Bitcoin NFTs: How the Ordinals Project Is Shaping the Bitcoin Blockchain

The controversial Ordinals project is rapidly gaining popularity, prompting heated discussions in the community about the viability of issuing NFTs on the Bitcoin network.

“Bitcoin purists” are convinced that digital gold was not created to host pictures on the blockchain. Yet there are many who believe the new capability will benefit the ecosystem and miners in particular.

- The idea of NFTs on the Bitcoin blockchain is not new. Yet only after a long gestation did it genuinely gain popularity.

- The hype around Ordinals significantly affects various on-chain metrics of digital gold: transaction activity, mempool congestion, block fullness, etc.

- The project remains in the early stages of development, but many in the community are actively building the infrastructure. Wallets with native support for this new type of NFT, user-friendly tools for anchoring digital objects into the blockchain, and solutions for Ethereum integration are emerging.

What Ordinals Are

The Ordinals project, which appeared in January 2023, opened the ability to place images and other data types in the Bitcoin blockchain—the largest cryptocurrency by market capitalization—without using a separate token or sidechain.

The system uses the numbering of satoshis (serialization) to record data in “witness portion” of a Bitcoin transaction.

“Ordinal Theory is a proposed methodology for identifying (by number) and tracking each individual satoshi across the entire Bitcoin supply,” — analysts at Glassnode.

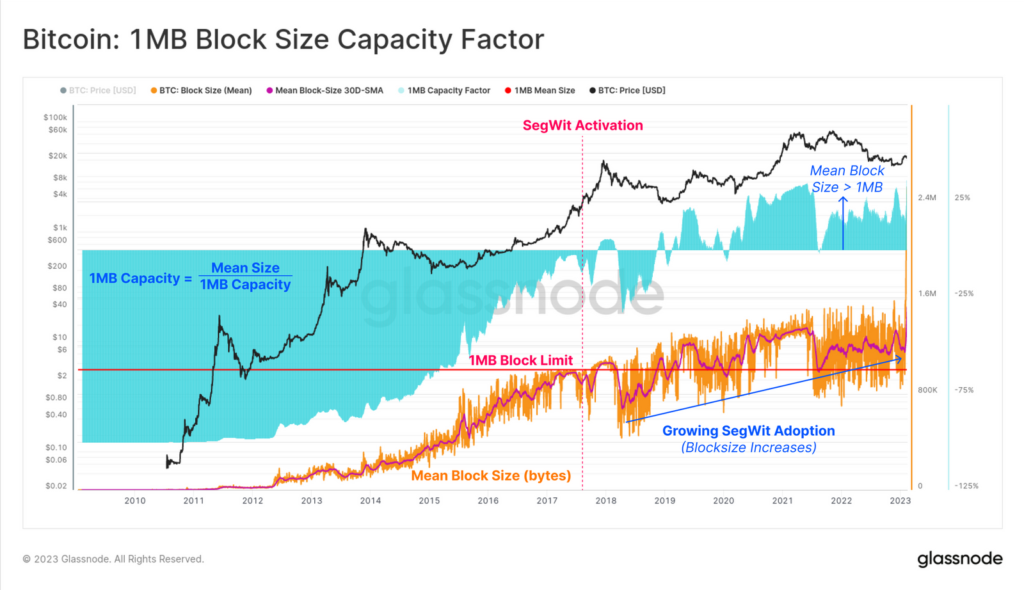

The Ordinals phenomenon became possible thanks to the implementation of Segregate Witness (SegWit) in August 2017 and the software fork Taproot implemented a few years later. The latter, among other things, helped reduce costs and increase privacy.

Primarily aimed at solving the scalability problem, SegWit changed the block structure, allowing signatures to be detached from the process of their transmission. The update also addressed the malleability problem and laid the groundwork for the development of Lightning Network.

“SegWit increased the Bitcoin block size from 1 MB to 4 MB. In turn, Taproot relaxed data limits, allowing an entire block of 4 MB to be filled with NFTs from Ordinals,” — noted partner NovaBlock Capital Leor Shimron.

