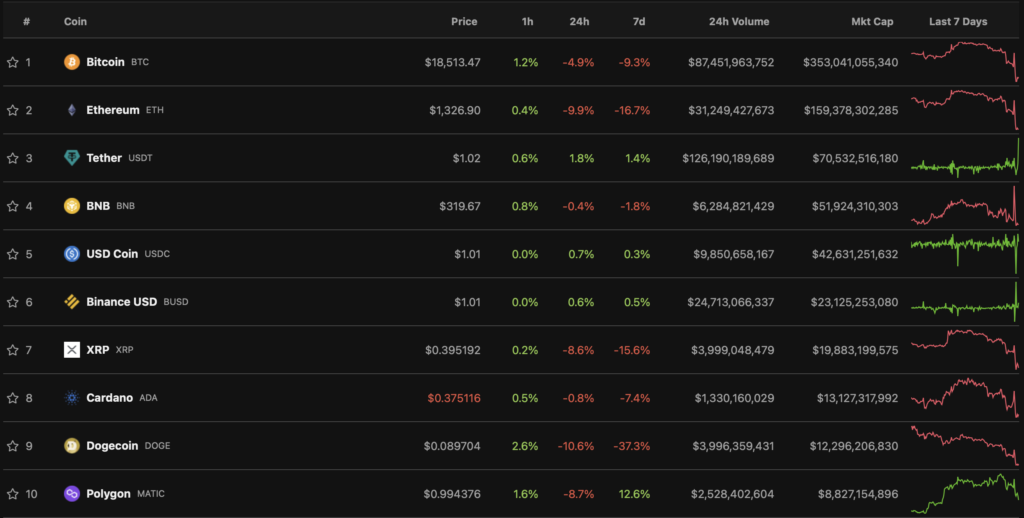

Bitcoin slides to $18,000 as Ethereum hits $1,300

Over the night of November 8–9, Bitcoin briefly fell to a one-year low of $17,166. Ethereum traded down to $1,233.

As of writing, Bitcoin was trading at around $18,400.

According to Coinglass, in the course of the futures-market correction, positions worth more than $722 million were liquidated over the 24 hours.

Against the backdrop of the liquidity crisis at the FTX bitcoin-exchange and announcement of its acquisition by rival Binance, all top-10 cryptocurrencies by market capitalization were in the red.

The cryptocurrency market capitalisation fell below $1 trillion.

Despite volatility, Binance’s native token BNB fell by just 0.4% over 24 hours. Meanwhile, FTX’s utility token FTT slumped 70%, to $4.50.

Solana (SOL) shed more than 20% over the day and ceded tenth place to its rival Polygon (MATIC). SOL trades around $21; MATIC around $1.

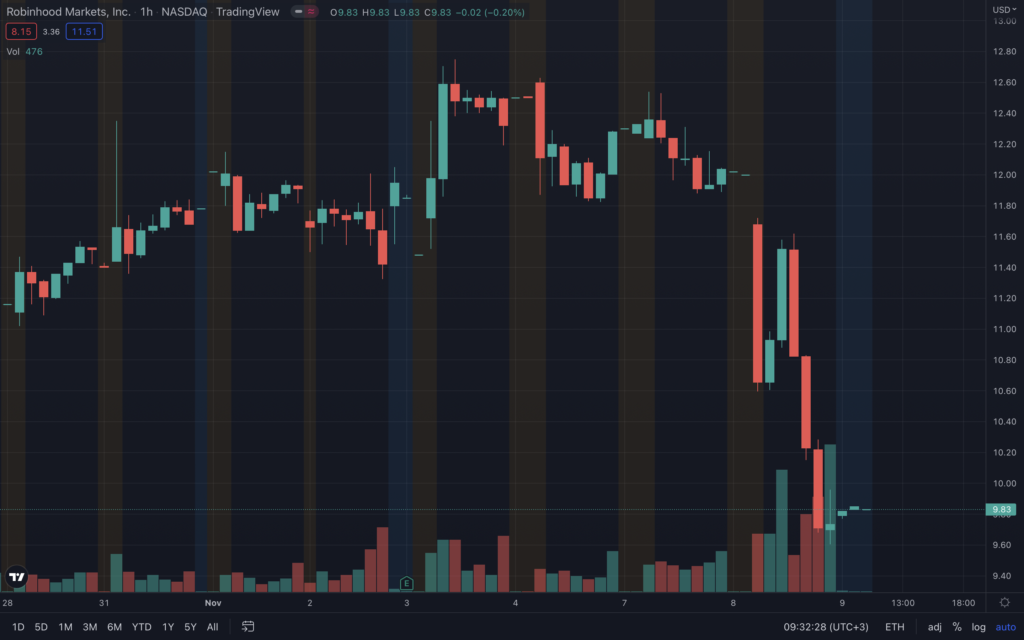

Following the announcement of the deal between the two largest Bitcoin exchanges, Robinhood’s stock fell almost 20%. In May, Emergent Fidelity Technologies acquired 56.28 million shares (7.6%) of the online broker for $648.29 million.

Back in the morning of November 8, Bitcoin slipped below the $20,000 level. The market capitalisation of digital assets remained above $1 trillion.

Earlier ForkLog experts warned of significant shocks to the crypto industry amid the showdown between Binance and FTX.

Read ForkLog’s bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!