Bitcoin Miners’ Fee Revenue Share Drops Below 1%

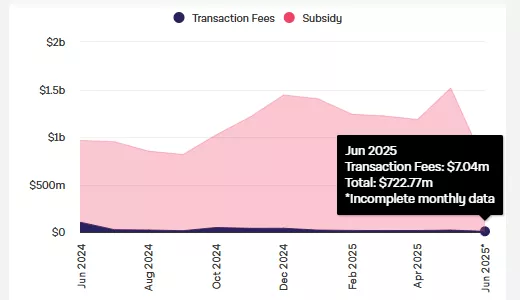

Since the beginning of June, miners of the leading cryptocurrency have earned approximately $7 million from fees, accounting for just 0.97% of the total revenue of $722.8 million.

This figure could potentially reach its lowest point since January 2022, noted TheMinerMag. By mid-month, the share of network fees in revenue had fallen to 0.65% per day.

The average weekly number of Bitcoin transactions declined to its lowest level since October 2023.

The decline in fee revenue has continued since the halving in April 2024, when a daily peak was recorded amid the launch of the Runes protocol. In the following full month, when the block reward was already 3.125 BTC, the fee share still reached 6.7%. A year later, in May 2025, it was 1.3%.

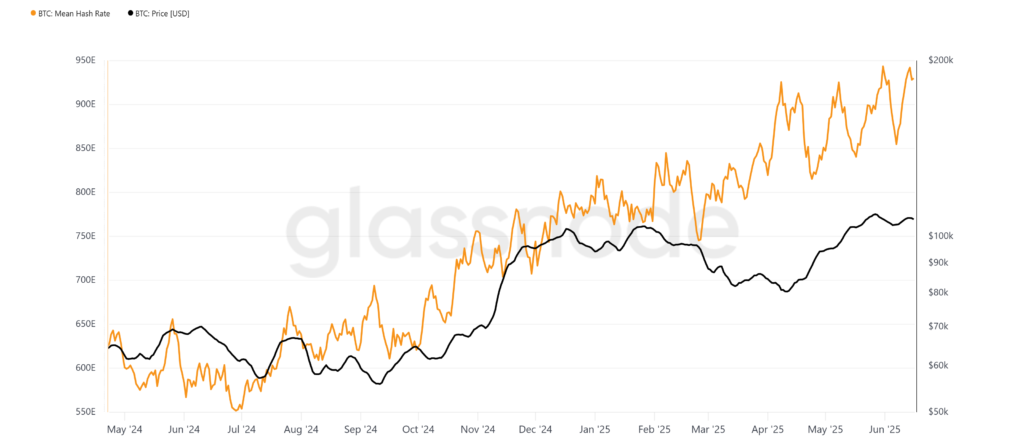

The reduction in network fee income and the rising hash rate are putting pressure on mining profitability. Hashprice stands at $52-53 per PH/s per day, according to Hashrate Index, despite Bitcoin holding above $100,000. In December 2024, at the same price levels, the mining profitability metric remained above $60 per PH/s per day.

According to Glassnode, the network hash rate (7 DMA) is at 930 EH/s and is steadily approaching the 1 ZH/s mark. The intraday value surpassed this significant level back in April.

Following the latest recalculation on June 14, mining difficulty retreated from the previously reached historic high of 129.98 T by a modest 0.45%.

Investors Remain Optimistic

JPMorgan noted the significant contribution of US-listed Bitcoin miners to the growth of the hash rate. Thirteen public companies tracked by the bank now account for 31.5% of the global network power, reports CoinDesk.

Since April, they have collectively added about 11 EH/s to the total figure. MARA Holdings expanded its capacity by 30% in a month, while HIVE increased by 32% with the launch of a new facility in Paraguay, according to TheMinerMag.

Cipher Mining plans to increase its hash rate by 70% following the expansion of operations in Texas.

The cost of next-generation ASIC miners ranges from $10-30 per TH/s, and the payback period for equipment, assuming an electricity price of $0.06 per kWh, exceeds two years.

Experts anticipate that by the end of the second quarter, the median cost of mining 1 BTC will approach $70,000. In the early months of the year, it was $64,000, and JPMorgan called them the “best quarter” for miners since monitoring began (over two years).

Bank analysts noted the divergence in the dynamics of miners’ stocks and the price of the leading cryptocurrency. In their view, investors are paying more attention to the resilience of business models than to Bitcoin’s price prospects. Shares of IREN, Core Scientific, and Bit Digital rose as digital gold retreated from its all-time high. For most industry companies, JPMorgan raised their forecast or left it at a neutral level.

In May, MARA mined a post-halving record of 950 BTC, increasing production by 35% compared to the previous month.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!