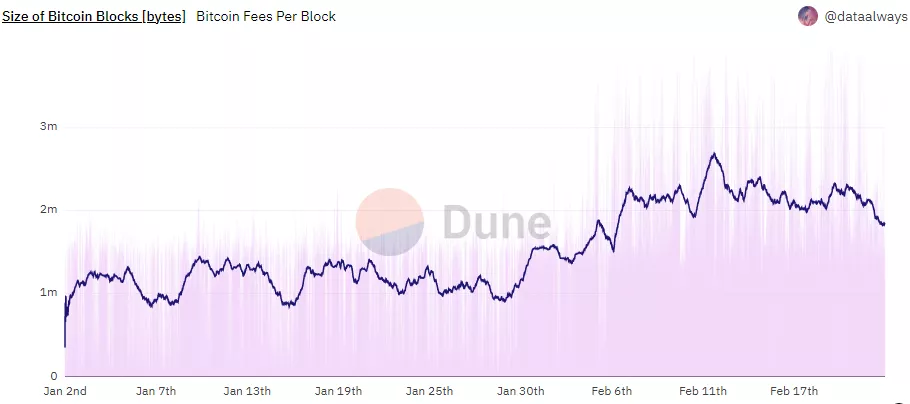

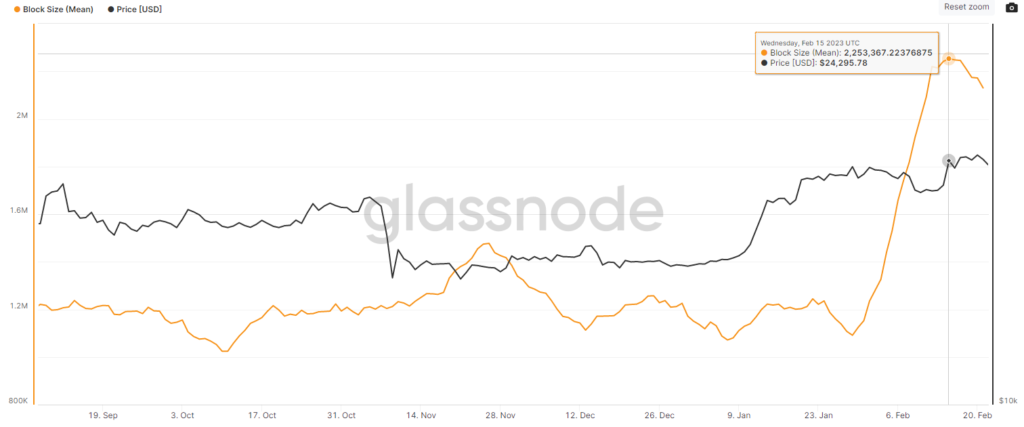

The graph below illustrates the move beyond the 1 MB limit and the subsequent gradual rise in Bitcoin’s average block size after SegWit’s soft fork:

Inscriptions created thanks to Ordinals are positioned as “digital artifacts”.

NFTs in other ecosystems such as Ethereum or Solana are tokens that attest to ownership of specific items. The latter are usually stored off-chain in some off-chain storage.

“Hosting services range from cloud servers to IPFS and blockchains for file storage […]. On the other hand, “inscriptions” actually contain raw data written directly into the Bitcoin blockchain. This makes them unique,” — explained researchers at Glassnode.

On the Ordinals site the following is stated:

“Digital artifacts are perfect. An NFT pointing to off-chain content on IPFS or Arweave is imperfect and, therefore, not a digital artifact.”

