Bitcoin Retreats to $59,000 Amid ETF Inflow Weakness

- Negative trends in BTC-ETF persisted for the third consecutive day.

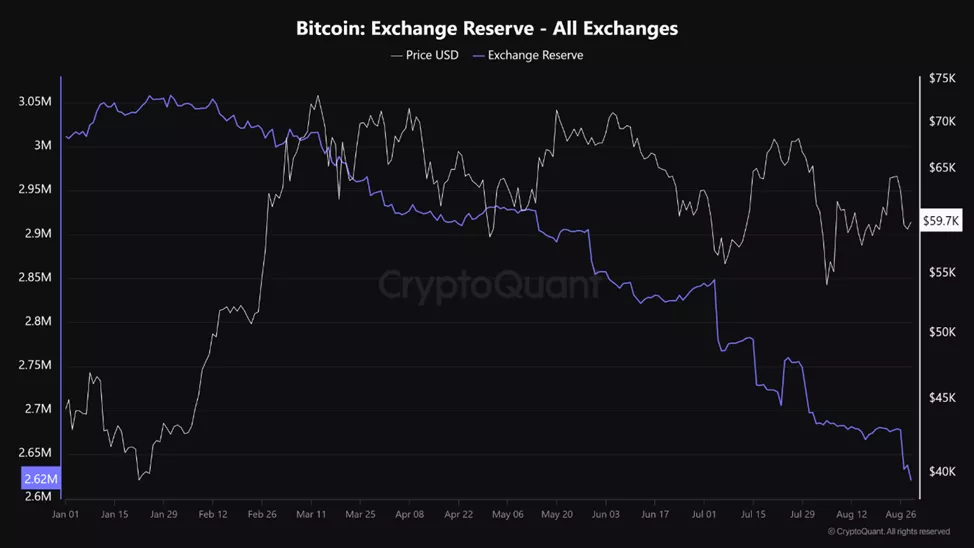

- The total exchange balance of bitcoins fell to a new low for the year.

- Traders remain cautious ahead of U.S. labor market data on September 6.

On August 29, net outflows from spot bitcoin ETFs amounted to $71.7 million, according to SoSoValue. This was one of the reasons for the unsuccessful attempt to recover some losses from the beginning of the week.

Negative trends in exchange-traded products continued for the third day in a row.

The largest fund in the sector, IBIT from BlackRock, recorded its first outflow since May 1, amounting to $13.5 million.

The overall structure of fund withdrawals is as follows:

- FBTC from Fidelity — $31.1 million;

- GBTC from Grayscale — $22.7 million;

- BITB from Bitwise — $8.1 million;

- BRRR from Valkyrie — $1.7 million.

Clients added $5.34 million to ARKB from Ark and 21Shares.

No changes were observed in other instruments.

Total inflows since the approval of BTC-ETF in January have decreased to $17.8 billion.

Exchange Reserves

On August 29, the total bitcoin balance on centralized platforms fell to a new annual low. Since January 1, the metric has decreased by ~12.9%, to 2.62 million BTC, according to CryptoQuant.

Experts believe this may indicate reduced selling pressure and potential for a bull market revival if demand strengthens.

According to analyst Bitcoin for Freedom, since August 22, 56,000 BTC have moved from CEX to non-custodial wallets.

14,600 Bitcoin taken off Coinbase today and 56,000 taken off exchanges the last week. That’s more than 4 months of mined supply. The supply shock will come soon because this is not sustainable.

— Bitcoin for Freedom (@BTC_for_Freedom) August 29, 2024

“The supply shock will come soon because this is not sustainable,” predicted the expert.

September Outlook

Amid sales by TradFi players, CryptoQuant identified increased demand from U.S. retail investors. This conclusion was drawn from the rising bitcoin price premium on Coinbase.

Experts also noted an increase in the flow of coins to U.S.-based platforms, which “historically correlates with price increases.”

In an interview with CoinDesk, Augustin Fan from SOFA expressed expectations for a revival in dynamics with the start of September.

“After Labor Day in the U.S. [September 2] and the labor market report [September 6], investors will begin a busy autumn season. This week has been mixed due to weakening ETF inflows,” commented the expert.

This view is shared by QCP Capital.

“Until October, there is a shift towards put options […], indicating caution regarding potential declines. In the absence of catalysts […], prices will continue to fluctuate within a range until September,” explained the specialists.

Previously, QCP Capital noted that the price of the first cryptocurrency will remain in a narrow corridor from $62,000 to $67,000 in the near term, as indicated by indecision in options.

Earlier, trader and analyst Rekt Capital pointed to a potential price reversal if the upper boundary of the descending channel is successfully retested.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!