Bitcoin hash rate sinks to July 2019 levels

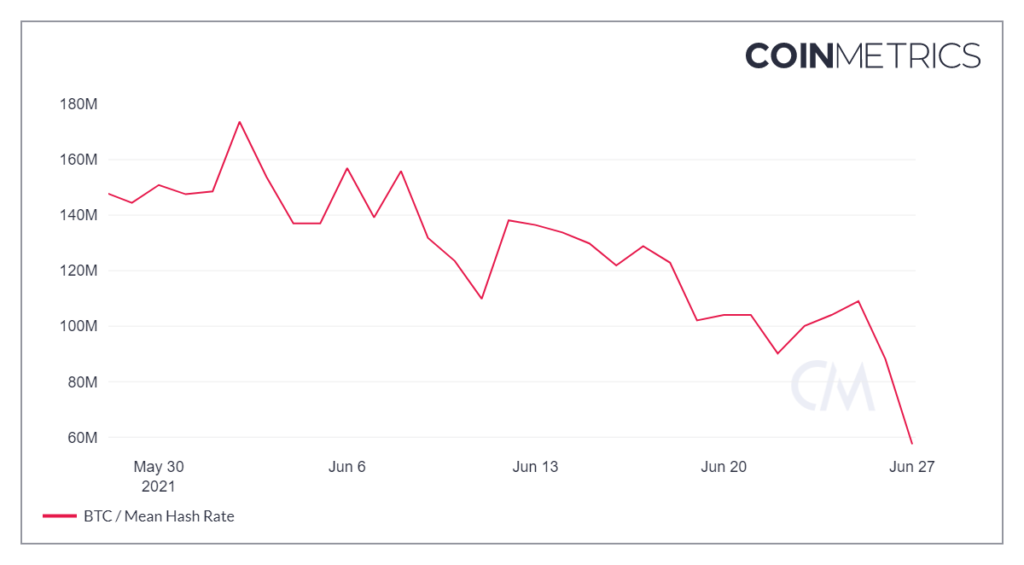

The hash rate of the network of the world’s leading cryptocurrency over the past 24 hours fell by 34% to 57.47 EH/s. According to Coin Metrics, the metric has not dipped below 60 EH/s since July 2019, when Bitcoin traded around $10,000.

The decline in hash rate may be linked to China’s crackdown on digital gold and the relocation of local miners, who are moving computing power abroad.

Earlier, Kevin Zhang, vice president of Foundry’s mining division, said that 70% of industry participants have already shut down their equipment, and by 30 June their share would approach 90%. He also noted that miners are actively moving ASIC devices out of China.

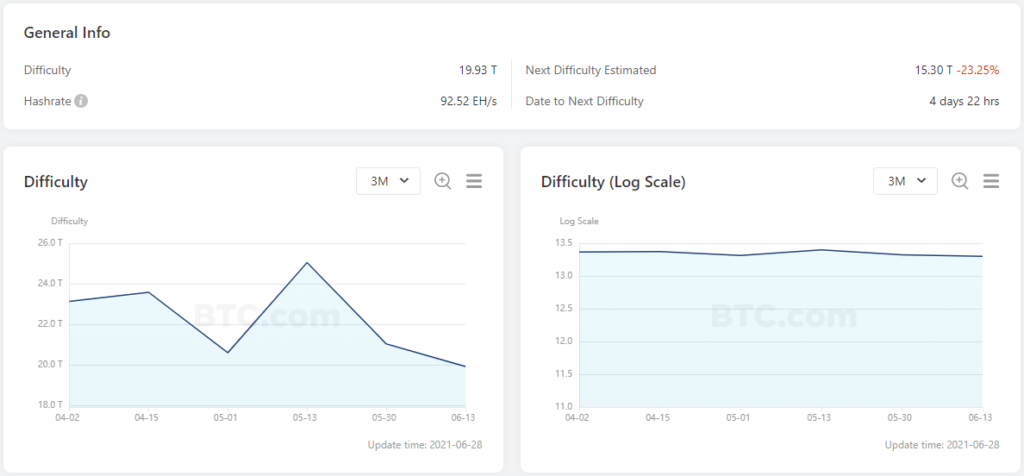

Against the backdrop of the hash rate decline, Bitcoin’s block time rose to 24 minutes, according to BitInfoCharts. Since the previous difficulty adjustment on 14 June, the average time to find a new block has been about 13.38 minutes. The mempool is waiting for confirmation of nearly 50,000 transactions.

As hash rate declines, Bitcoin’s block generation time has lengthened to about 24 minutes. At the same time, the network’s difficulty is expected to fall by more than 20% at the next adjustment, to around 15.3 T. The recalibration is due later this week.

Despite softer fundamentals, Bitcoin’s price rose 4.1% over the past 24 hours, according to CoinGecko. At the time of writing, Bitcoin is trading around $34,500.

The crackdown in China also affected Ethereum’s hash rate. the hash rate of the second-largest cryptocurrency fell by 20% as miners shut down in the country.

Subscribe to ForkLog’s news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!