Bitcoin climbs above $24,000

In the early hours of March 13, the price of the leading cryptocurrency rose sharply from about $20,280 to briefly above $22,670.

After the US market opened наблюдается a significant sell-off in bank-sector equities. Bitcoin reacted by moving above $23,500.

The price of the leading cryptocurrency exceeded the $24,000 mark on the Binance exchange.

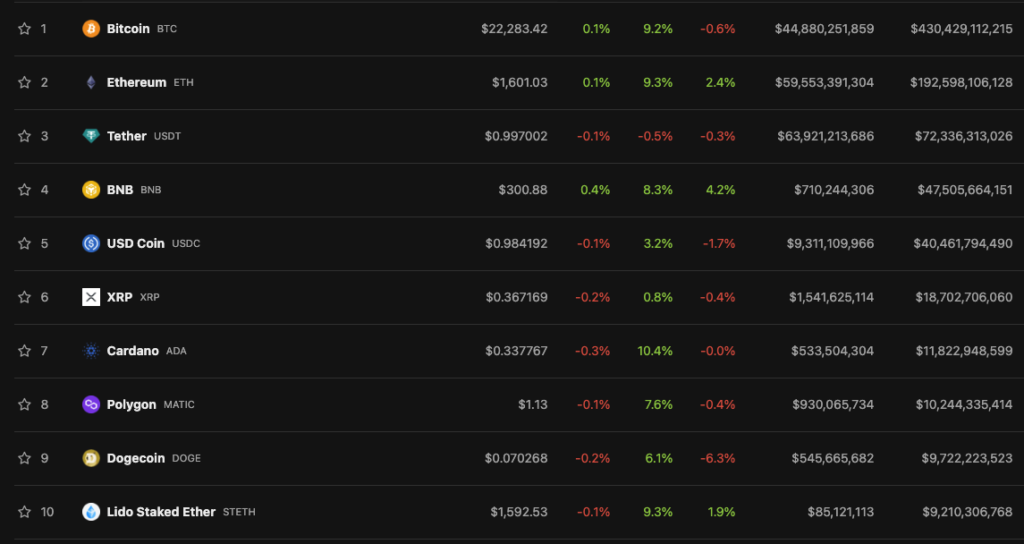

Over the last 24 hours the asset rose by 9.2% (CoinGecko), with the current price at $22,290. As shown in the chart below, the rise was accompanied by a surge in trading volume.

In the same period the second-largest cryptocurrency by market cap gained 9.3%. At the time of writing Ethereum trades above $1,600.

Following the leaders, assets in the top-10 by market cap turned green, with the exception of USDT. Cardano (ADA) registered the largest gain — 10.4% over the last 24 hours. Having lost the peg to the US dollar, the stablecoin USDC regained parity.

Total market capitalization surpassed $1 trillion. Bitcoin dominance index stood at 40.7%, Ethereum at 18.2%.

According to Coinglass, over the last 24 hours liquidations on the futures market reached $215 million.

On March 10, the first cryptocurrency tested below $20,000 amid news of the liquidation of Silvergate Bank. Market conditions were further complicated by problems at Silicon Valley Bank (SVB) — on the same day the California Department of Financial Protection and Innovation closed the institution due to “insufficient liquidity and insolvency” and appointed the FDIC as administrator.

SVB’s troubles strained its clients, among them Circle. On March 11 the company said it held part of its reserve assets there ($3.3 billion), but the next day promised to cover “any shortfall” in reserves.

Because of the peg disruption, USD Coin’s peg to the dollar, and algorithmic stablecoins that used the asset as collateral for issuance also lost their pegs. In particular, lost their pegs for DAI and FRAX.

On March 12, the U.S. Treasury, the ФРС and FDIC issued a joint statement on measures to support the banking system. The agencies said depositors of Silicon Valley Bank and another bank closed by authorities — Signature Bank — would be fully reimbursed.

In what followed, the MakerDAO community decided to adjust protocol parameters to limit the impact of USDC on its project. The measure entails reducing the maximum amount of DAI that can be borrowed against a given collateral.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!