Bitcoin rebounds to $88,000 after Bank of Japan lifts rate to a 30-year high

BOJ lifts rate to 0.75% (30-year high); bitcoin rebounds to $88,000.

On December 19, the Bank of Japan raised its policy rate to 0.75%—the highest level in 30 years. The leading cryptocurrency rose in response, recovering to $88,000.

Over the past 24 hours, digital gold has gained 1%.

A day earlier the market reacted positively to data showing cooling US inflation. However, after the US session opened, bitcoin slipped to about $84,000.

A surprise reaction and prospects for gains

The market’s response to the Bank of Japan’s decision proved unexpected. Several analysts, including MN Fund co-founder Michaël van de Poppe, had forecast a negative outcome and a continuation of the downtrend.

It’s very likely that the trend keeps going down until the BoJ comes out with the news.

Wouldn’t be surprised if $BTC continues to cascade and gets itself into a form of capitulation in the next 24 hours as the trend clearly is down.

That would mean -10/20% move on #Altcoins…

— Michaël van de Poppe (@CryptoMichNL) December 18, 2025

Later he noted that the hike had already been priced in. According to the expert, the actual impact will weaken as such moves are repeated, “because the marginal effect for the carry trade loses strength.”

“Now this factor has played out. Against the backdrop of moderate inflation, it is time for bitcoin to return to its fundamentally fair value,” he added.

Van de Poppe stressed that the key resistance is now at $88,500. In his view, the asset’s next move hinges on the US session open.

“However, given that all macroeconomic data point to a positive outlook, the business cycle is ready to expand. I believe the most likely scenario is an upside breakout in the coming days,” — summed up he.

BitMEX co-founder Arthur Hayes is similarly upbeat.

Don’t fight the BOJ: -ve real rates is the explicit policy. $JPY to 200, and $BTC to a milly. pic.twitter.com/PdZh87ruVI

— Arthur Hayes (@CryptoHayes) December 19, 2025

He sees the Bank of Japan’s move not as a short-term event but as the trigger for a longer-term macro trend. In his view, a weak yen and global liquidity will be among the drivers of the next crypto rally.

“Yen—to 200 per US dollar; bitcoin—to $1m,” he forecast.

Bear territory

Even so, market sentiment remains bearish, Santiment analysts noted.

😨 Commentary is mainly showing fear after Bitcoin bounced to $90.2K yesterday, and then quickly retraced to $84.8K. Bearish commentary like #selling, #sold, #bearish, or #lower are notably higher across X, Reddit, & Telegram.

📊 Historically, it’s a strong sign when retail is… pic.twitter.com/n299F6v4kn

— Santiment (@santimentfeed) December 18, 2025

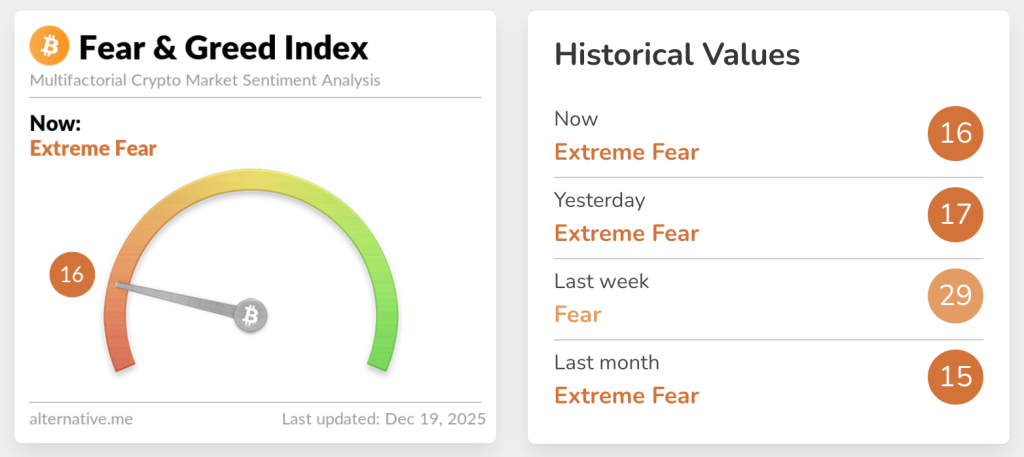

Judging by social-media chatter, after the pullback to $84,000 investors expect the correction to continue. The fear and greed index confirms the gloom: the gauge fell to 16, in “extreme fear” territory.

CryptoQuant analysts have observed a slowdown in bitcoin demand and a shift into a bearish phase.

Bitcoin’s demand boom is fading.

This cycle ran on three spot demand waves, and the latest one looks like it’s rolling over.

Since early October, demand is below trend, which can stay bearish for price. pic.twitter.com/7IWnRscD8H

— CryptoQuant.com (@cryptoquant_com) December 19, 2025

“Bitcoin demand growth has decisively slowed, signalling a transition to a bear market. After three major spot-market waves since 2023—driven by the launch of spot bitcoin ETF, the outcome of the US presidential election and the crypto-treasury bubble—demand growth has fallen below trend since early October 2025,” they said.

In the fourth quarter, exchange-traded funds based on the first cryptocurrency became among the main sellers—their assets under management fell by 24,000 BTC. That contrasts sharply with late 2024, when funds were actively adding positions.

Addresses belonging to ETFs and crypto treasuries (with balances of 100–1,000 BTC) are also moving against the trend, echoing late 2021 before the 2022 sell-off.

Risk appetite in derivatives has weakened as well. Funding rates have fallen to 2023 lows. Experts noted this is a classic bearish signal: traders are unwilling to hold long positions.

The technical picture has also deteriorated: bitcoin has broken below its 365-day moving average. This indicator traditionally marks the boundary between uptrends and downturns.

CryptoQuant estimates nearby support around $70,000. Historically, the bear-market trough often coincides with realised price, now roughly $56,000.

Earlier, derivatives bulls hedged the risk of bitcoin falling below $85,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!