Bitcoin Options Signal Bearish Market Shift

Aggressively bullish bets in the cryptocurrency options market have shifted to "decidedly bearish" positions.

Aggressively bullish bets in the cryptocurrency options market have shifted to “decidedly bearish” positions, observed CoinDesk analyst Omkar Godbole.

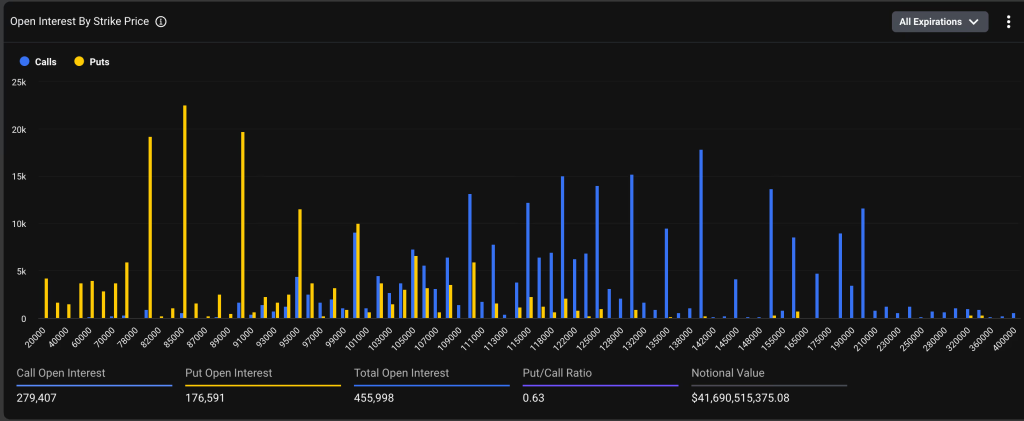

Since the end of 2024, traders have been actively betting on further growth, purchasing call options with strike prices of $100,000, $120,000, and $140,000. Until recently, the latter was the most sought-after on the Deribit exchange, with open interest (OI) consistently exceeding $2 billion.

“Now the picture is different. Open interest in call options with a $140,000 strike is $1.63 billion. Meanwhile, the leader is a put with an $85,000 strike and open interest of $2.05 billion. Puts at $80,000 and $90,000 have also surpassed the $140,000 call in this regard,” the researcher shared.

The chart below illustrates the concentration of OI in put contracts with lower strike prices.

The volume of open calls remains significantly higher, yet puts are trading at a noticeable premium. This indicates a shift in demand towards “bearish” contracts and reflects investors’ concerns about further market correction.

“Options reflect market caution towards the year’s end. Currently, the highest turnover is in short-term put options with strikes of $84,000-80,000. Implied volatility of options with the nearest expiration dates is around 50%, with the curve showing a pronounced skew towards puts (+5-6.5%) for downside protection,” commented Deribit commercial director Jean-David Pequinot.

Activity on the decentralized exchange Derive.xyz also points to growing bearish sentiment: the 30-day skew decreased from −2.9% to −5.3%. This is a sign that traders are increasingly hedging correction risks with put options.

“Looking at the end of the year, there is a noticeable concentration of put options on Bitcoin around the December 26 expiration, especially with an $80,000 strike,” commented Derive.xyz researcher Dr. Sean Dawson.

Amid ongoing concerns about the resilience of the US labor market and a reduced likelihood of a December rate cut to about 50%, there are few macro-level factors supporting bullish trader sentiment, the expert noted.

Put options give the buyer the right, but not the obligation, to sell the underlying asset at a predetermined price in the future. Such contracts are typically chosen by market participants expecting a decline in the asset’s value or seeking to hedge against a price drop. Conversely, a call option buyer anticipates market growth.

What Lies Ahead?

Despite the downward trend, selling pressure may soon ease: technical indicators signal oversold conditions, and market sentiment metrics have long been in the “extreme fear” zone.

“With the Fear and Greed Index around 15 and RSI approaching 30 (oversold zone, but not extreme), large wallets (with balances over 1000 BTC) have significantly increased positions over the past week. This suggests asset accumulation by ‘smart money’ at lower levels,” said Pequinot.

He added that overall, fear of further short-term decline is justified. The path of least resistance currently lies downward, but “such extreme situations in the past have rewarded those who took risks.”

Previously, Hasib Qureshi of Dragonfly called the current correction “insignificant” and urged against panic.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!