Bitcoin ETF Futures Trading Volume on Moscow Exchange Surpasses 423 Million Rubles

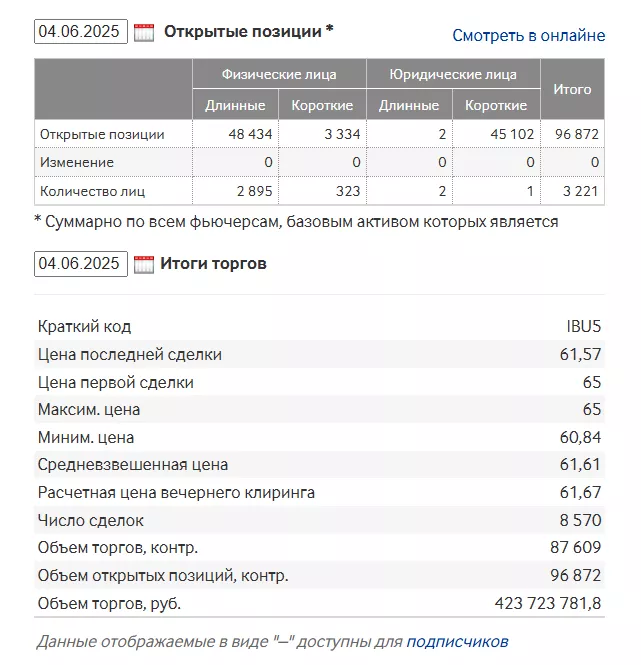

On June 4, the Moscow Exchange initiated trading in futures on shares of the iShares Bitcoin Trust ETF by BlackRock. On the first day, the trading volume exceeded 423 million rubles, with nearly 8,600 contracts concluded.

Access to the new instrument is available only to qualified investors.

Representatives from the brokerage community generally viewed the start of trading positively. Dmitry Lesnov, Deputy General Director for Brokerage Business at Finam, described the initial figures as “quite good for the first day” in a comment to Kommersant.

Sergey Selyutin from VTB My Investments characterized the first day as “testing the waters,” with investors seeking new formats for portfolio diversification.

Experts believe the futures will attract investors looking for legal ways to engage with cryptocurrency, as well as a younger audience.

Sergey Rybakov from Go Invest emphasized that crypto-related products draw attention amid the general interest in the industry.

Maksim Romodin from BK Region anticipates demand from asset management companies preparing to launch funds with cryptocurrency exposure. Lesnov also suggested the emergence of arbitrage strategies.

Artem Rasskazov from Sinara Bank noted that this simplifies position management. Alexander Gusev from T-Investments added that narrow spreads and the ability to execute trades quickly could attract speculators.

Earlier this month, Sber announced the launch of bitcoin bonds. The instrument is available to qualified investors on the over-the-counter market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!