Bitcoin at $760,000 and RWA Boom: ARK Invest’s 2030 Scenario

BlackRock believes Ethereum could significantly benefit from tokenization.

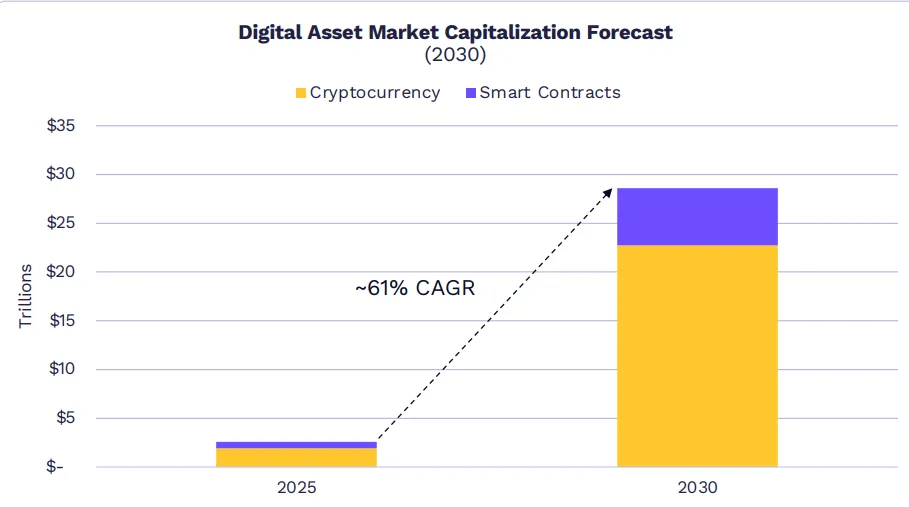

By 2030, the market capitalization of the first cryptocurrency is projected to reach $16 trillion, with the total value of the digital asset market climbing to $28 trillion, according to a report by ARK Invest Cathie Wood.

The $16 trillion valuation implies a Bitcoin price of approximately $761,900, assuming a supply of 21 million coins. This represents a 746% increase from the current price of around $90,000, with an average annual growth rate of about 61%.

ARK analysts have identified digital gold as the leader of a new class of institutional assets. The growth will be driven by the widespread adoption of public blockchains, inflows into ETFs, and corporate accumulation of coins.

According to the company, spot crypto funds in the US and public firms already control 12% of the total coin supply (previously 8.7%). In 2025, fund balances grew by 19.7% (to 1.29 million BTC), while corporate reserves increased by 73% (to 1.09 million BTC).

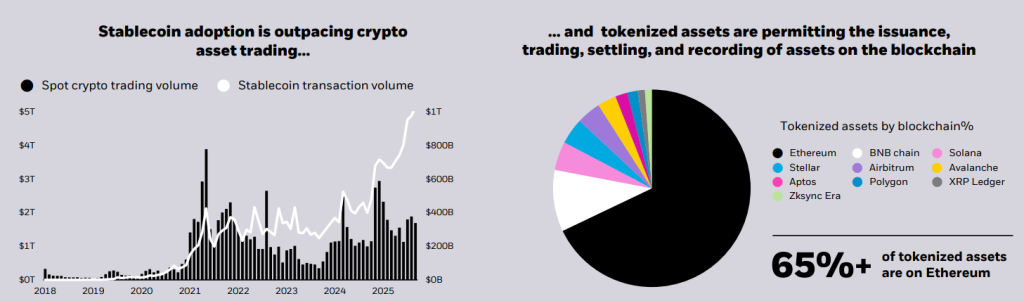

ARK maintains a long-term bullish outlook, although adjustments have been made to the model. Experts have raised the target market valuation for the first cryptocurrency due to the rising capitalization of physical gold. However, they have lowered expectations for Bitcoin’s use as a protective asset in developing countries, a niche now occupied by stablecoins.

In the smart contract platform sector, ARK analysts forecast a market capitalization increase to $6 trillion, with network revenues reaching $192 billion annually. Analysts believe that two or three layer-one blockchains will dominate the market.

RWA

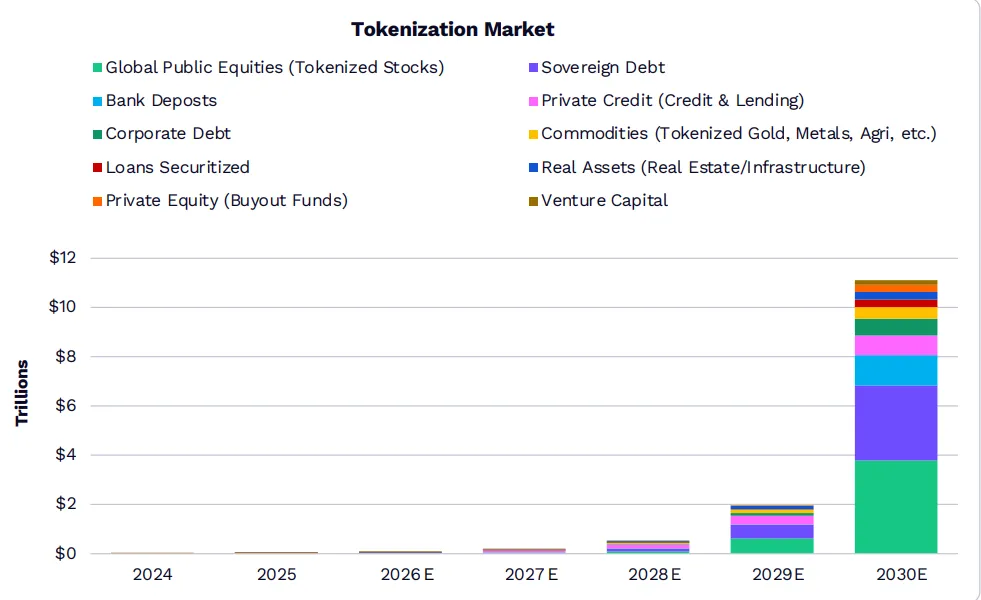

The most ambitious forecast concerns the tokenization of real-world assets (RWA). Analysts believe this market could exceed $11 trillion. Currently, the segment is valued at $19–22 billion. To achieve the stated goals in the next five years, the sector will need to grow by approximately 50,000%.

ARK analysts link these prospects to the migration of traditional financial instruments to the blockchain. The main driver will be the emergence of clear regulations and institutional-grade infrastructure.

Currently, sovereign debt obligations, primarily US Treasury bonds, dominate the tokenization sphere. However, experts anticipate a trend shift: in the future, bank deposits and shares of global companies will provide the main market capitalization.

“Since most of the world’s value is still off-chain, traditional assets remain the largest opportunity for blockchain technology adoption,” the company noted.

Even if the $11 trillion mark is reached, tokenized assets will account for only about 1.38% of the total global financial market.

BlackRock pays particular attention to this sector. In its 2026 forecast, the asset management company noted that Ethereum could gain significant benefits from tokenization. Currently, about 65% of such assets are hosted on this network.

BlackRock CEO Larry Fink emphasized that RWA is a trillion-dollar market that is only in its infancy.

In December, Wood stated that the mathematically limited supply makes the first cryptocurrency a more perfect scarce asset than gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!