Bitcoin retreats below $105,000

Bitcoin drops 2.2% to a multi-month low near $104,800 as liquidations top $1.3bn.

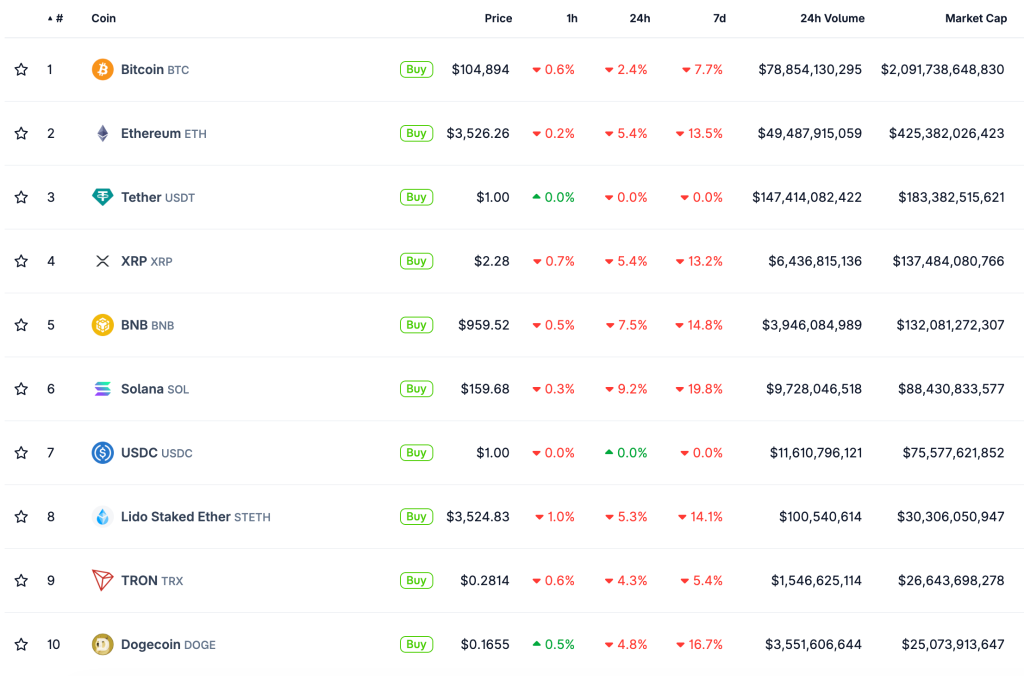

Over the past 24 hours the leading cryptocurrency fell 2.2%, hitting a multi-month low around $104,800.

Ether fell 5.4% over the same period. At the time of writing the leading altcoin trades near $3,500.

Total market value slipped 3% to $3.5 trillion. All the largest cryptocurrencies by market capitalisation pulled back.

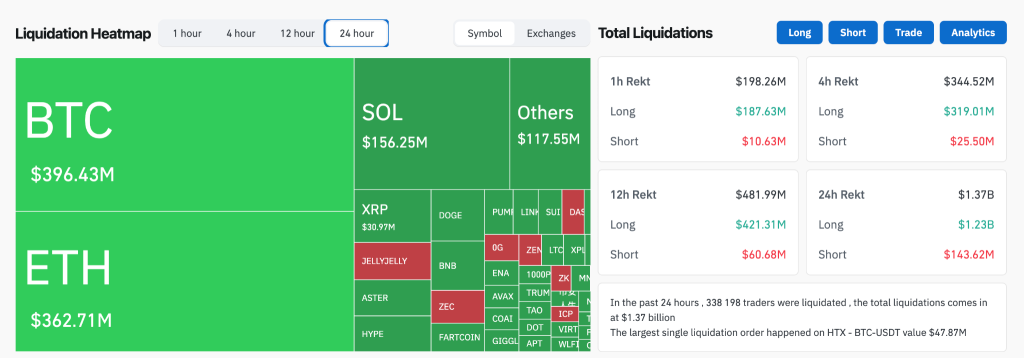

As prices fell, liquidations exceeded $1.3 billion over the past 24 hours. Longs accounted for $1.2 billion and shorts for $143.6 million.

