Bitcoin Plummets Below $99,000

Fear and Greed Index dropped to 15 points.

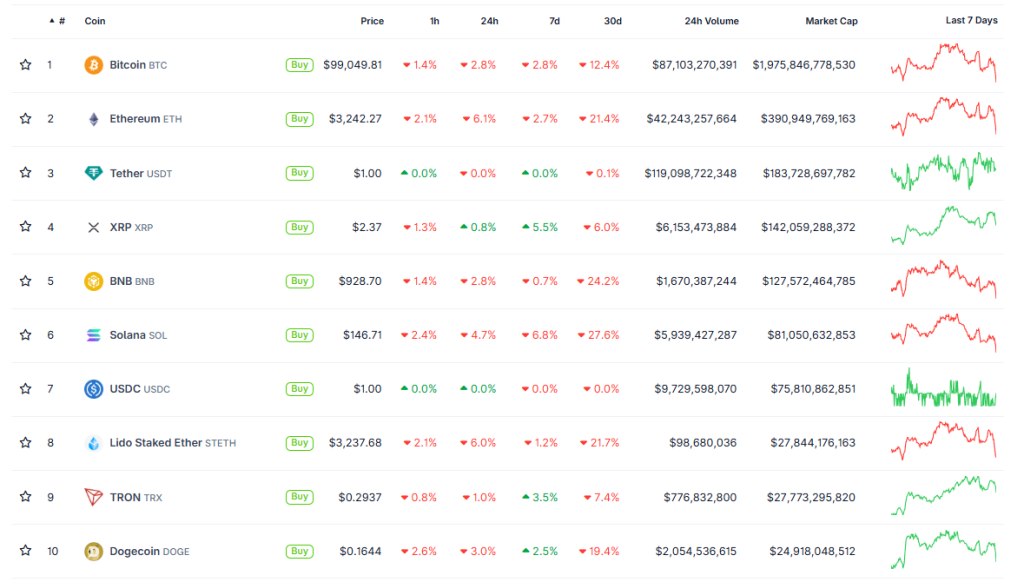

On the evening of November 13, the leading cryptocurrency fell below $99,000, despite persistent resistance throughout the week.

At the time of writing, the asset is trading around $98,400, having lost 3% in a day.

Since November 11, Bitcoin has shown signs of weakness. Its price fell from $107,000 to $102,000. On November 12, after recovering to $105,000, the asset experienced another correction to $101,000, but did not cross the psychological threshold.

However, even the end of the US government shutdown did not help Bitcoin maintain its value.

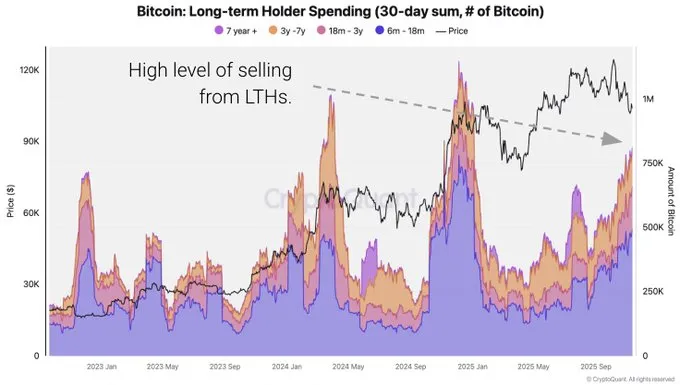

Shortly before today’s decline, Glassnode analysts noted that long-term holders (LTH) accelerated profit-taking as “bulls actively defended the $100,000 mark.”

Long-term $BTC holders are accelerating their distribution, with supply declining fast and net position change falling sharply into negative territory.

LTHs are booking profits as bulls defend $100k. https://t.co/yatqA1O7nd pic.twitter.com/rZ8XMSRZXR— glassnode (@glassnode) November 13, 2025

This position was confirmed by CryptoQuant. According to their data, over the past 30 days, LTHs have realized about 815,000 BTC — a record figure since January 2024.

Researchers at Arkham also recorded that today early Bitcoin whale Owen Gunden sold coins worth $290 million. His wallets still hold assets worth $250 million.

OWEN GUNDEN JUST SOLD ANOTHER $290M BTC

Owen Gunden just moved all of the remaining BTC out of his accounts. He deposited over HALF of his holdings directly into Kraken, depositing a total of $290.7M of BTC into Kraken.

He now has only $250M of Bitcoin remaining. pic.twitter.com/ZUB3aToAgH

— Arkham (@arkham) November 13, 2025

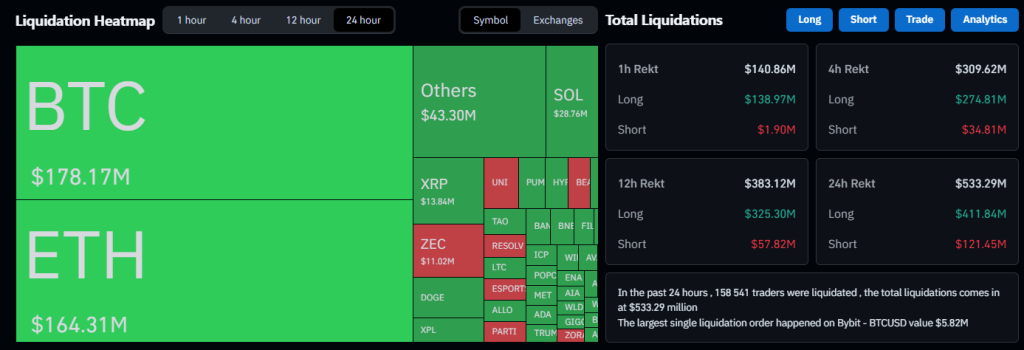

According to CoinGlass, the volume of liquidations over the past day reached $500 million. The majority ($411 million) were long positions.

Following Bitcoin, other top-10 cryptocurrencies by market capitalization also turned red. The exception was XRP, which mitigated the decline due to positive news from the launch of an exchange-traded fund.

The Crypto Fear and Greed Index dropped to 15 points, indicating “extreme fear.”

Analysts at QCP Capital identified factors supporting Bitcoin until the end of the year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!