Bitcoin price falls below $32,000

On Monday, May 9, Bitcoin prices hit their lowest since the summer of 2021. The price of the leading cryptocurrency fell below $31,600.

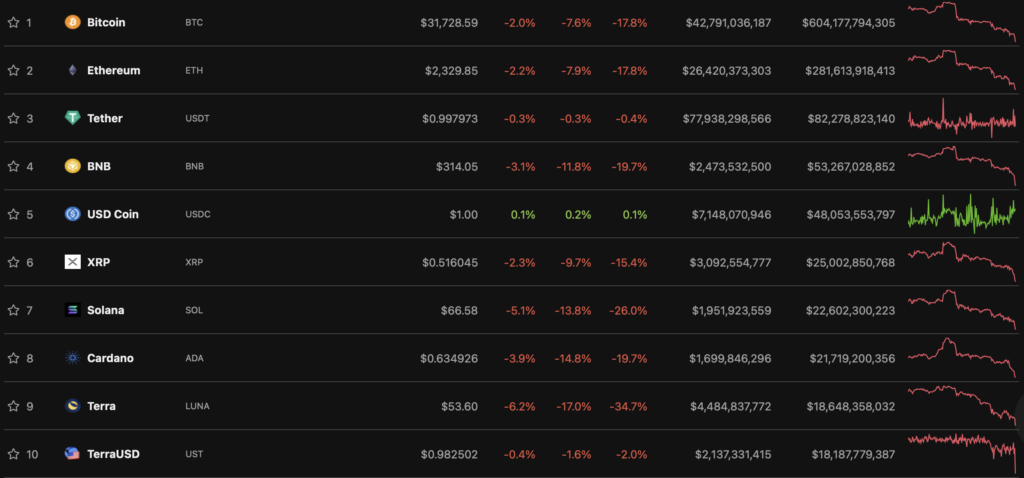

According to CoinGecko, BTC fell 7.6% in the last 24 hours and 17.8% over the past week. Following the leader, all top-10 crypto assets by market cap were in the red.

Ethereum is trading at around $2,329, down 7.9% in 24 hours. BTC dominance is 39.4%, ETH 18.2%.

According to Coinglass, daily futures liquidation volume exceeded $270 million.

The market’s grim prospects pushed the Fear and Greed Index down to 11 points, “Extreme Fear”.

Bitcoin Fear and Greed Index is 11 — Extreme Fear

Current price: $34,041 pic.twitter.com/PQK3x6YMok— Bitcoin Fear and Greed Index (@BitcoinFear) May 9, 2022

On May 8, Glassnode analyst Checkmate noted that “many are waiting for the Bitcoin capitulation wick.” The tweet reads as published.

Many of you are waiting for the #Bitcoin ‘capitulation wick’.

If it happens, and it really is THE capitulation wick, the majority of folks won’t step in a buy it because the fear will be too great.

This is the way it always is, and always will be.

Tip: have a plan, stick to it

— _Checkmate 🔑⚡🦬🌋 (@_Checkmatey_) May 8, 2022

“If that happens, and it really is capitulation, most people won’t buy Bitcoin because the fear will be too great. This has always been the case and will always be.”

Analyst Caleb Franzen noted the tendency to weaken and did not rule out that “more pain may be ahead”.

Seems worthwhile to expect more pain. Those who embrace it will be best-off in the long-term.https://t.co/oCQfBkDDQa

— Caleb Franzen (@CalebFranzen) May 8, 2022

On May 5, after a brief spike in quotes on the back of Fed‘s rate hike, the price of the leading cryptocurrency began to fall, nearing $35,000.

In April, former BitMEX CEO and co-founder Arthur Hayes predicted Bitcoin would fall to $30,000 by the end of the first half of the year. He linked this to a possible drop in the Nasdaq 100 (NDX), with which digital gold is highly correlated.

Arcane Research analysts confirmed that the statistical link between Bitcoin and the Nasdaq index has reached its highest level since July 2020.

Back in April, trader and head of Factor LLC Peter Brandt warned of a drop in the price of digital gold to $28,000.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!