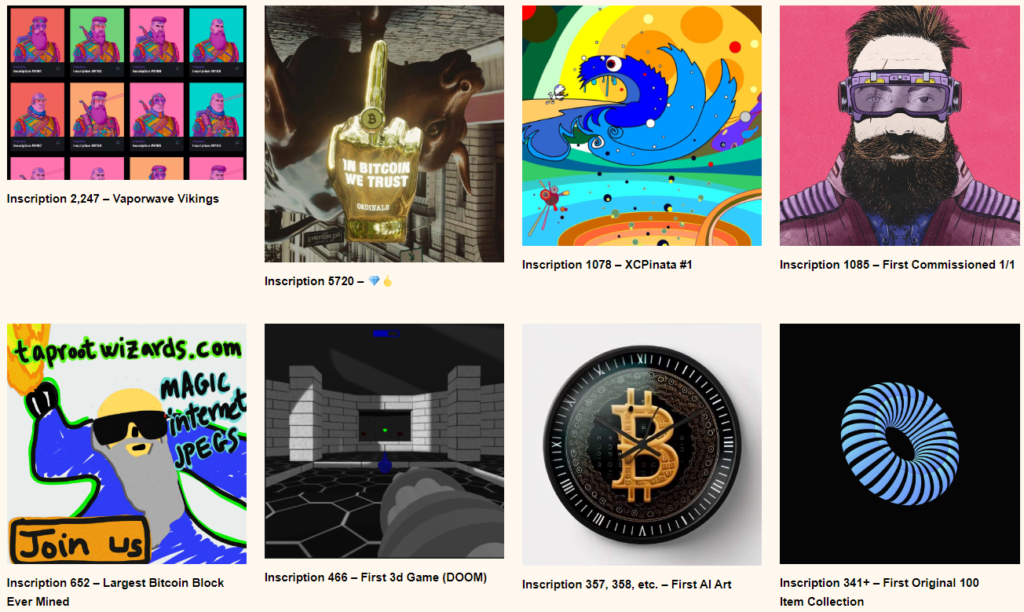

One of the popular collections of the new type of assets is Ordinal Punks, consisting of just 100 digital items. According to Leor Shimron, the NFT shown below sold for 9.5 BTC (~$226,000 at the 22.02.2023 rate).

Chronicles of the Bitcoin NFT Boom

It is worth noting that the idea of NFTs on the Bitcoin blockchain is not new — experiments with similar assets began with solutions such as Colored Coins and Counterparty in 2012 and 2014 respectively. Only after a long gestation did the concept genuinely gain popularity.