In total, 338,314 traders were affected. The largest forced closure was on HTX in the BTC/USDT pair at $47.8 million.

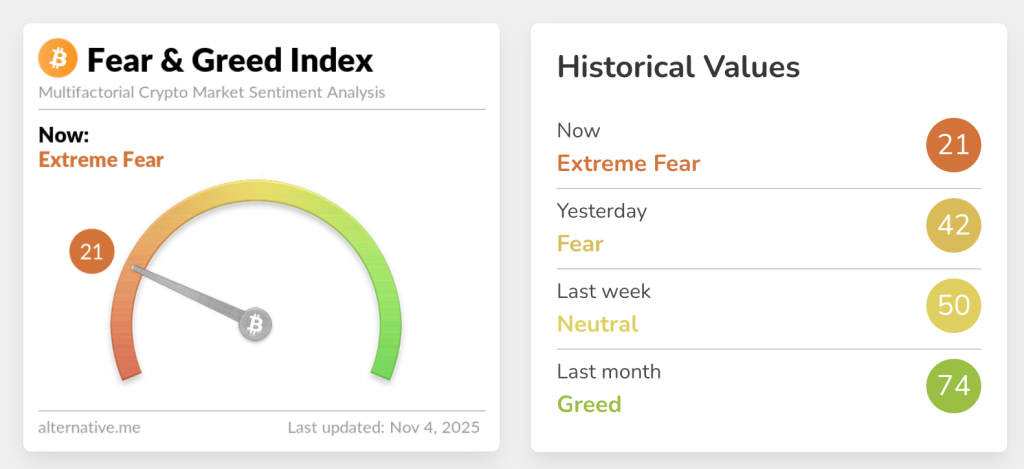

The crypto Fear and Greed Index fell to 21—an “extreme fear” reading. A day earlier it stood at 42, signalling moderate concern.

What is pressuring bitcoin?

On November 3, Lookonchain analysts flagged an early bitcoin investor who has transferred about 13,000 BTC ($1.4 billion) to exchanges since the start of October.

Another whale, known as Owen Gunden, has deposited 3,265 BTC worth $364.5 million to Kraken since October 21.

Bitcoin OGs are dumping $BTC!

BitcoinOG(1011short) has deposited ~13K $BTC($1.48B) to Kraken, Binance, Coinbase, and Hyperliquid since Oct 1.

Owen Gunden has deposited 3,265 $BTC($364.5M) to Kraken since Oct 21.https://t.co/qyZllJWfFShttps://t.co/u3b8zn5iYe pic.twitter.com/qQe3dYlnfp

— Lookonchain (@lookonchain) November 3, 2025

On November 4, the player sent another 1,289 BTC worth $138.2 million to the same venue. He still holds more than $700 million in bitcoin, according to Arkham.

Meanwhile, a wallet holding 31,000 BTC ($3 billion) moved for the first time since 2019. It transferred 2,300 BTC to Paxos, which offers OTC trading.

A Bitcoin Whale that hasn’t moved funds in 6 years deposited 2300 $BTC to Paxos 13 hours ago.

This whale holds at least 31K $BTC ($3B)

Paxos does operate a OTC desk as well providing custody to institutional investors. pic.twitter.com/CpWQz4aLx1

— Emmett Gallic (@emmettgallic) November 3, 2025

Quinten François, co-founder of WeRate, noted that long-term holders sold 400,000 BTC in the past 30 days—about 2% of total supply.

Long-term holders dumped 400,000 Bitcoin in the last 30 days

That’s nearly 2% of supply

If Bitcoin can stay above $100,000 while whales unload hundreds of thousands of coins, you don’t want to know what it’ll do when the real demand turns on. pic.twitter.com/wpVw4Xb055

— Quinten | 048.eth (@QuintenFrancois) November 3, 2025

Further pressure may be coming from a third straight day of outflows from spot bitcoin exchange-traded funds. The vehicles lost $191 million in the last trading session and more than $1.1 billion since October 29.

