded an outflow of $257.78 million. However, FETH from Fidelity and ETH from Grayscale reported inflows of $8.64 million and $9 million, respectively.

The cumulative net inflow into Ethereum ETFs is $11.8 billion, with AUM at $26.86 billion.

At the time of writing, Ether is trading around $4,300, having appreciated by 3% over the past day, while Bitcoin has risen by only 0.2%, according to CoinGecko.

The Strength of Ethereum

Ether’s robust recovery following a recent correction is supported by fundamental factors.

Notably, open interest in Ethereum futures on the regulated CME exchange has reached a historic high of $8.3 billion, indicating strong interest from major players.

ETH: CME Open Interest hits ATH by $8.3B#Ethereum #ETH #CME #Futures #OpenInterest pic.twitter.com/sBBumjVRpZ

— Maartunn (@JA_Maartun) August 20, 2025

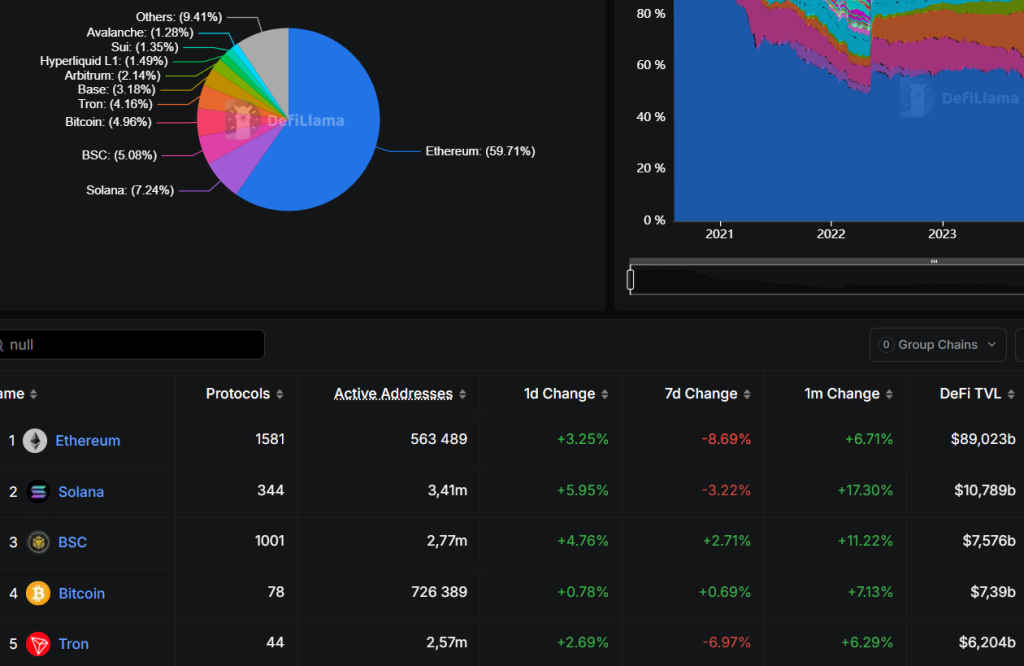

Moreover, the share of Ethereum-based applications in the total TVL of the DeFi ecosystem remains significantly above 50%.

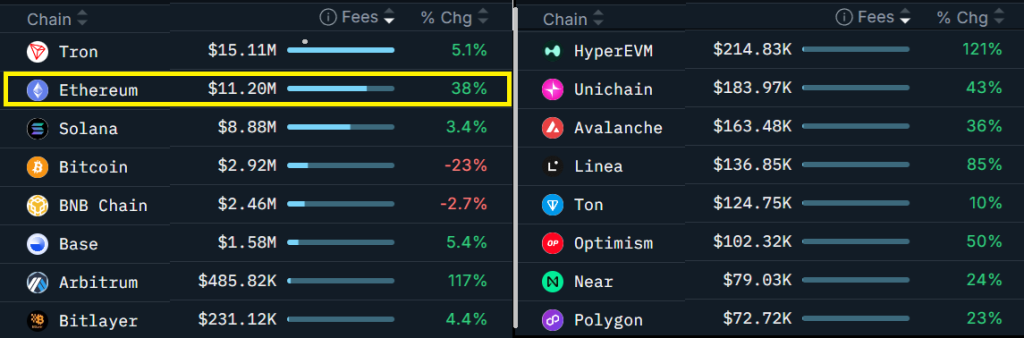

According to researchers at Nansen, the volume of transaction fees on the network of the second-largest cryptocurrency by market capitalization has increased by 38% over the past seven days. This reflects growing on-chain activity and high demand for block space.

For comparison, Solana’s corresponding figure grew by only 3.4%, while BNB Chain recorded a decline of 2.7%.

It is worth noting that 69 companies have added more than 4.1 million ETH to their reserves, representing 3.39% of Ethereum’s total supply. The value of these assets has exceeded $17.6 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!