Bitcoin back above $111,000

Bitcoin reclaimed $111,000 amid a broad crypto rally and improving macro sentiment.

On October 20, the price of the leading cryptocurrency rose above $111,000. The recovery came amid a broader crypto-market advance and firmer trader confidence in supportive macroeconomic conditions.

Over the past 24 hours, bitcoin rose 4.2% to about $111,300, according to CoinGecko. Before that, the price had traded below $110,000 for four days.

Ethereum jumped 4.7% to top $4000. BNB added 4%, XRP 5%, and Solana 4.3%.

BTC Markets analyst Rachel Lucas explained the rise by citing inflows of institutional capital and improving macro conditions. In her words, spot crypto-ETFs are back in demand, and market participants saw the recent sell-off as a buying opportunity.

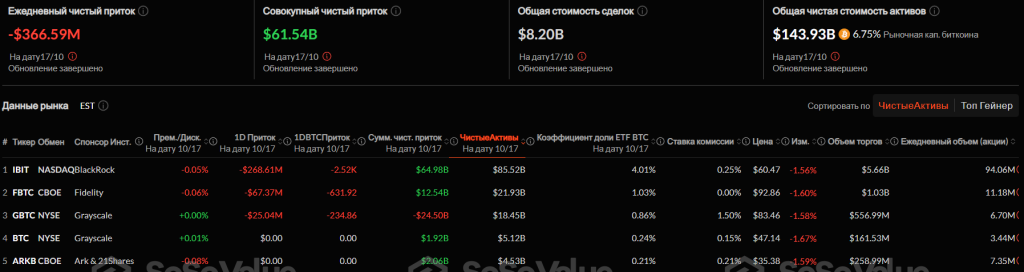

Yet outflows from such vehicles have not ceased. Daily net outflow for bitcoin-based funds stands at $366.59 million. The negative trend has persisted for three trading sessions in a row.

Earlier, prices fell on headlines about US tariffs on Chinese goods and worries over troubled loans at US regional banks.

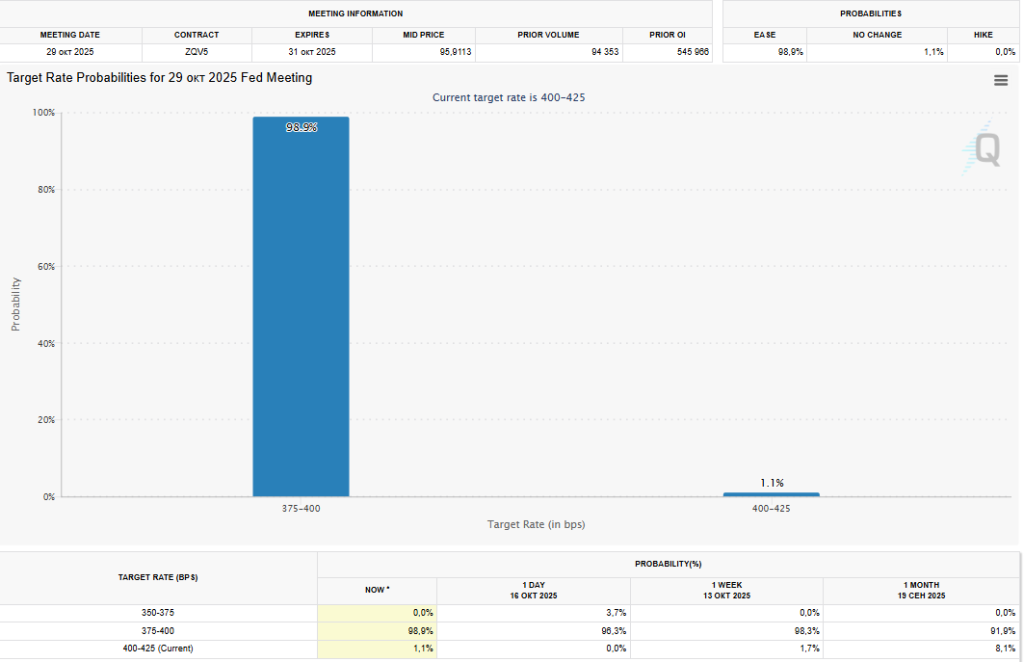

Traders are now pricing in a potential rate cut in October. Fed Chair Jerome Powell noted persistent labour-market weakness despite steady economic growth. That pushed bond yields lower and improved liquidity conditions for risk assets, including digital ones.

The CME FedWatch tool puts the probability of a 25-basis-point cut at 98.9% at the next meeting.

