Bitcoin ETF Inflows Surpass $50 Billion

The cumulative net inflow into spot exchange-traded funds (ETFs) based on the leading cryptocurrency has, for the first time, exceeded $50 billion.

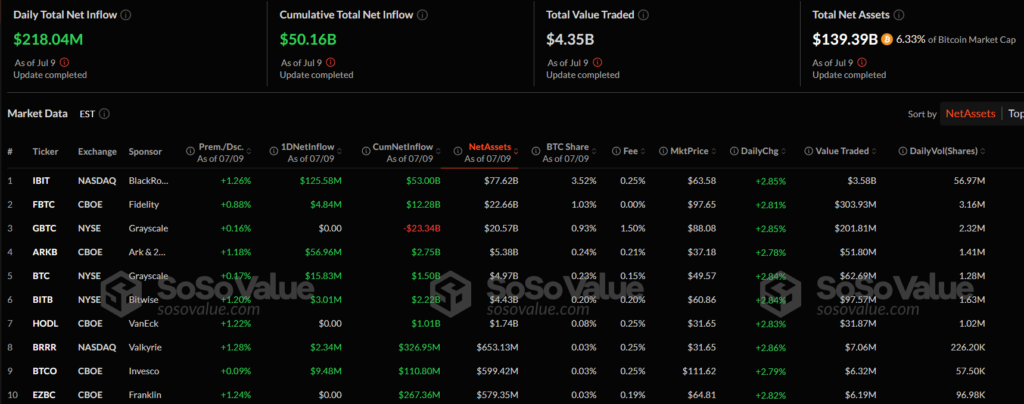

In the past 24 hours, 12 American bitcoin ETFs saw inflows amounting to $218 million.

As of July 9, seven out of the twelve funds recorded inflows. Leading the pack was BlackRock’s IBIT with $125.5 million. In second place was ARKB from Ark and 21Shares, which attracted $56.96 million. Grayscale’s Mini Bitcoin Trust received $15.8 million. Positive trends were also seen in instruments from Fidelity, Bitwise, Valkyrie, and Invesco.

BTC Markets analyst Rachel Lucas described the $50 billion milestone as a “turning point in the institutionalization of the asset.”

She noted that the growth is driven not by retail investors but by steady demand from asset managers, corporations, and platforms for wealthy clients. Consistent inflows over several weeks confirm this emerging trend.

Lucas also suggested that bitcoin’s growth is due to “a combination of macroeconomic factors and catalysts related to the current market structure.” Increased demand for risk assets has been spurred by geopolitical tensions and Trump’s statements on the need for sharp rate cuts.

“Bitcoin, with its limited issuance and global liquidity, is in a unique position [… ] However, it is the ETF format that ensures [institutional] participation. These are regulated, transparent products available through the same infrastructure as stocks or bonds,” Lucas noted.

Presumably due to “whale” demand and the strengthening narrative of monetary policy easing by the Fed, bitcoin’s price on July 9 approached the $112,000 mark. At the time of writing, the asset is trading slightly above $111,000.

Ethereum ETFs

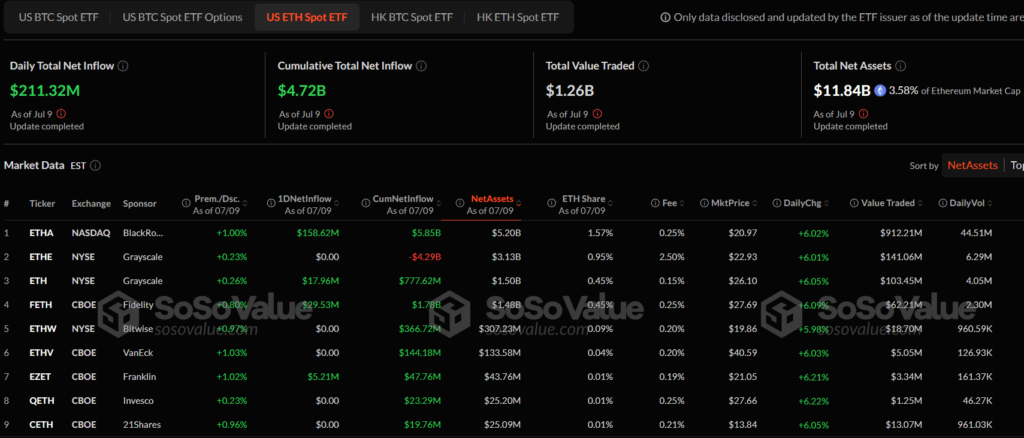

As of July 9, the cumulative net inflow into spot ETH ETFs reached $211 million, with the total figure hitting $4.72 billion.

“This is not 2021. It’s about reallocating capital on balance sheets, not betting on luck. Bitcoin is increasingly seen not as something high-risk but as a macro tool for the long term. […] The infrastructure is already in place, regulation is becoming clearer, and capital is flowing with a long-term perspective. This is what fuels the current inflow — and it is not slowing down,” Lucas commented.

Institutional Interest and Solana

U.S.-based exchange-traded funds on Solana attracted $78 million, indicating growing interest in investment products based on altcoins, analysts at CoinDesk believe.

According to Bloomberg Intelligence, the REX-Osprey Solana Staking ETF (SSK), launched on July 2, has already attracted over $41 million. The leverage ETF from Volatility Shares (SOLT) has accumulated $69 million since the beginning of the year, while the traditional Solana-based fund (SOLZ) has $23 million.

Senior ETF analyst at Bloomberg Intelligence Eric Balchunas acknowledged that volumes significantly lag behind those based on bitcoin and Ethereum. However, “the abundance of green numbers” can already be considered a positive signal.

In June, Balchunas predicted a “summer of altcoin ETFs.” According to him, as early as July, the U.S. Securities and Exchange Commission may approve instruments based on a basket of cryptocurrencies, followed by a decision on Solana-based funds.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!