Bitcoin ETF Inflows Hit Record $673 Million in a Single Day

On February 28th, cumulative inflows into spot Bitcoin ETFs reached a record $673.4 million, with total inflows since the product’s approval on January 11th amounting to $7.4 billion.

UPDATE: We have a new record inflow for the Cointucky Derby #Bitcoin ETFs! $IBIT took in a record $612 million on its own. On a net basis the group took in $673 million. This beats the day 1 record of $655 million. (still waiting on $BTCO)

Also, IBIT crossed $9 billion in assets pic.twitter.com/1lWqFFyC5b

— James Seyffart (@JSeyff) February 29, 2024

The previous peak of $655.2 million was recorded on the first trading day of the instrument.

Of the $673.4 million, $612.1 million was attributed to BlackRock’s IBIT. Such high figures were recorded for the first time.

Fidelity’s FBTC attracted $245.2 million, while ARK Invest 21Shares’ ARKB brought in $23.8 million.

[1/5] Bitcoin ETF Flow — 28th Feb 2024

All data in. Today was a record inflow day, with $673.4m of net inflow. This was driven by Blackrock, which also had a record day, with $612.1m of inflow pic.twitter.com/vklRVtrDoI

— BitMEX Research (@BitMEXResearch) February 29, 2024

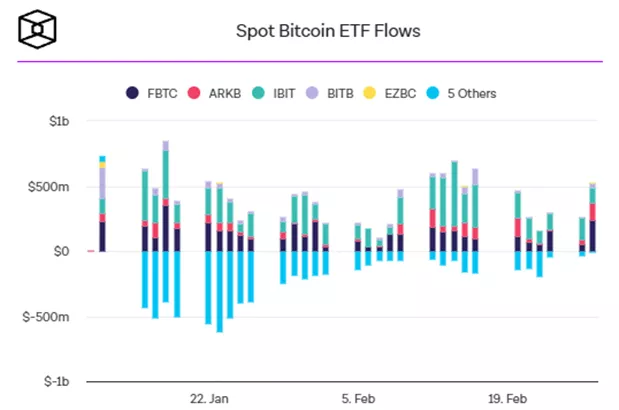

The chart below illustrates the inflow/outflow dynamics of major Bitcoin ETFs.

Analysts at K33 Research noted that the assets under management in IBIT exceeded 150,000 BTC, while FBTC surpassed 100,000 BTC.

AUM of competitors GBTC reached 330,000 BTC ($20.7 billion). Over the previous two trading days, the figure increased by 30,754 BTC ($1.9 billion).

BlackRock has surpassed 150k BTC under management, while Fidelity has surpassed 100k BTC under management.

The newborn nine now holds 330,000 BTC! pic.twitter.com/s1y0f3hV6z

— Vetle Lunde (@VetleLunde) February 29, 2024

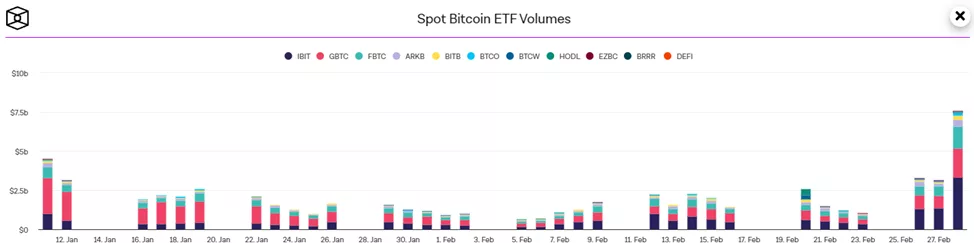

On February 28th, trading volume for spot Bitcoin ETFs reached a record $7.6 billion. This marks a new high since the instruments’ launch on January 11th ($4.54 billion).

Analysts at CoinShares have calculated that demand for the product exceeds the digital gold’s production by three times.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!