Further market moves will hinge on upcoming US inflation and industrial output data, as well as employment and retail-sales statistics in Australia, Lucas concluded.

Kronos Research CIO Vincent Liu flagged $107,000 and $110,000 as key support and resistance levels, respectively.

A break below roughly $107,000 could trigger a cascade of liquidations, he said. Sustained buying pressure above $111,000 would open the way for further gains.

Lucas added that bitcoin is testing resistance between $111,700 and $115,500. A decisive break above $111,000 could prompt a short squeeze and accelerate the advance.

Despite the upbeat tone, the BTC Markets analyst warned of short-term risks. Tensions between the US and China continue to weigh on sentiment, especially ahead of the leaders’ meeting later this month.

Profit-taking by ‘old hands’

According to analyst James Check, the sharp crypto-market correction is not linked to manipulation or “paper bitcoin”. The reason is “good old-fashioned sellers”.

The sheer volume of sell-side pressure from existing Bitcoin holders is **still** not widely appreciated, but it has been THE source of resistance.

Not manipulation, not paper Bitcoin, not suppression.

Just good old fashioned sellers.

Also, it won’t become irrelevant. https://t.co/4QnfCn2f7w pic.twitter.com/YiK7gtjkzj

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) October 19, 2025

He added that participants still underestimate the scale of sell-side pressure from existing holders of digital gold, and that this is the “source of resistance” at present.

To back this up, the analyst cited a chart showing a rise in the average age of coins being spent, indicating that long-term holders are doing the selling.

Another chart shows realised profits jumping to $1.7 billion per day, while losses rose to $430 million — the third-largest reading of the current cycle. Meanwhile, “revived supply” from old coins reached $2.9 billion a day.

Investor Will Clemente argues that “bitcoin’s relative weakness over the past year mostly represented a transfer of supply from ‘old hands’ to TradFi.”

After some thinking this weekend, I believe the last year of relative weakness for BTC has mostly been transfer of supply from OGs to tradfi, can see this in on chain data. This dynamic will be mostly irrelevant in coming years, just as everyone is focused on BTC’s rel weakness.

— Will (@WClementeIII) October 19, 2025

Galaxy Digital CEO Mike Novogratz agreed with this assessment.

“Many in the bitcoin world who held it for a very long time finally decided: ‘I want to buy something’,” he said.

Novogratz said the only supply his firm is seeing comes from “old hands” and miners.

Institutional conviction

Some 67% of institutional investors are positive on bitcoin’s prospects over the next three to six months, according to Navigating Uncertainty from Coinbase Institutional. The survey included 124 respondents.

The study found a divergence of views on the market’s current phase. Some 45% of institutions think the bull market is in a late stage. Among other investor categories, only 27% think so.

David Duong, head of research at Coinbase Institutional, noted the influence of digital-asset managers. He said they were active buyers on the dip.

For example, BitMine took advantage of the market’s decline and bought more Ethereum worth $417 million. At the same time, Michael Saylor hinted at a possible bitcoin purchase by Strategy.

The most important orange dot is always the next. pic.twitter.com/N5GQOdqr6y

— Michael Saylor (@saylor) October 19, 2025

Duong believes the bull market “has room to run”. Positives include resilient liquidity, a strong macro backdrop and supportive regulatory policy.

Coinbase analysts also pointed to macroeconomic factors. An expected Fed rate cut and possible stimulus in China could draw new investors into the market.

The firm views the current setup as especially favourable for bitcoin. It remains more cautious on altcoins.

A buy signal

CryptoQuant analyst CryptoMe believes that a strong signal to accumulate bitcoin would be a panic sell-off by short-term investors (STH). For now, he says, the market is only approaching that point.

Their Loss is Our Opportunity

“STH-SOPR data will start to make a dive into the Green Zone. Those moments are the place for the smart investor to buy their losses.” – By @cryptometugce pic.twitter.com/7IM8o2aExC

— CryptoQuant.com (@cryptoquant_com) October 20, 2025

The STH-SOPR metric has fallen below 1, confirming loss-making sales by short-term holders. This creates opportunities, in his view, but he advises against rushing in as losses remain limited.

He split short-term investors into several cohorts. Those who held assets from one week to three months are now selling at a loss. Meanwhile, the three-to-six-month group is near breakeven.

If the price continues to fall and that cohort starts locking in losses, selling pressure could spur a deeper correction.

According to CryptoMe, such a panic sell-off would be the strong buy signal: it would send STH-SOPR “deep into” the green zone. He argues these are the best moments to build positions gradually.

On October 17, the price of digital gold fell below $105,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!