Bitcoin Climbs 30% in Second Quarter

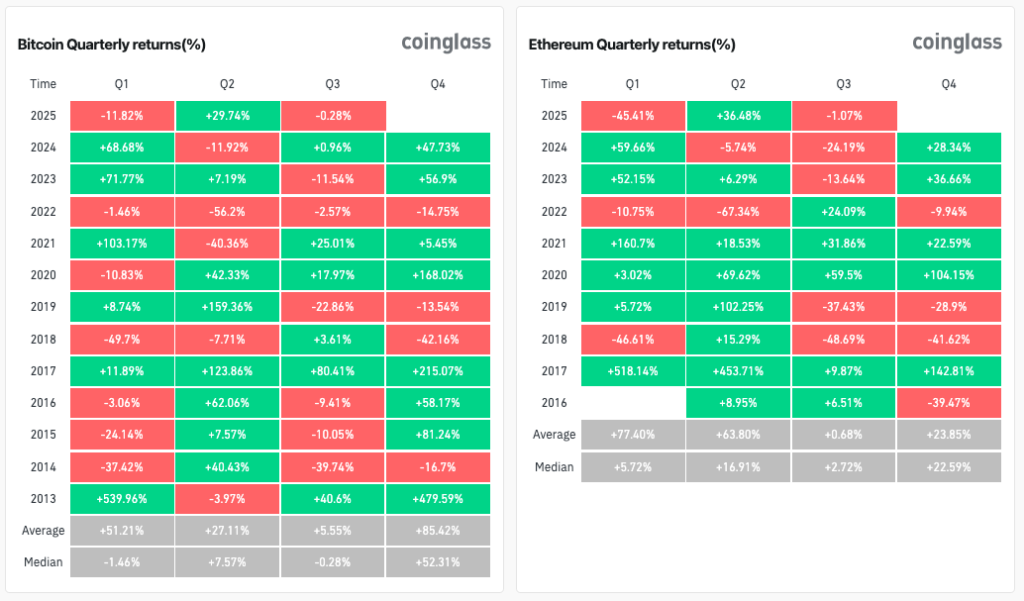

The second quarter proved successful for leading cryptocurrencies. Bitcoin’s price surged nearly 30%, while Ethereum rose by 36%.

However, in June, the momentum slowed—digital gold added 2.5%, and the second-largest cryptocurrency by market cap gained 1.5%.

On June 29, Bitcoin prices exceeded $108,500, reaching a two-week high.

At the time of writing, Bitcoin is trading at $106,751 (-0.9% over the day).

The rise occurred amid low liquidity and an attempt by major players to liquidate trader James Wynn’s short position.

Bullish on $BTC?

James Wynn(@JamesWynnReal) has closed his short and flipped long on $BTC.

Aguila Trades(@AguilaTrades) is doubling down, increasing his long to 2,201 $BTC ($238M).https://t.co/FX6sISWuDPhttps://t.co/1Aq6gywbqf pic.twitter.com/HB61RN0Gnv

— Lookonchain (@lookonchain) June 29, 2025

The trader opened a short position of $13.9 million. Market participants began pushing the price towards his liquidation level around $108,630. Ultimately, Wynn prematurely closed the short and opened a long position on 60 BTC.

Signs of Further Market Strengthening

A trader known as Autumn Riley pointed to a bullish structure on the 15-minute chart.

Most people are seeing $BTC just going sideways, but there’s actually a lot happening inside this range.

If you look at the 15-minute chart, the structure is bullish. Every time price sweeps a high, it reacts down but keeps making higher lows. The pressure from sellers is fading… pic.twitter.com/rpVyGbWzIC

— Autumn Riley (@Autumn_Rileyy) June 29, 2025

According to her, the price continues to form higher lows, and the pressure from sellers is weakening.

Another trader, under the pseudonym BitBull, noted a “golden cross” on the MACD indicator.

$BTC daily MACD bullish cross has happened.

Another signal which shows that bulls are in control.

Right now, we are in a low liquidity weekend so don’t expect big movements.

Once the market opens tomorrow, I’m sure the volatility will kick in and it’ll most likely be to the… pic.twitter.com/TaE8AcXys5

— BitBull (@AkaBull_) June 29, 2025

He sees this as a signal of bullish control and expects increased volatility after the markets open.

Analyst Rekt Capital noted that Bitcoin is close to its highest weekly close in history—above the level of approximately $109,000.

Can Bitcoin Weekly Close above the final major Weekly resistance?

Bitcoin has never performed such a Weekly Close

Therefore in doing so, that would not only be historic, but it would enable Bitcoin to enjoy a new uptrend into new All Time Highs$BTC #Crypto #Bitcoin https://t.co/sKJB5uY5gB pic.twitter.com/yOI3QJZGk7

— Rekt Capital (@rektcapital) June 29, 2025

In his view, consolidating above this level would pave the way for new all-time highs.

Back on June 26, CryptoQuant analyst Axel Adler Jr. presented a “conservative” forecast for the leading cryptocurrency—a rise to $160,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!