Another factor is the Coinbase premium, which remains in negative territory, said CryptoQuant analyst Maartun. On Friday the gauge was -$80, and during the November 3 correction -$30. At the time of writing it is about -$25.

“This points to persistent selling pressure from US spot-market traders,” the expert explained.

CryptoQuant’s head of research, Julio Moreno, pointed to a demand-supply imbalance. In his view, that is why crypto prices have been declining in recent weeks.

Instead of looking at Bitcoin long-term holder distribution/spending, I like to look at the other side of the trade.

Is there enough demand to absorb the supply at higher prices? Since a few weeks ago the answer is no, and that is why we see prices declining.

On a longer term… pic.twitter.com/3cNBY9Vk7e

— Julio Moreno (@jjcmoreno) November 3, 2025

“In the longer term, demand continues to grow, but at a slower pace and below trend,” he added.

What next?

Swissblock analysts called $100,000 a key level for bitcoin. They noted that “digital gold” has not closed below that mark for 180 days.

Bitcoin, what is the plan?

It’s been 180 days since Bitcoin broke above $100K, and it hasn’t closed below it once.

The $100K zone is the point of break: a structural floor built on high volume and strong confluence.

This is what November brings:

Hold $100K, and the bulls… pic.twitter.com/TfnldKOphr

— Swissblock (@swissblock__) November 3, 2025

If that floor holds, they see scope for another leg higher. Otherwise, a deeper correction looms.

Glassnode’s experts see a high probability of testing $104,000, below which sit the purchases of 80% of the largest investors in the asset.

“At such levels, weak hands typically capitulate and coins are redistributed to stronger holders. Such processes usually require considerable time or a deeper price decline,” they added.

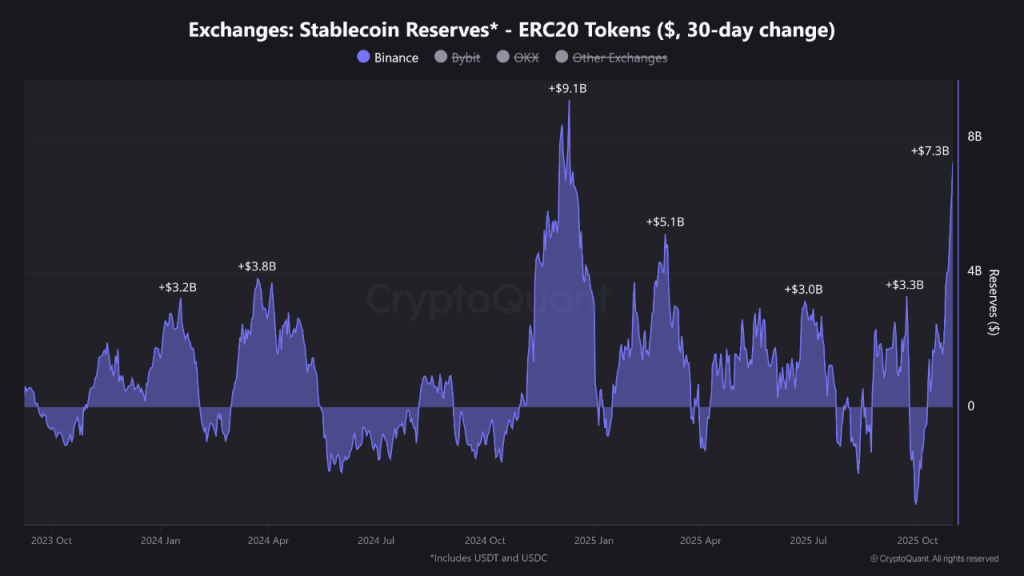

At the same time, stablecoin inflows to Binance reached $7.3 billion—the highest since December 11, 2024, noted Maartun. That points to rising market activity.

A similar level of inflows was observed shortly before “digital gold” set a record high at $67,000 in November 2024 and rose to $108,000 in May 2025.

Earlier, the trader known as CrypNuevo suggested that bitcoin could be forming a bottom around $101,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!