Bitcoin Price Surpasses $49,000

On Monday, February 12, the price of the leading cryptocurrency exceeded $49,000. At its peak, the asset reached $49,139 on the Binance exchange.

The price of Bitcoin hit $49,800, nearing the $50,000 mark.

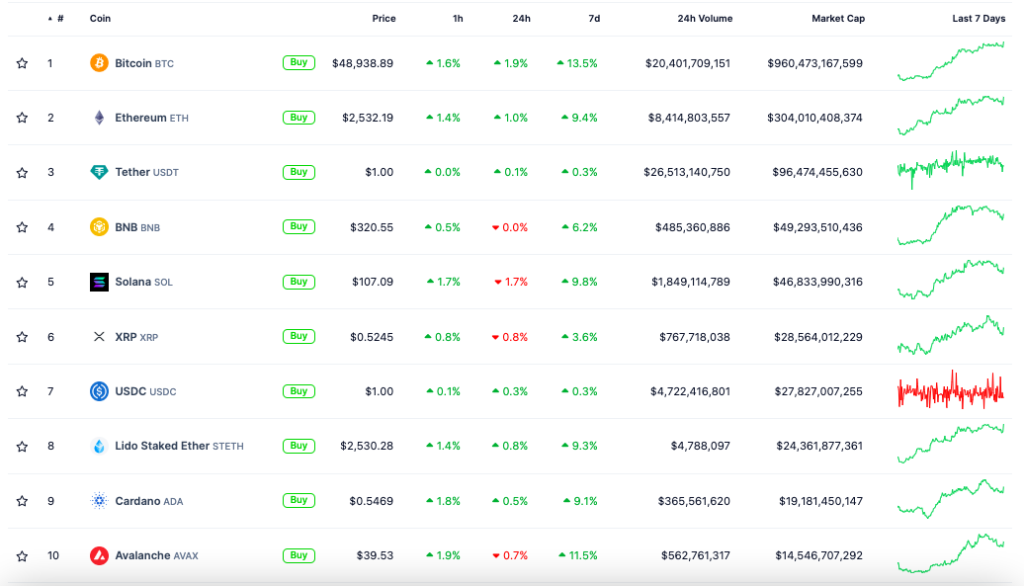

The current price is $48,828. Over the past 24 hours, Bitcoin has risen by 2%, according to CoinGecko.

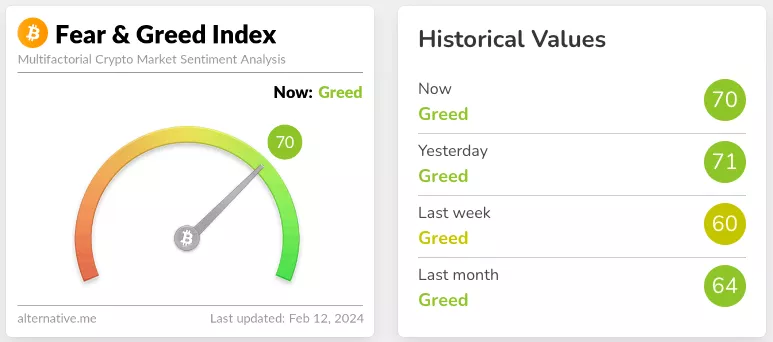

The cryptocurrency fear and greed index stands at 70, indicating buyer pressure.

Other top-10 assets by market capitalization also entered the “green zone.” Ethereum is trading above $2500.

Crypto analyst Patrick Scott noted that retail traders still “ignore” Bitcoin despite it reaching $49,000.

BTC is at $49K and there’s barely any retail attention.

Once it breaks $50K, expect a lot of people that wrote crypto off to start coming back.

— Patrick Scott | Dynamo DeFi (@Dynamo_Patrick) February 12, 2024

“Once it surpasses $50,000, expect many who dismissed cryptocurrency to start returning,” he added.

CoinShares reported a weekly inflow of $1.1 billion into cryptocurrency investment products. The assets under management reached their highest level since early 2022, totaling $59 billion.

Macro analyst Noelle Acheson told CoinDesk that Bitcoin is currently benefiting from increased accumulation. This is mainly due to “expectations of capital inflows into China to halt the stock market rout and the inevitable currency devaluation even in developed countries in the future.”

“Given the lack of a clear catalyst explaining the movement of the leading cryptocurrency in recent days, we are likely witnessing increased accumulation for the aforementioned reasons, as well as the ongoing dissemination of information about Bitcoin by the marketing machines of [ETF issuers],” she added.

However, technical analyst Ali warned that the 30-day MVRV indicator exceeded 11.5%. This suggests correction risks, according to historical patterns.

#Bitcoin has shown a pattern of entering a brief correction phase whenever the 30-day Market Value to Realized Value (MVRV) ratio exceeds 11.50% over the past two years. The MVRV ratio recently crossed this threshold again, serving as a cautionary signal for $BTC traders! pic.twitter.com/7vdu3T80UT

— Ali (@ali_charts) February 12, 2024

Previously, Grayscale analysts predicted a “favorable” structure for the Bitcoin market post-halving. However, their counterparts at DecenTrader warned of potential correction risks for the leading cryptocurrency during this period.

ForkLog compiled a report featuring the most intriguing forecasts from crypto industry experts regarding the price prospects of digital gold post-halving.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!