Bitcoin ETFs Surpass Silver-Based Funds in AUM

A week after their launch in the US financial market, spot Bitcoin ETFs have surpassed silver-based exchange-traded funds in assets under management (AUM), reports The Block.

“Bitcoin ETFs have overtaken their silver counterparts in the US by size, driven by significant interest from market participants,” noted Yak Kooner, head of derivatives at the crypto exchange Bitfinex, in a conversation with the publication.

He added that the unmet demand from institutional investors for digital gold played a crucial role in this process.

Previously, silver was the second most popular asset in the US in the context of commodity ETFs. However, spot Bitcoin-based exchange-traded funds (including the converted GBTC trust from Grayscale) manage assets worth $27.9 billion, according to CC15Capital.

LATEST #Bitcoin ETF Holdings tracking schedule ?

1.) $IBIT posted the update, showing 4,923 $BTC buy yesterday

2.) Orange highlights = ETF data not posted yet

3.) New ETFs grabbing $GBTC ‘s outflows$IBIT $FBTC $ARKB $BITB $BRRR $BTCO $HODL $EZBC $BTCW $DEFI $GBTC pic.twitter.com/MPRksZKUTy

— CC15Capital ?? (@Capital15C) January 17, 2024

According to Coinglass, Grayscale Bitcoin Trust ETF manages approximately 592,100 BTC valued at $25.25 billion.

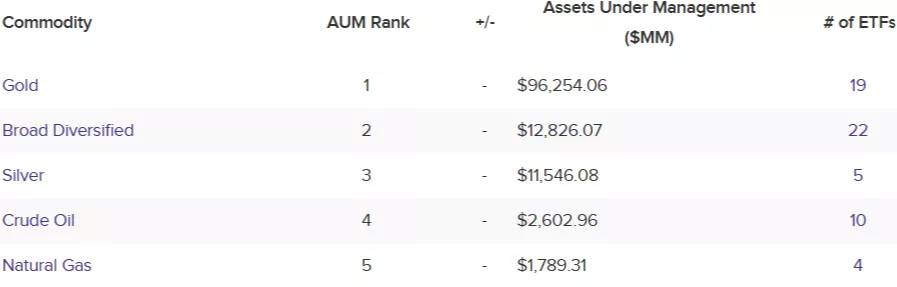

Based on data from ETF Database, silver, with a corresponding figure of $11.5 billion, ranks third in AUM among single-commodity-based funds.

For comparison, the AUM for all 19 “gold” exchange-traded funds in the US amounts to approximately $96.3 billion.

“Grayscale’s conversion of its existing Bitcoin trust into an ETF created the world’s largest exchange-traded fund literally overnight,” Kooner emphasized.

According to him, the “pent-up” demand for new products will stabilize the market and make it more liquid.

“While some in the investment community still view cryptocurrencies as risky, the growth of these ETFs could pave the way for more innovative crypto funds and new underlying assets like Ether,” the expert noted.

The expert predicts a steady increase in investor interest in new products, partly due to “competitive fee structures.”

Earlier, ForkLog reported that the trading volume of spot Bitcoin ETFs reached $11 billion in four days.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!