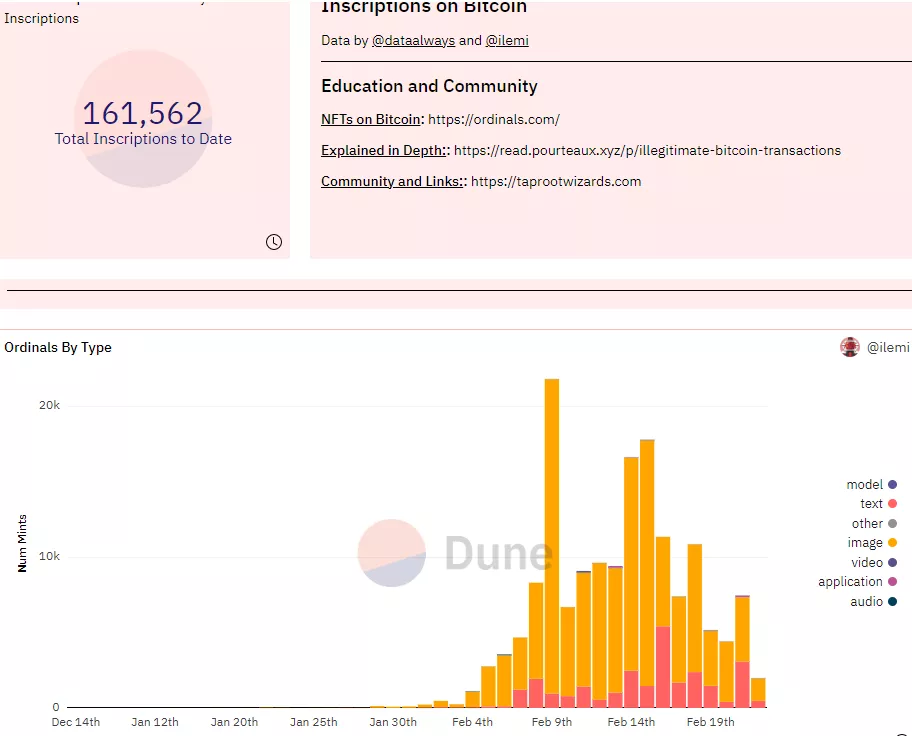

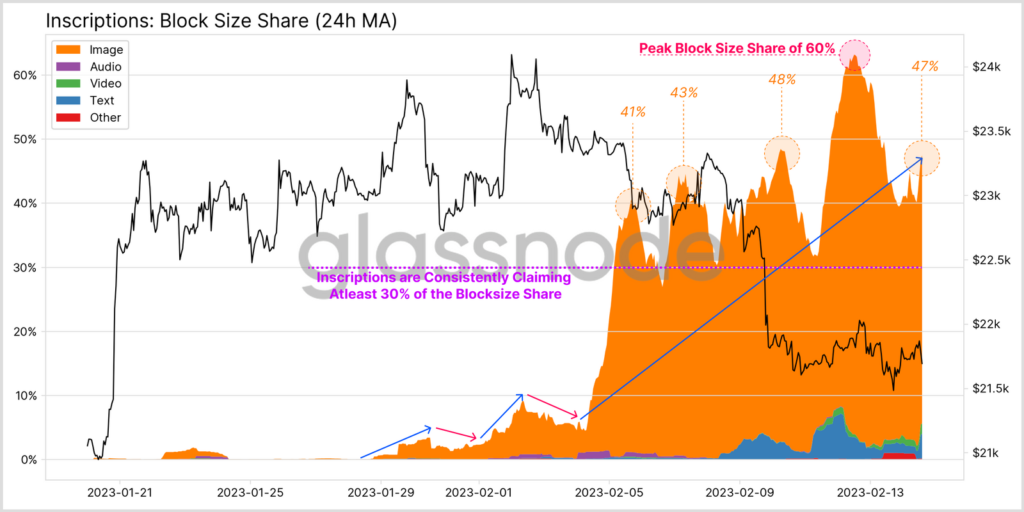

As of 22.02.2023 the number of Ordinals assets issued exceeded 160,000. The chart shows that the majority of objects (>80%) are images. The text-format Bitcoin NFT ranks second in popularity (>10%).

“The hype surrounding the spread of information about inscriptions is notable. The excitement around the possibility of anchoring digital artifacts in the oldest and most decentralized blockchain has led to explosive growth in transaction volumes, mempool congestion, and increased average block size,” researchers at Glassnode noted.

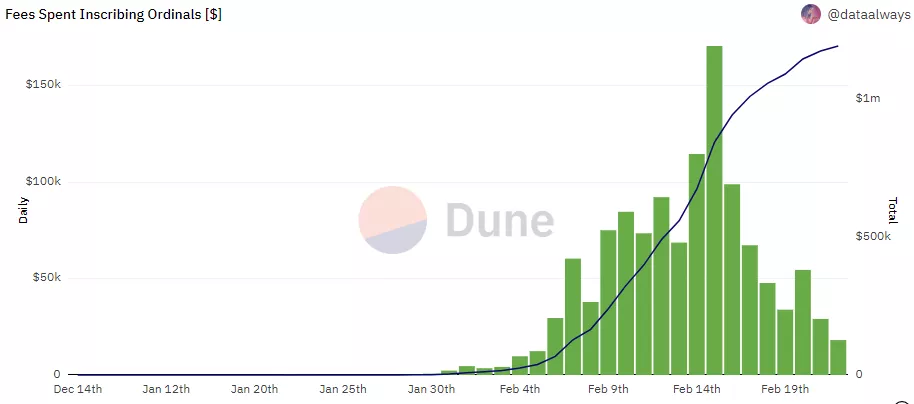

Below is shown the dynamics of the fees spent inscribing NFTs — on February 15 the daily total exceeded $170,000.

The Ordinals project’s popularity has positively affected the amount of fees per block. Thus, some increased miner revenue can be expected.

