Bitcoin Slips Below $60,000 Mark

In the early hours of Wednesday, August 28, the price of the leading cryptocurrency fell below the psychological threshold of $60,000. The decline was exacerbated by the triggering of stop orders, as indicated by the increased trading volume.

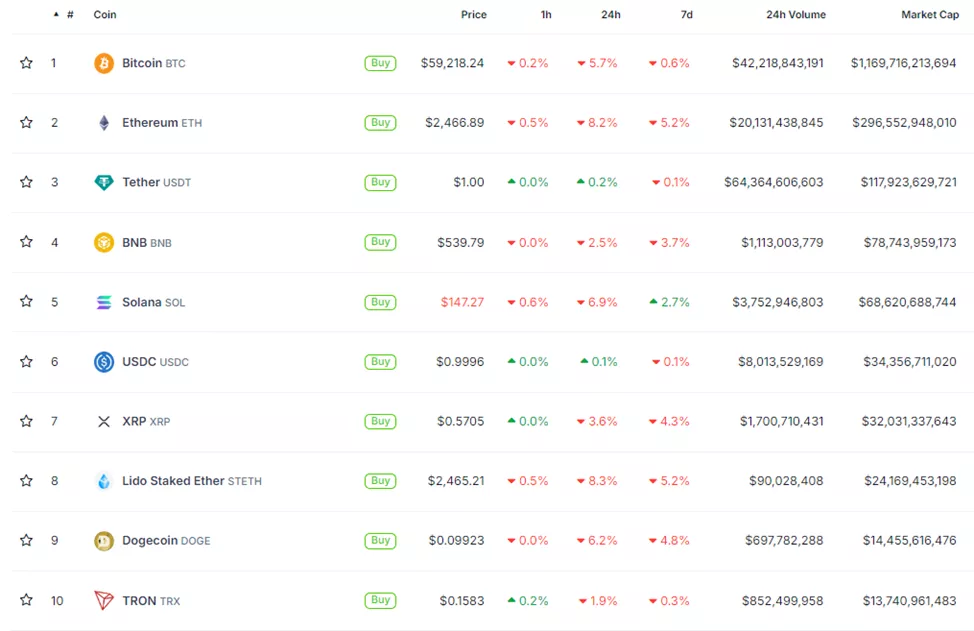

At the time of writing, Bitcoin is trading at $59,200, having lost 5.9% over the past 24 hours. Ethereum’s daily decline reached 8.2%, with prices breaking below $2500 to $2466.

Among the top 10 cryptocurrencies by market capitalization, Tron (-2%) and BNB (-2.5%) showed greater resilience compared to Ethereum, according to CoinGecko.

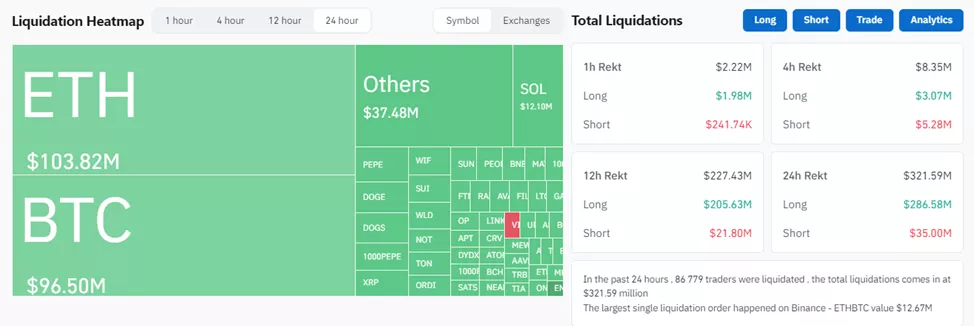

According to Coinglass, the total volume of liquidated positions over the day amounted to $321.9 million, with $286.8 million in long positions, most of which were related to Ethereum.

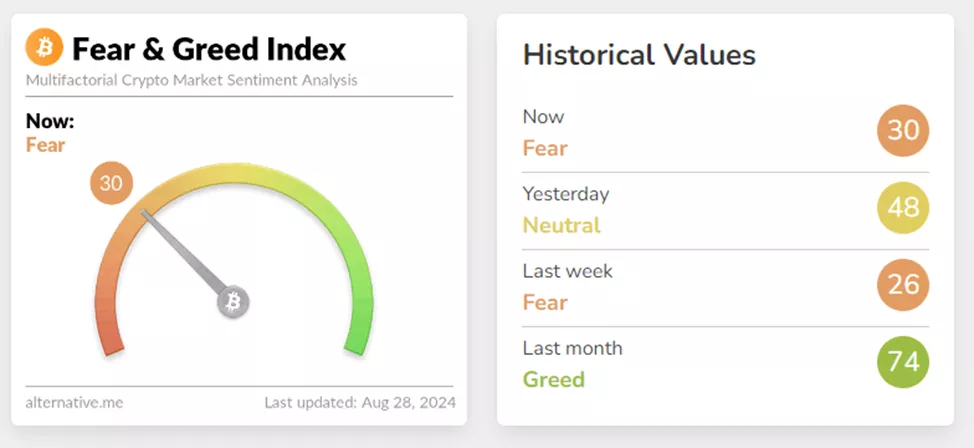

The Fear and Greed Index fell to 30, indicating growing bearish sentiment. The previous day, the index stood at 48 points.

In an interview with The Block, Rachel Lucas from BTC Markets stated that the current decline is a combination of factors.

“The US Dollar Index is oversold on the daily chart, which could indicate a potential rebound, traditionally leading to downward pressure on risk assets like cryptocurrencies,” she explained.

The expert also noted the negative seasonality of digital gold in September. This effect arises from portfolio rebalancing and tax-loss harvesting, compounded by caution ahead of the US elections.

Lucas did not rule out that Bitcoin could fall to ~$56,000 in the near term if the price remains below the 50 DMA ($61,991).

Trader and analyst Rekt Capital pointed to a potential reversal in prices if the upper boundary of the descending channel is successfully retested. This would confirm the breakout, the expert added.

Imagine if this is a post-breakout retest of the Downtrending Channel

Successful retest of the top of the Channel would fully confirm the breakout and precede upside continuation$BTC #Crypto #Bitcoin https://t.co/9N9QS5Wxp2 pic.twitter.com/UjDKcIRdkv

— Rekt Capital (@rektcapital) August 27, 2024

Analyst Jamie Coutts from Real Vision has predicted a “crazy season” for Bitcoin with a target of $150,000.

Earlier, QCP Capital noted that the price of the leading cryptocurrency is likely to remain in a narrow range between $62,000 and $67,000 in the near term, as indicated by indecision in options.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!