Bitcoin price slides 10%

On Sunday, April 18, bitcoin traded from above $61,000 to as low as below $52,000, with volume surges accompanying the drop.

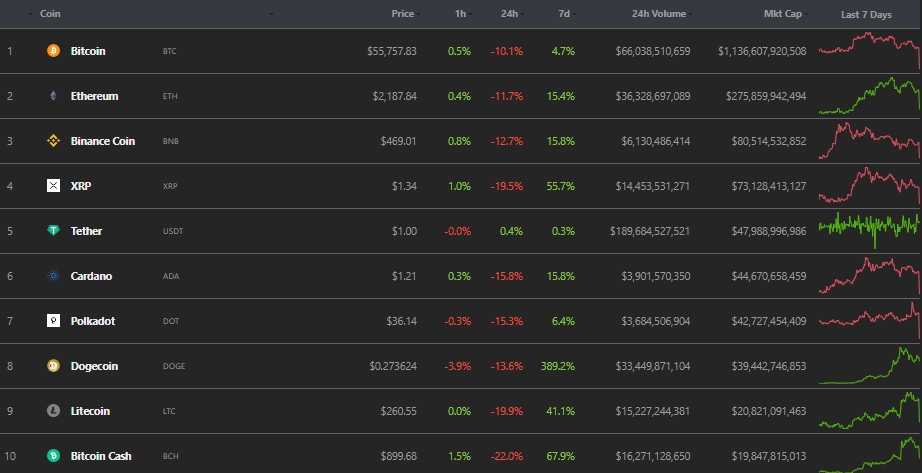

As of writing, bitcoin was trading around $56,000. In the last 24 hours the coin has fallen about 10% (per CoinGecko).

On Friday, the hash rate of leading bitcoin mining pools fell sharply amid power-supply problems after explosions and flooding in coal mines in several Chinese provinces.

A popular trader Tone Vays suggested that this news triggered panic in the market. He described it as a good time to buy the asset.

Analyst Willy Woo noted that price and hash rate have always been correlated, hence the price drop is linked to power outages in China.

The Block’s head of research Larry Cermak disagreed, arguing that the drop was due to natural market exhaustion.

“Over weekends, liquidity is low, markets have been rising for weeks, many players are over-leveraged, and negative narratives are converging,” he noted.

Among the negatives, Cermak cited disappointment with Coinbase listing. On the eve of the FTX event, traders valued COIN at more than $620; on Nasdaq’s first trading day the close was $328.28, and by week’s end — $322.75.

LOL if you think the hashrate drop was the reason for the dump you’re ngmi. https://t.co/Xx1R8xQY1n

— Larry Cermak (@lawmaster) April 18, 2021

Some users linked the price drop to reaction to a post by the popular crypto-focused Twitter account FXHedge, which, citing its own sources, claimed that several financial institutions were being charged by the U.S. Treasury with money laundering using cryptocurrencies.

U.S. TREASURY TO CHARGE SEVERAL FINANCIAL INSTITUTIONS FOR MONEY LAUNDERING USING CRYPTOCURRENCIES -SOURCES

— FXHedge (@Fxhedgers) April 18, 2021

However, lawyer Jake Chervinsky called the message implausible. He noted:

- The Treasury does not have authority to file charges — that is the remit of the DOJ;

- a case against several organisations appears unusual;

- such investigations are strictly confidential and leaks are extremely rare.

I don’t find this credible. The tweet itself is fishy: Treasury doesn’t charge money laundering (DOJ does) & a case against several FIs at once would be unusual. Also, criminal investigations are kept strictly confidential & rarely leak. I’m not convinced by unnamed «sources.» https://t.co/71opA5cUby

— Jake Chervinsky (@jchervinsky) April 18, 2021

Together with the flagship, the prices of all the largest cryptocurrencies fell. Yet over the past seven days all assets remained in the green. Dogecoin, whose price entered a correction on the eve, rose over the period by nearly 390%.

Against the backdrop, 24-hour liquidation volume reached $9.795 billion, the largest on record, according to journalist Colin Wu. Bybt data show more than a million traders were affected, with the largest bitcoin order liquidated on Binance at $68.7 million.

Bitcoin market capitalisation exceeds $2.24 trillion, and the Bitcoin dominance index stands at 50.6%.

Bitcoin reached a historic high above $64,000 on April 14.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!