Bitcoin price tumbles below $23,000

Late on June 13, Bitcoin traded near $25,000, Ethereum near $1,300.

At the time of writing, Bitcoin had slipped below $24,700.

Ethereum trades near $1,260.

Bitcoin breached the $24,000 level.

Bitcoin quotes had fallen below $23,000 (−17.1% for the day, according to CoinGecko). The total liquidations in the futures market approached $1 billion.

Ethereum fell by 20.1% over the past 24 hours, to $1,192. Total cryptocurrency market capitalization reached $988.9 billion.

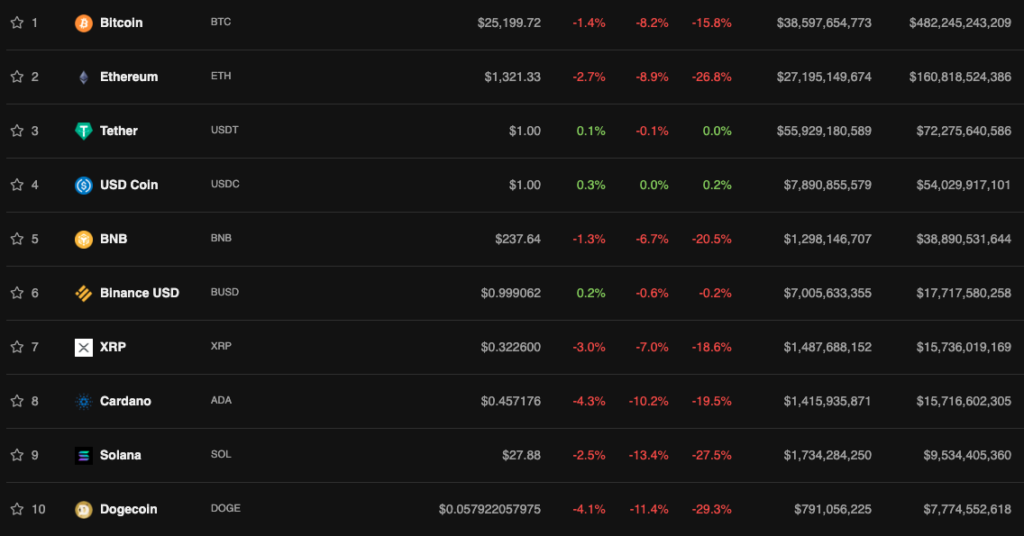

At the time of writing, Bitcoin is around $25,600. In the last 24 hours the cryptocurrency had shed about 6.5%, according to CoinGecko.

Over the same period, Ethereum fell 8.9%. The current price is $1,313. Charts suggest the declines in both assets were accompanied by a surge in trading volume.

Following the leaders, nearly the entire market moved into the red. The biggest declines over the last 24 hours were Solana (-13.4%) and Dogecoin (-11.4%).

Total market capitalization fell by almost 6% to below $1.1 trillion. Bitcoin dominance stood at 45.3%, ETH at 15.1%.

According to Coinglass, liquidations on the futures market totaled more than $500 million.

The Crypto Fear and Greed Index stood at 11 points (‘Extreme Fear’).

Bitcoin Fear and Greed Index is 11. Extreme Fear

Current price: $26,808 pic.twitter.com/jOE6ArjuID— Bitcoin Fear and Greed Index (@BitcoinFear) June 13, 2022

On June 10, Bitcoin fell below $30,000 amid news of accelerating inflation in the United States. On that day, an analyst using the pseudonym PlanC noted that he did not yet see a meaningful trend reversal in the near term.

Thought of The Day 🤔

In the current macro backdrop it doesn’t matter how many charts are showing confluence that we are reaching historically oversold levels. #BTC

As long as #Bitcoin remains correlated to risk on assets I don’t see a significant trend reversal anytime soon.

— Plan©️ (@TheRealPlanC) June 10, 2022

The head of MicroStrategy, Michael Saylor, noted that inflation “has not peaked, and neither has Bitcoin.”

Inflation hasn’t peaked, and neither has #Bitcoin.

— Michael Saylor⚡️ (@saylor) June 10, 2022

Monday opened with declines in traditional markets as well. Hong Kong’s Hang Seng fell 3.19%, Japan’s Nikkei 225 by 3.01%. Nasdaq-100 futures fell 4.44%, and the S&P 500 by 2.91%.

Earlier, Guggenheim Partners’ chief investment officer Scott Minerd warned that Bitcoin could fall to $8,000.

Earlier, Bitcoin critic Peter Schiff said a drop to $10,000 was ‘quite likely’ if the asset decisively breaches the $30,000 level.

Galaxy Digital founder Mike Novogratz said the crypto market could fall further. In his view, the next few quarters would be volatile amid negativity on Wall Street.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!