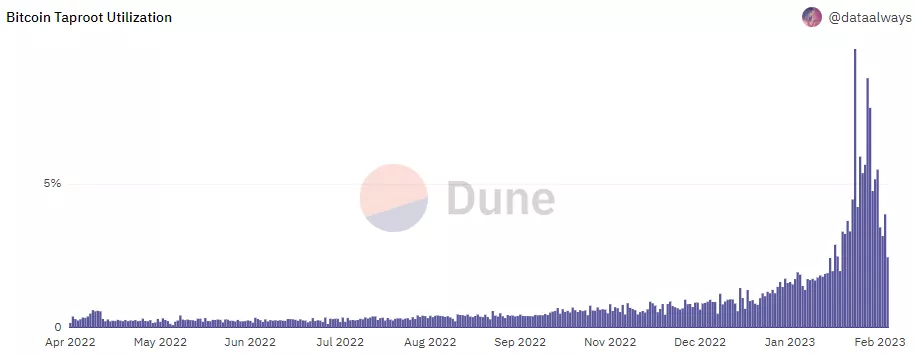

Another consequence of the hype around the innovation is the expansion of Taproot signature usage. The graph below shows a historical maximum readout.

Average block size has also increased. Arbitrary data like images and other objects can fill the entire available space.

The share of block space occupied by Ordinals transactions peaked at 60%. It then stabilized around 47%.

“Noting that inscriptions account for 4.2% of total on-chain transactions, while consuming more than 47% of block space, this is an incredibly dense data class,” stressed Glassnode’s analysts.

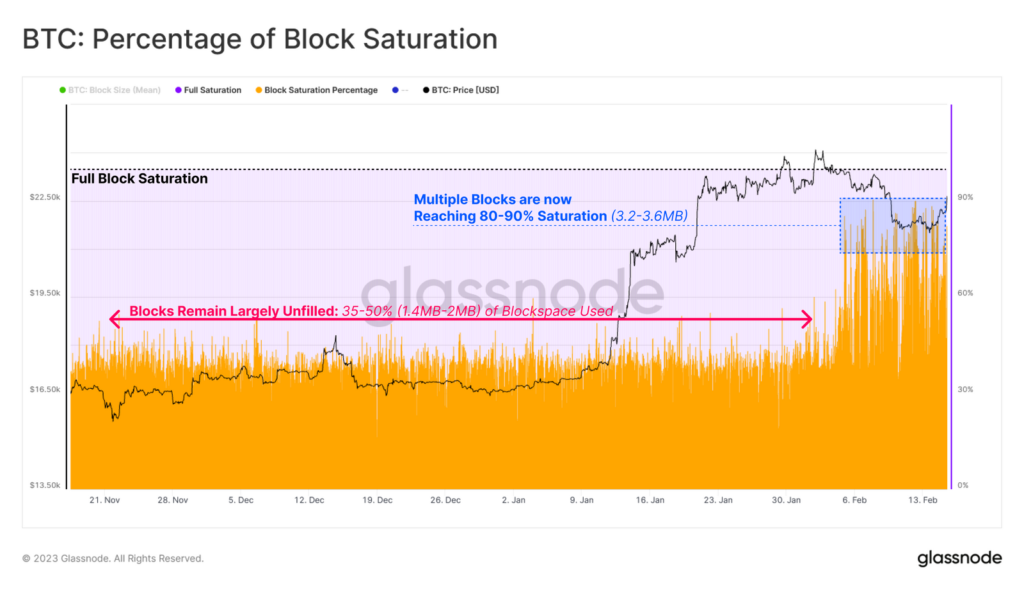

According to their observations, before the Ordinals mania blocks were filled to 25-50%. Now this figure ranges from 80-90%, which corresponds to 3.2–3.6 MB.

“Given that inscriptions account for 4.2% of total on-chain transactions, while consuming more than 47% of block space, this is an incredibly dense data class,” emphasized Glassnode’s analysts.

According to their observations, before the Ordinals mania, blocks were filled to 25-50%. Now this figure sits in the 80-90% range, corresponding to 3.2–3.6 MB.

