Bitcoin Poised for Consolidation Before Reaching New Heights, Predicts Expert

As long as the $65,300 support holds, a pullback completion can be anticipated. Bulls need to regain control over the $69,000 mark to resume the upward trajectory, according to the analyst known as CryptoJelleNL.

#Bitcoin continues to play out as expected.

So long as we hold $65,300 — I’m pretty sure the bottom is in.

Need to reclaim $69,000 to turn full bull again, but so far, so good.

Don’t get chopped up. pic.twitter.com/s4BMwY1IDl

— Jelle (@CryptoJelleNL) March 21, 2024

The scenario presented by the specialist suggests consolidation at current levels over the coming days, followed by a breakout of its upper boundary.

A similar chart was presented by trader BobLoukas. The expert noted the formation of lows on the daily timeframe on March 20, driven by the strength of the Fed. To break out of consolidation upwards, a close above $70,000 is necessary, he added.

Fairly clean path for #bitcoin.

#FOMC strength could mean lows on 60-day timeframe.

If a move lower still to come, this tag of 10dma is where it turns to lower low. Structurally better if it does for bull market sustainability.

Otherwise close >$70k likely go go go time pic.twitter.com/cIXzVupbyE

— Bob Loukas ? (@BobLoukas) March 21, 2024

Analysts at Swissblock share a similar view. They stated that Bitcoin’s pullback has ended after reaching the target zone of $58,000–59,000.

“Higher levels ahead,” they commented.

According to specialists, altcoins and Bitcoin mining stocks will “perform well” in the next phase of the bull market.

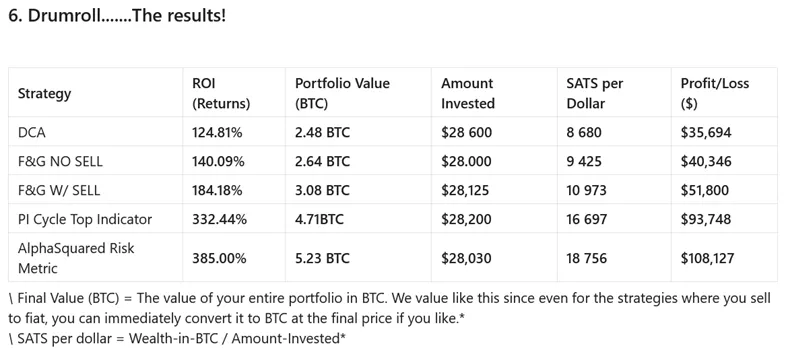

In light of recent events, Reddit user u/skogsraw shared calculations suggesting that selling 5% of coins during times of “extreme greed” in the cryptocurrency fear and greed index yields higher returns on investment than simple holding. This conclusion is relevant for a dollar-cost averaging strategy.

The classic approach involved u/skogsraw buying $100 worth of Bitcoin once a week from March 17, 2018, to September 9, 2023, resulting in an ROI of 124.8%.

The modified approach involved buying $150 worth of coins during “extreme fear,” $100 during “fear,” $75 during “neutral,” $50 during “greed,” and $25 during “extreme greed.” This resulted in an ROI of 140.1%.

The third strategy was the same, except it would sell 5% of accumulated Bitcoin each week if in the “extreme greed” zone. This proved to be the most profitable strategy with an ROI of 184.2%.

For testing, the author chose the period from March 17, 2018, to September 9, 2023, which covered two major bear markets and one bull market. The enthusiast did not account for fees, which peak during times of “extreme greed.”

In March, the cryptocurrency fear and greed index reached levels seen in February 2021.

Earlier, Bernstein analysts considered the correction to around $63,000 a good buying opportunity “at the lows” before the halving. Subsequently, experts revised their Bitcoin forecast from $80,000 to $90,000 by the end of the year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!