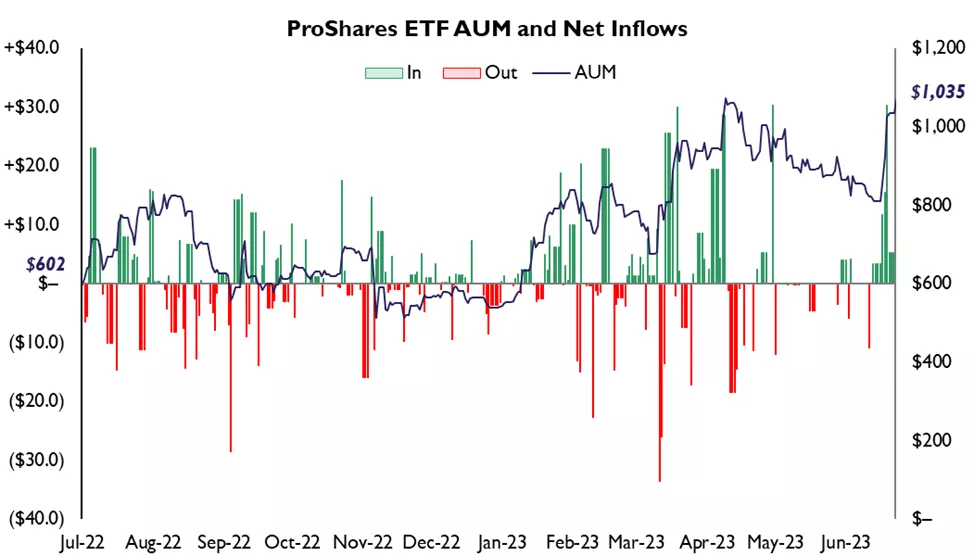

Bitcoin ETF frenzy lifts ProShares’ assets under management above $1 billion

Driven by BlackRock’s application to launch a bitcoin ETF, the rally in digital gold helped lift ProShares’ ETF’s AUM to $1.04 billion.

For comparison, prior to the June 15 news the figure stood at $822 million.

In 2021 the SEC approved products ProShares and Valkyrie Investments, based on bitcoin futures on the Chicago Mercantile Exchange. To date, the Commission has rejected all spot ETFs based on digital gold.

According to CoinShares, inflows into crypto investment funds reached $334 million over the last two weeks.

In the SEC filing queue, ARK Invest c 21Shares have priority over BlackRock and the rest based on the timing of their filings. VanEck, Fidelity Investments, WisdomTree and Invesco have entered the ETF race.

On June 30, sources for The Wall Street Journal said the Commission returned the filings because they lacked sufficient information about the so-called joint oversight agreement or details of that mechanism. The latter became a key addition to BlackRock’s application.

Subsequently, the aforementioned companies promptly sent the agency refined proposals.

According to Bernstein analysts, the regulator will not be able to remain long in holding its negative position toward spot ETFs based on the first cryptocurrency.

Circle CEO Jeremy Allaire predicted that the recent wave of applications to launch spot exchange-traded funds based on digital gold will lead to SEC approval.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!