The chart shows that the greatest congestion occurred during dramatic events related to FTX. However, the situation soon stabilized—the inflow of high-fee transactions dropped significantly.

In the case of Ordinals, mempool filling occurs gradually, as demand for block space grows.

New Market Segment

The project is still in the early stages, but many community participants are actively building the infrastructure.

For example, the Bitcoin wallet Hiro Wallet is being developed with native support for this new type of NFT. A similar solution is being pursued by the project Xverse.

We’ve begun rolling out support to Hiro Wallet for Bitcoin, NFTs and Ordinals for a truly cross-protocol Bitcoin Web3 experience. https://t.co/OAVriTraFq

? A thread with details… #bitcoin #web3 #stx #nfts #ordinals pic.twitter.com/SiWrIluFhk

— Mark Hendrickson | mark.btc | Hiro Wallet (@markymark) February 14, 2023

The Gamma marketplace on Stacks has offered a tool for users to easily create inscriptions on Bitcoin without the need to deploy a full node.

So you want a Bitcoin ordinal?

Start with a Bitcoin full node, then install……no, no.

For the past year, we’ve focused on making the best creator tools possible.

Today, we’re launching no-code ordinal inscriptions to anyone with a BTC address.

— Gamma.io (@trygamma) February 9, 2023

Similar service has been implemented by the Oridalsbot team, which previously created the Satoshibles collection.

CapsuleNFT, tied to the blockchain company Bloq, released the Ordinary Oranges collection, whose digital artifacts are also available on the Ethereum mainnet. There is also an option to “burn” assets back to the Bitcoin network.

“The appeal of such approaches lies in the combination of Bitcoin’s security with greater programmability of decentralized apps and L2 protocols, running on the Ethereum Virtual Machine. They also imply greater liquidity found on NFT marketplaces like OpenSea,” — CoinDesk’s Mike Casey noted.

In his view, such developments should make the crypto ecosystem more integrated.

“Different protocols serve very different functions, and this is all tied to a deeply rooted blockchain based on Proof-of-Work with a 15-year history, which no US regulator can stop,” — Casey explained.

The company behind the NFT collection Bored Ape Yacht Club, Yuga Labs, announced the TwelveFold collection on the Bitcoin blockchain.

Introducing TwelveFold. A limited edition collection of 300 generative pieces, inscribed on satoshis on the Bitcoin blockchain.https://t.co/aFWEIhzqcI pic.twitter.com/PjWABKKBr4

— Yuga Labs (@yugalabs) February 27, 2023

An Ordinals analogue also appeared on the Litecoin blockchain. Developer Anthony Guerrero adapted the code to work with input data from the altcoin network. He accounted for differences between blockchains, such as the supply cap and block creation times.

The first object he inscribed thanks to the protocol transfer was the white paper MimbleWimble. In May, developers activated this upgrade on the Litecoin network.

According to Guerrero, unlike Bitcoin, where inscriptions can cost around a tens of dollars, in Litecoin the operation would cost “around two cents.”

Some mining companies welcomed the budding trend. For example, Luxor Technologies announced the acquisition of the OrdinalHub platform for issuing, selling, and tracking Bitcoin NFTs.

Company representatives noted that the segment remains fragmented: issuances and deals with new assets occur across multiple Discord servers. In the view of mining experts, this makes project tracking difficult for creators and collectors. The lack of an escrow system hampers trading and leads to high fees.

“OrdinalHub will solve these problems by providing the community a central hub for discovering projects, trading NFTs, discovering new emission venues, and access to educational materials. The Ordinals sector is still in its infancy. The market lacks robust enterprise-grade solutions for indexing collections, escrow, and price discovery,” Luxor said.

Researchers from Matrixport suggested that the rapid rise of Bitcoin NFTs could propel the Stacks Network by Blockstack to an ecosystem with a multi-billion-dollar capitalization.

The firm stressed that, unlike traditional non-fungible tokens, assets on the Ordinals protocol are not reliant on standards such as ERC-721; they are issued directly on the Bitcoin blockchain, ensuring immutability of the data.

Experts from Matrixport agreed that Bitcoin NFTs are “digital artifacts,” since smart-contract developers cannot change them.

Stacks Network — a layer-2 network offering Bitcoin-compatible smart contracts. For transactions it uses the Bitcoin blockchain as the security layer.

Over the last 30 days, STX prices rose by more than 150%. The coin’s market cap approached $1 billion.

Controversial Views

Not all players in the crypto industry are enthusiastic about what is happening. For example, Bitcoin Core developer Luke Dashjr called Ordinals-based assets “garbage” and hinted at the need for a “spam filter.”

Is anyone working on a spam filter for this garbage yet?#Bitcoin https://t.co/Wws8hi54R4

— @LukeDashjr@BitcoinHackers.org on Mastodon (@LukeDashjr) January 28, 2023

Mr.Hodl, a well-known Twitter regular, is also convinced that censorship concerns are valid.

It’s not really the miners that would be the one censoring, mostly pools. And if I was a pool op, I’d censor the shit out of anyone that clogged up the chain. They would need to bribe the shit out of me to mine those TXs.

— Mr.Hodl ⚡️ ?? B.R.E.A.M.??? (@MrHodl) January 29, 2023

A similar call was later echoed in a deleted tweet by Blockstream CEO Adam Back, who called Ordinals-based assets “crap.”

Adam Back used to sell T-shirts with RSA code printed on them, to fight the US government’s attempts to censor free speech

Now he’s encouraging miners to censor jpegs because he thinks they’re “crap” pic.twitter.com/eha4Zxrwyc

— Udi Wertheimer ?♂️ (@udiWertheimer) January 29, 2023

“Bitcoin purists” are convinced that Bitcoin NFT transactions clog block space at the expense of “more legitimate financial operations.”

Meanwhile, Ordinals supporters argue that inscriptions positively affect fee markets and miner revenues. Accordingly, the rise of this asset class makes the Bitcoin network more resilient.

“They also appeal to libertarian principles, whereby the market determines the best use of block space,” — Leor Shimron commented.

Gamma.io founder Jamil Dhannani emphasized that “Bitcoin purists” reduce Bitcoin’s functionality to transaction processing. In their view, any other use case is “abuse.”

“Since Bitcoin is an open, public system, anyone can send a transaction with any data at their discretion. And we have seen incredible creativity and many innovations aimed at extending Bitcoin beyond its original use,” — Dhannani shared.

Ordinals developer Casey Rodarmor is convinced that the development and popularity of his project are only to the benefit of Bitcoin.

“To keep Bitcoin secure, blocks must be full. It’s part of the coin’s security model. If blocks aren’t full, no one has an incentive to pay fees beyond their minimum level,” — he said.

Similarly, Udi Wertheimer argued that Ordinals create incentives for miners to make the Bitcoin network more secure. This is particularly relevant given upcoming halvings, which reduce the block reward.

In an interview with Cointelegraph, Wertheimer noted the emergence of a new use case aimed at making Bitcoin development commercially viable.

“Considering all this interest in Ordinals and inscriptions, I expect a very large ecosystem to emerge,” — one expert commented.

Regarding criticism of the project from some crypto community members, Wertheimer said that in recent years Bitcoin developers have “ignored user needs.”

Conclusions

The Ordinals phenomenon is one of the most unexpected events in Bitcoin’s history, so it’s not surprising that it has sparked lively debate.

Given the popularity of NFTs on Ethereum and other blockchains in recent years, it is not unthinkable that the trend will continue. The likely result is sustained demand for block space in the Bitcoin network.

“Inscriptions” are already loading the mempool, but there are no obvious signs of displacing the “legitimate financial operations”—the minimum required fee to include a transaction in a block has risen only slightly.

Regardless of how the community regards Bitcoin NFTs, they are already influencing key metrics of the network. It will be interesting to watch the ongoing on-chain data, the ecosystem around Ordinals, and the impact on the broader market.

Found a mistake? Select it and press CTRL+ENTERРассылки ForkLog: держите руку на пульсе биткоин-индустрии!